A new report has found one in five Australian households are struggling to pay their energy bills, with renters being more heavily affected due to the "woefully inadequate" solar and insulation in rental properties.

More than one in 10 households report spending more than 6 per cent of their income on energy bills, which, according to the Energy Consumers Australia (ECA) report, is a key indicator of energy hardship.

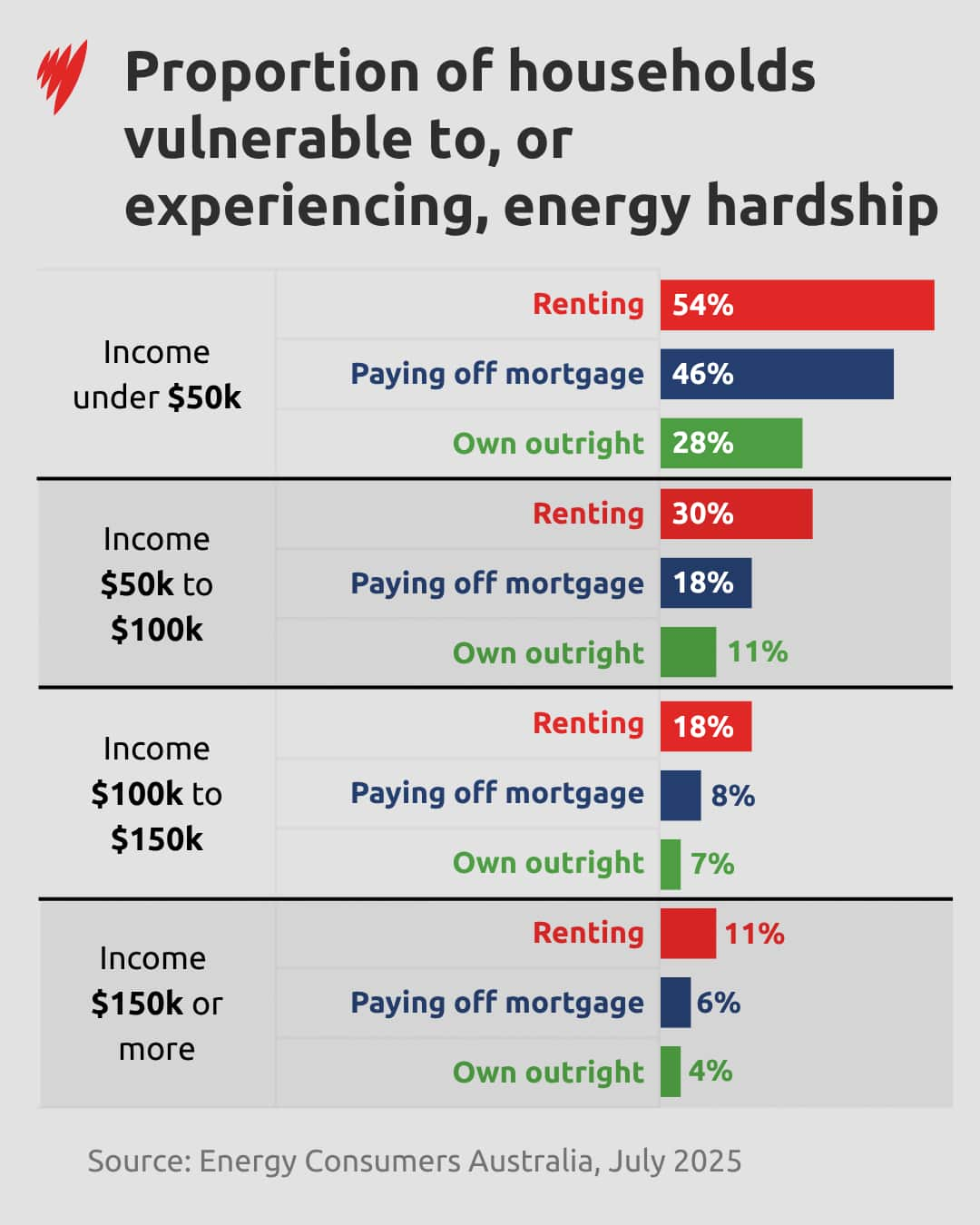

Households on lower incomes are more likely to experience some form of financial stress, whether that's being unable to afford electricity bills or having to forgo heating and cooling to save power.

