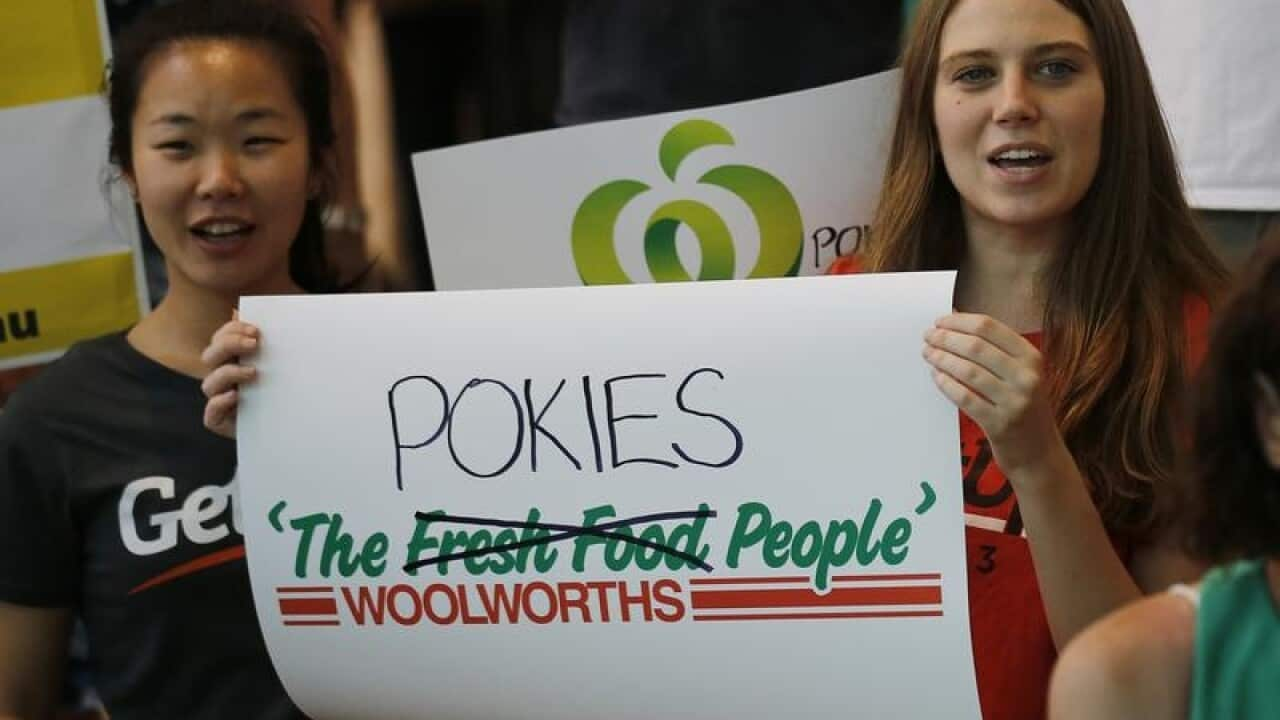

Supermarket giant Woolworths is combining its liquor and hospitality businesses ahead of a divestment next year but insists it is not trying to distance itself from the gambling industry.

Woolies is currently Australia's biggest pokies machine owner through its majority stake in ALH Group, but will merge the hotels, pubs and gaming company with its Endeavour Drinks business by the end of 2019.

It will then separate the new standalone Endeavour Group, which would include the Dan Murphy's and BWS liquor chains, by the end of 2020 through a demerger or other value-accretive alternative.

Shares in Woolworths rose by as much as 3.7 per cent after Wednesday's announcement to a more than five-week high of $34.17, and were still 3.22 per cent higher at $33.99 at 1440 AEST.

Woolworths did not say whether it plans to sell or list the new business, although it does expect to retain a minority shareholding whichever route it takes.

Wesfarmers pursued the latter option last year when it divested supermarket chain Coles, retaining a 15 per cent stake as Woolworths' fierce rival listed on the ASX.

Woolworths has already offloaded its petrol business and said the next separation will simplify its structure and help it focus on its core food and everyday needs markets.

"The board believes that a merger of Endeavour Drinks and ALH followed by a separation, is in shareholders' best interests and will benefit customers and team members of both groups," Woolworths chairman Gordon Cairns said.

Chief executive Brad Banducci told analysts the sale was not to distance Woolworths from gambling activities, despite the company facing pressure from activists to do so.

"It's not about gaming, it's about helping both businesses unlock their full potential," Mr Banducci said.

Independent Federal MP Andrew Wilkie was among those to welcome Woolworths' planned exit from Australia's largest poker machine operator.

"Poker machines are a toxic product and any responsible business should have nothing to do with them," Mr Wilkie said.

"Poker machine money is blood money and it was always unconscionable for one of the country's biggest supermarkets, and most well-known brands, to profit from human misery for so long."

Ratings agency S&P Global said, while the separation may reduce Woolworth's scale and diversity, the reduced exposure to hotels and gaming "removed significant regulatory risks and improves the group's perceived social license to operate".

"In our view, the group's Australian and New Zealand food business remains strong," S&P said.

Endeavour Drinks and ALH together were responsible for more than 30 per cent of Woolworths' earnings in the 2018 financial year, with Endeavour Drinks the group's second-largest contributor after Australian supermarkets in terms of both sales and earnings.

The integrated Endeavour Group will include more than 1,500 BWS and Dan Murphy's retail drinks outlets and 327 ALH hotels and neighbourhood pubs.

Other businesses to be included in the merger include Endeavour Drinks' own and exclusive brands business, Pinnacle Drinks; Langton's, a fine wine auction and retail business; Cellarmasters, a wine subscription business; and an 8.7 per cent stake in ALE Property Group.

The separation will leave Woolworths owning Australia's No.1 supermarket chain, New Zealand's Countdown supermarkets, and the Big W department stores.

Bruce Mathieson Group, the junior partner in the ALH joint venture that includes hotels and pokies, will swap its 25 per cent stake for a 14.6 per cent interest in the new Endeavour Group.

Woolworths chief financial officer David Marr will switch to a chief operating officer role to oversee the project, with Stephen Harrison taking over as CFO on August 1.