Key points:

*Commissioner Hayne has referred 24 cases of misconduct to regulators for further investigation

*Borrowers, rather than banks, would pay mortgage brokers under a key recommendation

*The government has vowed to act on all 76 recommendations

*A compensation scheme will be set up for victims of banking misconduct

An overhaul of banking fees and commissions, tougher enforcement of penalties for misconduct and more leniency for farmers are part of sweeping changes to the banking industry recommended by the royal commission.

In his scathing final report, released on Monday, Commissioner Kenneth Hayne said banks and those at the top should be held accountable for allowing misconduct to thrive.

He has made 24 referrals of misconduct to the Australian Securities and Investments Commission and the Australian Prudential Regulation Authority for further investigation.

Those referred include every major bank except for Westpac, AMP, TAL and Suncorp and two unnamed individuals.

He said the time for apologies was over.

“Choices must now be made. Saying sorry and promising not to do it again has not prevented recurrence. The time has come to decide what is to be done in response to what has happened," Commissioner Hayne said.

During 68 days of hearings over the past 12 months, the royal commission heard from 130 witnesses and received more than 10,000 public submissions.

The hearings exposed a long list of unscrupulous practices driven by greed, including institutions charging fees for services not provided and insurance providers selling worthless policies to vulnerable customers.

In one case, a young man with Downs syndrome was the target of aggressive sales tactics and sold a financial product that he did not want, need or understand.

Key recommendations

Among the most significant of the 76 recommendations made is a requirement that borrowers, rather than lenders, pay mortgage brokers for their services.

The change is designed to give brokers an incentive to act in the best interests of the customer rather than lenders that pay them commission.

“In particular, the changes will induce brokers to search out the best deals available,” Commissioner Hayne said.

He acknowledged requiring customers to pay a fee may be unpopular, but Commissioner Hayne said it was necessary to create a level playing field.

Measures compelling banks to treat farmers more compassionately have also been proposed, with a ban on charging default interest on agricultural land in times of drought or natural disaster.

A national scheme of farm debt remediation would also be established.

The commission also recommended the two regulators cooperate together and better enforce the rules.

On superannuation, the commission suggested banning unsolicited selling of any products and prohibiting deducting advice fees from MySuper accounts.

Compensation scheme

A compensation scheme for victims of banking misconduct is the centrepiece of the government’s response to the damning findings.

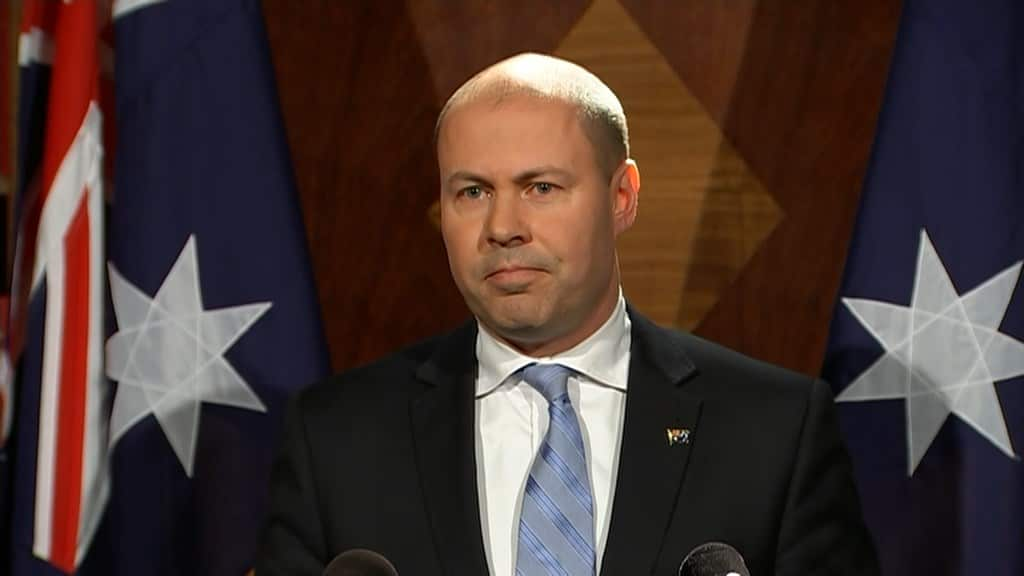

After considering the report’s findings over the weekend, Treasurer Josh Frydenberg said the government would act on all 76 recommendations.

“My message to the financial sector is that misconduct must end and the interests of consumers must now come first. From today the sector must change, and change forever.”

The scheme will be open to those hurt by financial industry misconduct over the past 10 years.

It will cover almost 300 consumers who had been found to be entitled to $300 million in compensation by predecessor bodies of the Australian Financial Complaints Authority but had yet to see any money.

“This will be a scheme paid for by industry reflecting their obligation to right their wrongs.”

‘Five mortgages before Christmas’

Commissioner Hayne condemned a culture within the banking sector that allowed misconduct to thrive.

“Entities and individuals acted in the ways they did because they could,” Commissioner Hayne said.

For too long, the wrongdoing has gone unpunished, he said.

“Misconduct, especially misconduct that yields profit, is not deterred by requiring those who are found to have done wrong to do no more than pay compensation.

And wrongdoing is not denounced by issuing a media release.”

Commissioner Hayne remains unconvinced the banks are willing to change their ways, singling out NAB.

“I thought it telling that in the very week that NAB’s CEO and Chair were to give evidence before the Commission, one of its staff should be emailing bankers urging them to sell at least five mortgages each before Christmas.”