The findings come after electricity prices rose for almost half a million households in NSW, south-east Queensland, and South Australia on 1 July following an increase to the Default Market Offer — a reference price for electricity set by the Australian Energy Regulator.

What did the report find?

The report highlights the dire financial situation facing thousands of Australians who must choose between paying their bills and running their utilities.

Households with incomes of less than $50,000 per year were the most likely to face energy hardship, with 54 per cent of renters and 46 per cent of mortgage holders experiencing financial strain.

These percentages drop markedly as household income increases.

Of the highest-earning households with incomes of at least $150,000 or more per year, only 11 per cent of renters and 6 per cent of mortgage holders faced energy hardship.

People who own their own homes were far less likely to deal with these same financial pressures.

Liz Stephens, general manager of public affairs and strategy at ECA, told SBS News the findings show that an urgent response is needed from energy retailers and the government to address the financial strain faced by households.

"Without decisive action, many Australians will continue to face unaffordable energy costs, unsafe living conditions, poor health outcomes, and sustained financial stress," she said.

Renters are worse off

Stephens emphasised renters are "disproportionately affected" by higher energy prices.

"Many rental homes in Australia have the energy efficiency of a tent," she said.

"Not only does this lead to higher energy costs, adding to cost of living pressures for renters, it also affects them financially, because energy inefficient homes cost more to heat and cool, thus further entrenching energy hardship."

