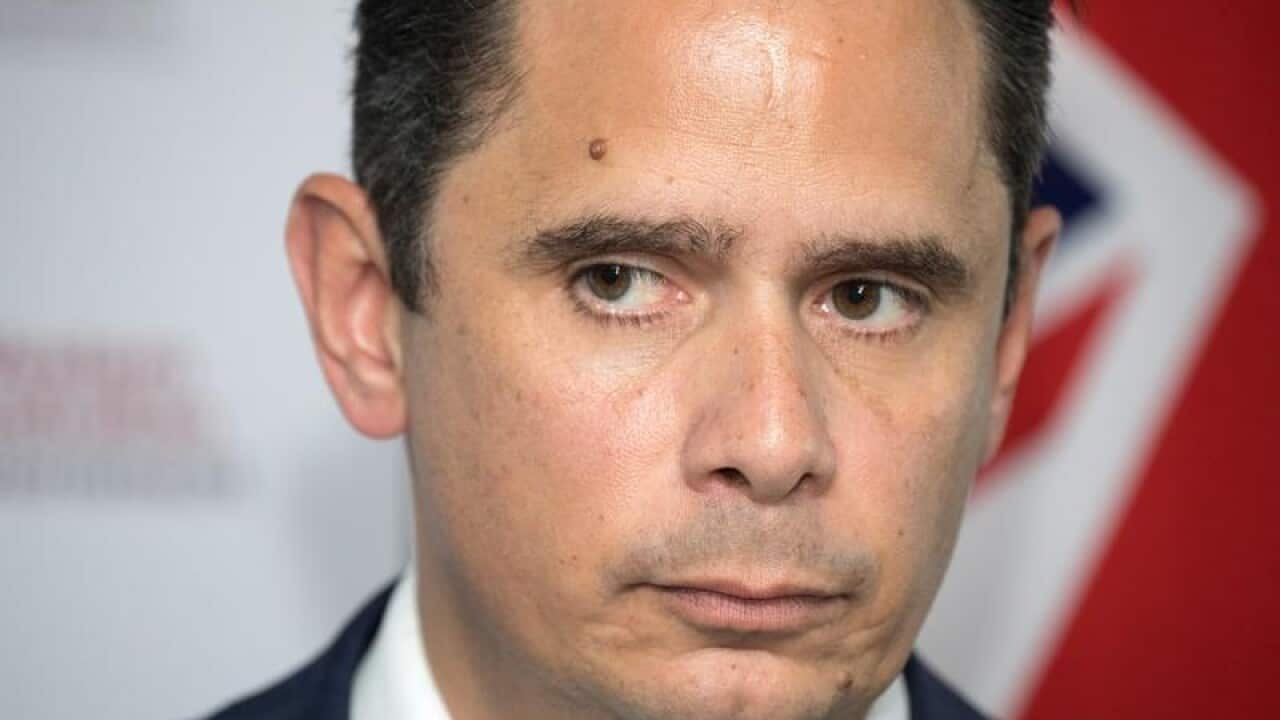

WA Treasurer Ben Wyatt has urged the Productivity Commission not to be deterred by hostility from other states over the GST revenue system while renewing calls for more Commonwealth support.

Mr Wyatt told a Productivity Commission hearing on Tuesday he welcomed a draft report vindicating WA's position that the current system is broken, and hoped the independent body could provide the Commonwealth with a way forward.

He said WA was not getting enough support at the federal level but the Productivity Commission seemed undeterred and he wanted both major parties to be open to considering a transition period.

"The stand-off among state treasurers was extraordinary and so this has been an opportunity to provide a circuit breaker to have an independent organisation ... look at this," he told reporters after the hearing.

"My challenge has always been to try to convince the other states to not fear any outcome of the Productivity Commission and also to try to encourage the Commonwealth government to be part of the transition period."

Due to the complicated horizontal fiscal equalisation formula, WA received only 34 cents for every dollar raised this year.

The treasurer said for WA to get an extra $1 billion, he would have to increase stamp duty by $1 billion or iron ore royalties by $8 billion.

"That's the perverse outcome we have with the redistribution of our income," he said.

"We are now as a government having to look at decisions that you perhaps wouldn't otherwise do to try to ensure that your revenue sources aren't redistributed to other states.

"And it's undermining, I think, the integrity of the state development process that has really been the bedrock of development in WA."

WA Opposition leader Mike Nahan backs the idea of a "floor" below which a state's GST share cannot fall and also says the territories should be excluded from the carve-up as they're the Commonwealth's responsibility.

"Keep the existing system for three to five years but having a floating floor so as WA's share improves, it cannot go down," Dr Nahan told reporters.

"We get to a point where, in three to four years' time, if you take out the territories, the system stabilises."

Commonwealth top-up payments should reduce debt, not pay for new infrastructure, he added.

The WA government has previously said a per capita share would provide about $10.5 billion over three years.