(Transcript from World News Radio)

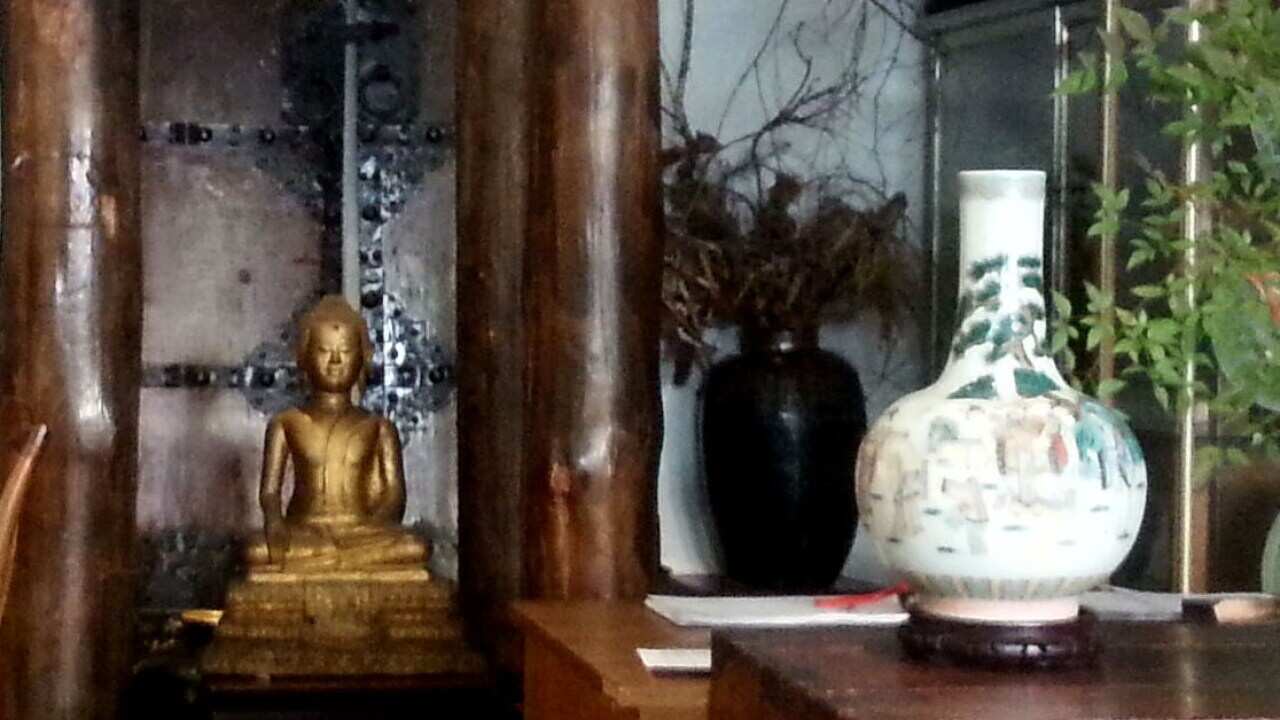

The most expensive Chinese porcelain item in the world recently sold for almost $40 million dollars at a Hong Kong art auction.

It was one sign of a boom in demand for Asian art pieces and antique objects around the world, particularly Chinese.

And as Samantha Yap reports, it's bringing cashed-up Asian bidders to art auctions in Australia - and pushing some locals out of the market.(Sound of auction)

Prices at art auctions around the world fluctuate, as market forces work to meet changing fashions.

Right now, one strong demand is for Asian art, especially Chinese.

Paul Sumner is the Melbourne-based managing director of art auction house Mossgreen, which specialises in Asian art.

He says many of the buyers of Chinese art pieces and antique objects are ethnic Chinese, from China itself, as well as Taiwan and Singapore.

"Essentially it's Chinese people that are driving this market."

"Essentially it's Chinese people that are driving this market. The market's not booming because when you talk about Asian art, you've got to qualify that. It is Chinese art that's booming. It's not Japanese art that's booming, or Korean, or Vietnamese. It's all about China at the moment."

Paul Sumner says Chinese buyers are coming to Australia because they trust the auction system.

"We have a very reliable legal and banking system, so that's really trustworthy. I think trust is a big factor for the Chinese buying in this area, because they're aware many copies are being made and more often than not, copies are being made in their own home turf. Provenance in Australia is an interesting thing,. There's a degree of integrity in the things coming here for sale. So suddenly, Australia from being rather distant, we suddenly gain a bit more respect in terms of the world and the big factor that's changed forever, our geographic position to Asia is the internet, because everyone can find us."