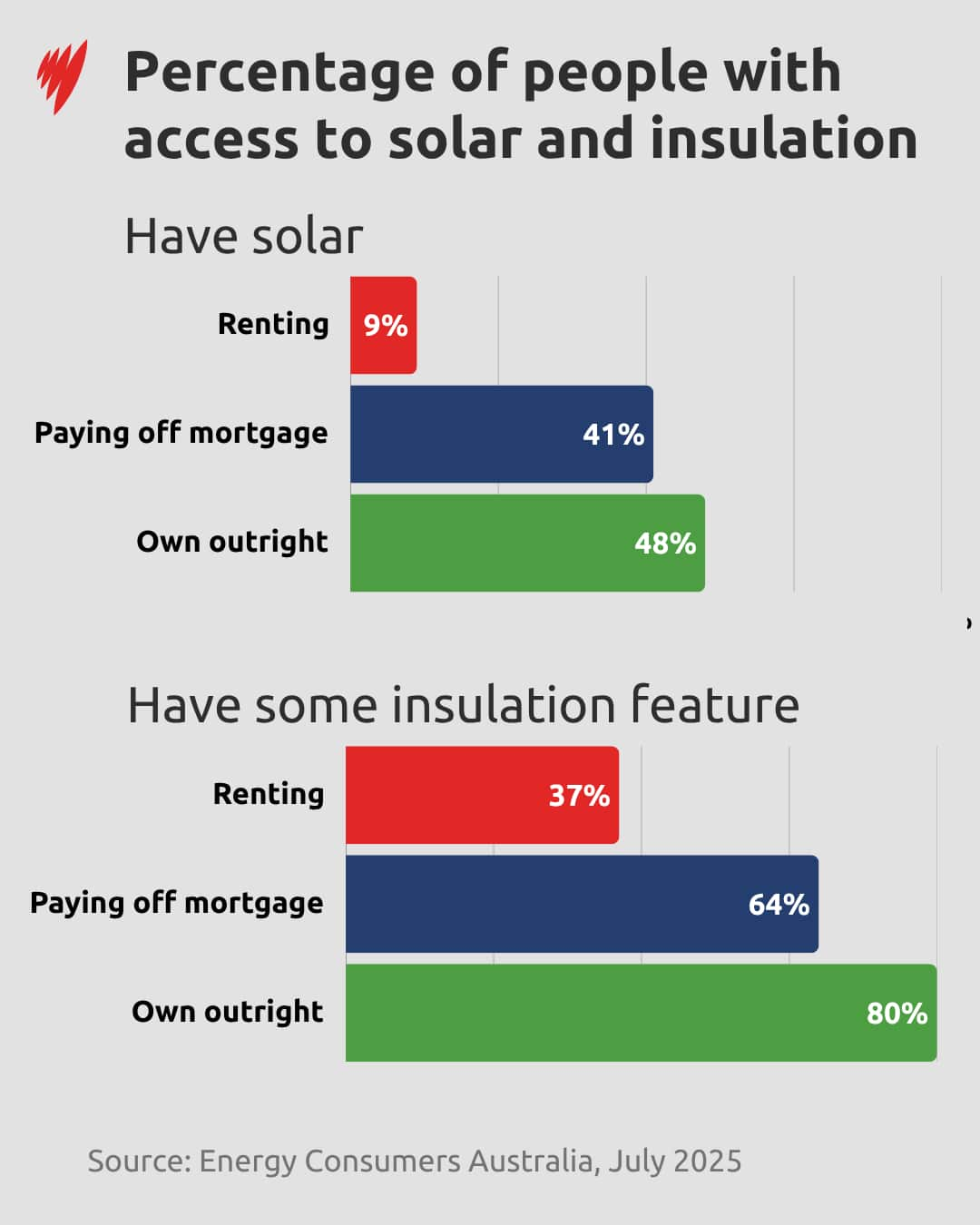

One indicator of this is the proportion of households with access to solar panels and insulation.

Only 9 per cent of renters have access to solar power, compared to 41 per cent of mortgage holders and 48 per cent of outright homeowners.

Around two-thirds of renters also lack at least one form of insulation, such as ceiling insulation, floor insulation, double- or triple-glazed windows, or draft proofing, according to the report.

While 64 per cent of mortgage holders and 80 per cent of those who own their homes outright have at least one of these features.

The report argues that landlords aren't incentivised to invest in these features for tenants, as there is a limited financial payoff, while tenants often cannot afford to retrofit or don't want to invest in a property they don't own.

While the ACT and Victoria have enforceable minimum energy efficiency standards for rental homes, most states and territories do not.

"We want to see nationally consistent minimum energy performance standards for all rental properties in Australia," Stephens said.

However, reform is underway in some states.

In 2019, all jurisdictions committed to establishing a framework for energy-efficiency standards for renters by the end of 2022, with implementation to follow in subsequent years. While some states have made progress, others have lagged behind.

What can you do about high energy bills?

If you are struggling to pay your power bills, regardless of home ownership, you do have options.

"The first step is to speak with your energy provider as soon as you can and see what support they can offer you. Tell them you're having a hard time and that you need support to pay your energy bill — you have a right to receive help," Stephens said.

By law, providers must inform you if a better offer is available to you.

It is also required that all retailers have a residential customer hardship program, for which you can sign up.

This allows you to access various payment options, including adjusting the frequency or timing of your payments, as well as payment assistance or payment matching.

