Use our budget calculator to find out how you will be affected by this year's budget measures.

- Refugees to wait twice as long for job search services

- Migrants to wait four years for Centrelink in welfare crackdown

- Government to claw back $300m from welfare debtors

- Visas for foreign doctors cut in $400m saving to health system

- Turnbull government's Indigenous strategy blasted

- Churches win exemption from paying for Aussie apprenticeships

- Funding freeze for ABC, boost for SBS

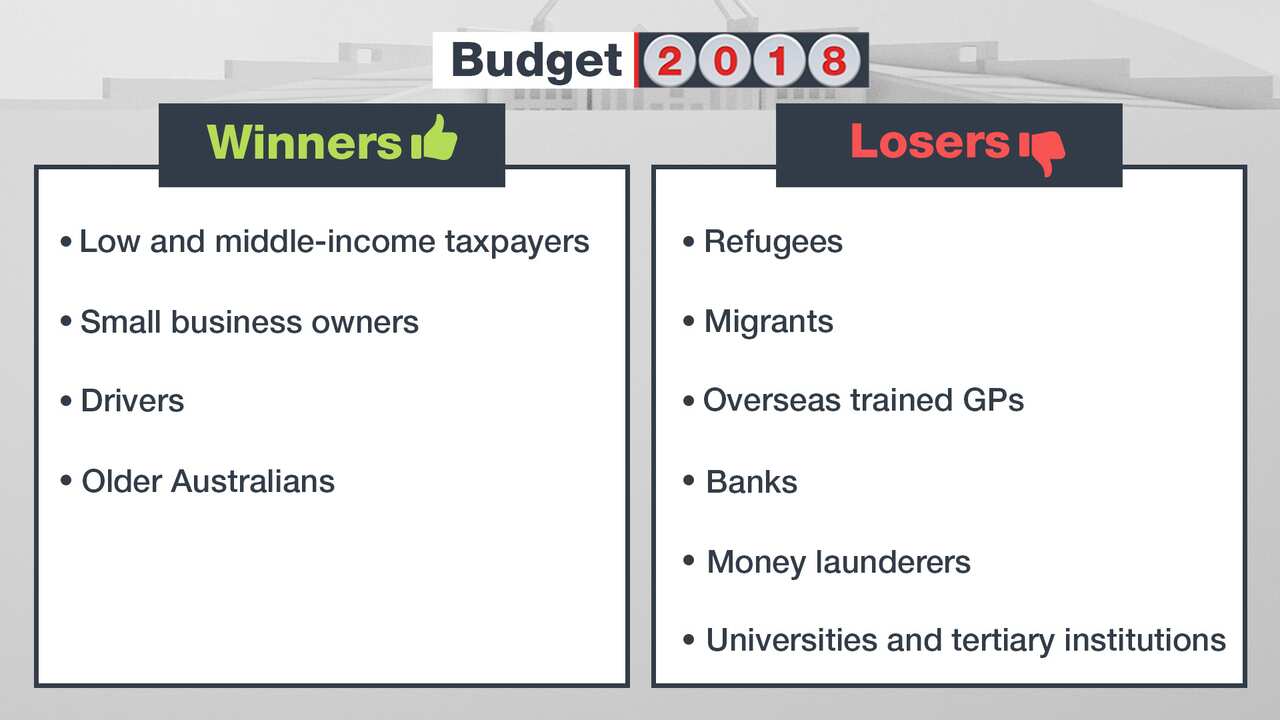

WINNERS

Low and middle-income taxpayers

- Up to 10 million workers will save up to $530 a year from 2018-19 under a new tax offset.

- More than 200,000 taxpayers won’t be paying 37 percent tax rate when the 2.5 percent tax bracket is lifted to those earning $90,000 from July 1, 2018.

- There’ll also be further measures to tackle bracket creep from 2022-2025, which will mean more Australians will be paying less tax under the 32.5 percent rate.

- By 2025, 94 percent of Australians will be paying the 32.5 percent tax rate.

Small business owners

- Will have another year to claim the $20,000 instant asset write-off, allowing them to deduct the cost of goods costing less than $20,000.

Drivers

- $1 billion urban congestion fund to fix “pinch points and improve traffic flow”.

Older Australians

- The number of home care places will be hiked by 14,000 over four years, costing $1.6 billion.

- Another $146 million will be spent on boosting access to aged care services for those in regional areas.

- Older Australians in aged care will also be able to draw from an $83 million fund to combat depression and loneliness.

- All age pensioners can now access the Pension Loans Scheme, which will allow them to boost their retirement income by $17,800 for a couple without having their pension eligibility questioned.

- Pensioners can also earn an additional $1300 a year without having their payments cut.

- Self-employed can now earn up to $7800 and still get the pension.

LOSERS

Refugees

- Will have to wait another 13 weeks – or a total of six months - to get help finding a job.

- Currently they wait 13 weeks to receive help from Jobactive, the government’s job services provider, but that is now being extended to 26 weeks after their arrival.

- The government says the waiting period will help them improve their English language skills.

Migrants

- Will have to wait four years instead of the current three years to access welfare payments from July 1, 2018.

- This will save the government $200 million over five years.

Overseas trained GPs

- The government will bring in 200 fewer doctors from overseas to save $400 million.

Banks

- Levy to continue and the Australian Financial Complaints Authority to start on November 1, and Banking Executive Accountability Regime on July 1.

Money launderers

- Outlawing large cash payments more than $10,000 made to businesses for goods and services from July 1, 2019. Transactions over a threshold will only be allowed through an electronic payment system or cheque. The government says this will tackle money laundering and tax evasion.

- A new hotline will also be set up allowing members of the public to dob in those engaging in money laundering or tax evasion.

Overseas hotel providers

- Will have to pay GST the same way as local providers from July 1, 2018.

Universities and tertiary institutions

- All HECS-HELP and FEE-HELP providers will have to pay an annual fee for the administration of the programs as well as the application process.