Paul Sumner says imperial Chinese porcelain pieces in particular are fetching high prices .

"At the moment, number one is Chinese porcelain. There's huge prices being achieved all around the world for the rarest, what we call, mark in period. It's actually imperial pieces from the 18th century from the reign of the Emperor Qian Long. That, that really is almost the most valuable items on the planet really now."

Other items that are gaining enormous prices include gilt bronze sculptures and jade.

In 2012 Mossgreen made a record sale of $1.2 million dollars for a 15th Century Chinese gilt bronze figure.

It's the highest price for any piece of decorative artwork or item sold in Australia.

And Paul Sumner says about 35 per cent of that value was realised due to the provenance of the piece.

Director of the Asian Art Institute of Australia, Larry Lucas, says provenance can significantly contribute to the value of an item.

"If people are looking at something to purchase and they know it's been in a well known collection, that can actually add to the value. It doesn't necessarily mean that it's going to be a great piece or even a genuine piece because even in the best of collections there may be things that are not so good. But you might bring in provenance in terms of calculating the value of something."

Asian art dealer and specialist for the Mossgreen auction house, Ray Tregaskis, says the Chinese are searching the world for art pieces to return to the country.

He says there are few genuine artworks and antique objects left for sale on the open market in China.

"So many objects were destroyed during the Cultural Revolution in China. This sort of thing was looked down upon."

"So many objects were destroyed during the Cultural Revolution in China. This sort of thing was looked down upon. They just wanted to obliterate that past, and now the Chinese are free to embrace it."

Larry Lucas from the Asian Art Institute of Australia says as more Chinese have become wealthy, more have looked to invest in their own culture.

"Partly it's investing in something that is to do with their heritage and their heritage is being more valued. And partly in some cases it's a gamble. You can see prices are going up and so you would gamble that prices will keep going up."

Marjorie Ho is a director and founder of an Asian art gallery in Melbourne selling artwork and antique objects.

She says Chinese people are purchasing items all over the world, and until recently, items in Australia were regarded as relatively cheap.

"It's not only Australia they're coming to. They're going all over the world, nothing stops them. They go to Amsterdam, they go to Paris, they go to Germany, they go to England, they go to America, Japan...Hong Kong. All these places are covered by them, but Australia to them at one stage was very cheap in comparison and because of our population our prices have to be a bit lower sometimes."

Now, says Marjorie Ho, Australian art dealers are finding it difficult to compete with the Chinese buyers to obtain new stock for resale.

"For a couple of years now it's very hard to acquire, because you're sitting right next to a collector from China who has any amount of money. Dealers are very constricted. They can't buy things only because they like them but because they have to sell it again. But the Chinese are getting it for themselves, or else for a museum, or else for a huge company or something like that, with an unlimited source of money."

Marjorie Ho doesn't regret the surge in demand for Chinese artwork and antiques.

But she says it's become hard to service local customers, many of them Chinese Australians, because they're just getting priced out of the market.

"The Chinese from China, nothing limits them. If they want that piece they'll keep going and it could be millions."

"It does us quite a bit of good, because they bring in a lot of new people. They roam around the places, then they go to the auction, then they come back if they can't get it. Some of them are limited. And they're the usually the Chinese Australians living here. Whereas, the Chinese from China, nothing limits them. If they want that piece they'll keep going and it could be millions. That's how dangerous it is."

While there is growing interest from foreign art collectors in Asian art items that come up for sale in Australia, Paul Sumner says Australian public art galleries and museums don't seem active in the local market..

"Sadly our Australian institutions have showed no interest in items that have come up for sale in Australia either at auction or in galleries for that matter, which is a shame. Some of the best items that have come up for sale haven't even been inspected by our institutions who have been buying in London or New York, rather than looking locally. But that said, it has become harder for local collectors to buy. So those group of collectors, they are finding it very hard to compete now with the Chinese who do come here and buy the rarest and the most expensive things."

The actual amount of Asian art and antique objects that come up for sale in Australia is relatively small by international standards.

Ray Tregaskis says that's a result of history.

"We're not a very old country. I mean the Chinese were exporting porcelain in vast amounts in the 12th Century and from then on. They exported enormous amounts to Europe and to America and they've always exported to Southeast Asia. So there's millions of pieces, millions that were exported over centuries. But Australia wasn't part of that. Most of the objects that came here came from European families that migrated or Chinese people that came here, that's why we've got these things."

Despite the strong foreign competition, Larry Lucas says public art galleries and museums in Australia should become more involved in bidding for items that come up for auction locally to expand their Asian collections.

"They could certainly save a lot of money buying things in Australia which are genuine and have come through auction houses, rather than going overseas and paying a real premium for them."