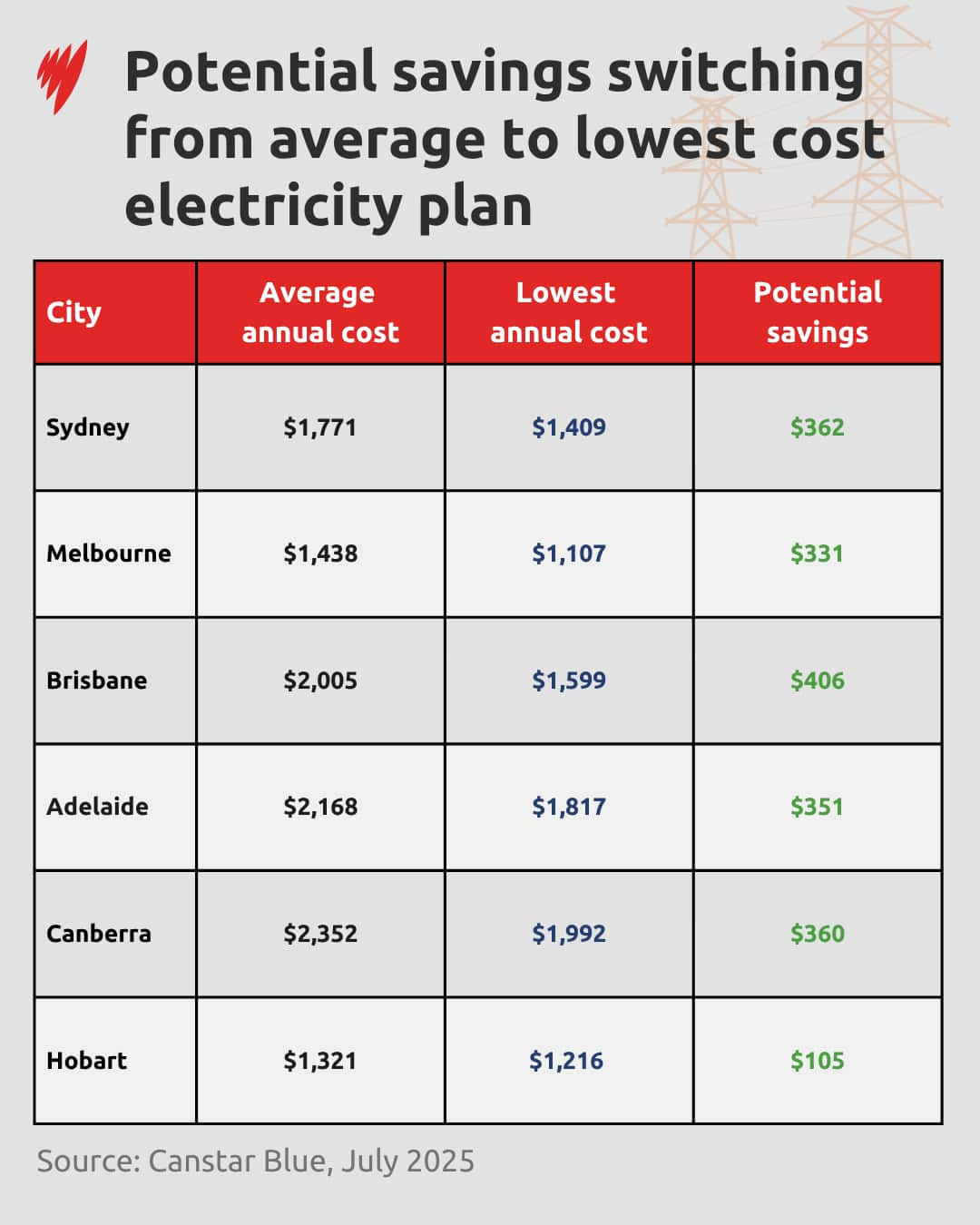

Sally Tindall, data insights director at comparison website Canstar, said millions of Australians are paying more than they need to for electricity and gas, simply because they haven't compared their options in a while.

"Our research shows switching from an average-priced plan to one of the lowest in the market could save a typical household up to $406 a year in some areas, even more for larger households," Tindall told SBS News.

"For some households, this could be the difference between clearing their next couple of electricity bills and picking up the phone to their provider to ask them to go into hardship."

For the latest from SBS News, download our app and subscribe to our newsletter.