Beginning on July 1 this year the Department of Social Services began retesting Disability Support Pension (DSP) recipients under the age of 35 who had claimed DSP between 2008 and 2011. These recipients began receiving payment prior to a tightening of the eligibility criteria in September 2011.

Understandably, this reform has been the source of considerable anxiety for many of those who may be affected by these reforms. Speaking on SBS's Insight, one panellist spoke of the fear of being "…forced into employment services and being take off the DSP." Perhaps something that has compounded this anxiety is the less than nuanced media coverage of the growth in DSP receipt in the lead up to the July reforms.

This reform, and those that have preceded it, have been necessary and there remains a need for further reform. Welfare is never as good as having a job, and currently the DSP does not do enough to ensure that people with disabilities who can work are encouraged to do so.

Some pundits, such as Greg Jericho at The Drum, argue that there is no urgency. He contends that the percentage of working age Australians, those aged 15 to 64, on DSP has barely moved in recent years and that any increase has largely been the result of population ageing. This is not the case.

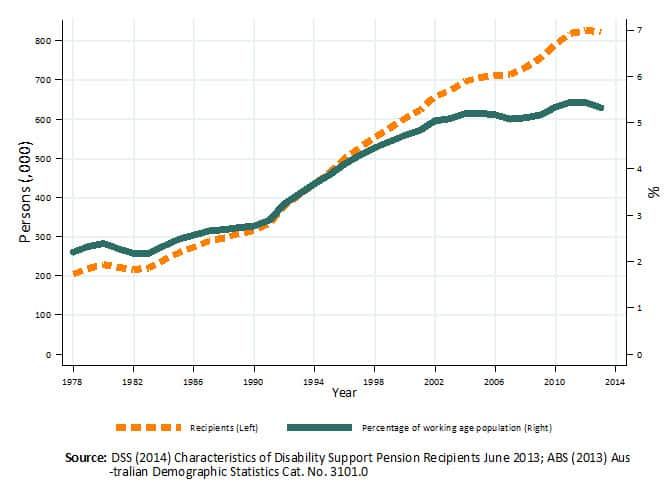

The figure below presents the number of DSP recipients between 1978 and 2013 (left axis) next to DSP recipients as a percentage of the working age population (right axis). While there has been a modest decline in the rate of DSP receipt since 2011, this was preceded by 24 years of sustained growth between 1982 and 2006 in which the rate of receipt more than doubled.

With more than one in twenty working age Australians on DSP as of June 2013 costing the taxpayer $16 billion in 2013-14 there is no room for complacency.

It is certainly true that population growth, an ageing population and changes to Age Pension eligibility for women have all contributed to some of the increase in the numbers on DSP. However, research by the Melbourne Institute indicates that, together, these only explain a third of the increase in DSP between 1982 and 2011.

The other two thirds are the result of declining economic conditions and past mistakes in Australia’s income support policy settings that need fixing.

The reason that the numbers on DSP continue to be a concern for policy makers is that until recently there have been far more people claiming, and being awarded, DSP than have been exiting the payment. Also present in policy maker’s minds are the mistakes of the early 1990s when eligibility for DSP was relaxed under the Hawke government’s Disability Reform Package in the midst of a deep recession.

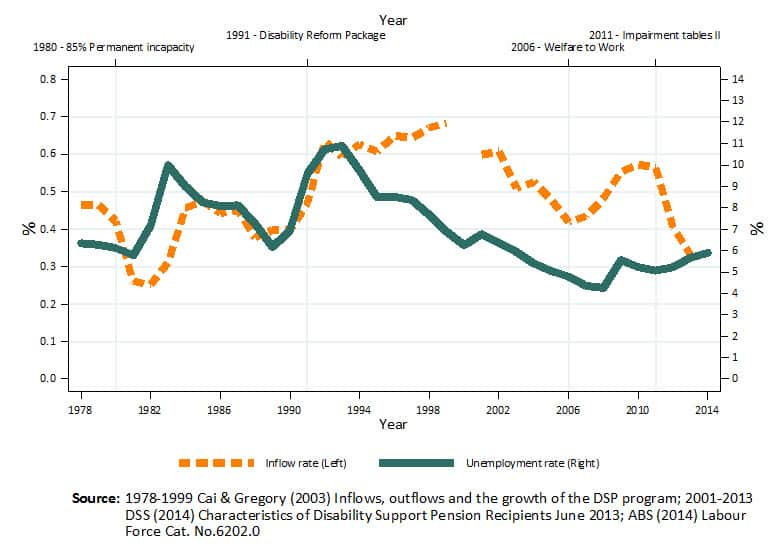

The consequences of this can be seen in the next figure which plots the rate of inflow onto DSP (entry as a proportion of the working age population, left axis) next to the unemployment rate (right axis). The upper horizontal axis marks the timing of some of the more important reforms to DSP over the period.

Prior to the recession of the early 1990s the entry rate closely followed the unemployment rate with inflow declining as the labour market recovered. This changed in the early 1990s; the significant growth in DSP that occurred during that recession marked the beginning of a period of significant expansion of DSP that lasted until the end of the decade after which entry slowly began to decline.

When DSP blows out during a downturn it can take a very long time for it to stabilise. It would take almost a decade for the rate of inflow to fall back to what it was at the height of the recession and 16 years for it to fall back to anywhere near its pre-recession level.

With the increase in DSP claims in the wake of the Global Financial Crisis the Gillard government moved to tighten DSP eligibility in September 2011. New DSP claimants who were assessed as having a condition that had not been fully diagnosed, treated and stabilised were referred to employment services for a program of support to help them find work and were placed on Newstart for up to 18 months.

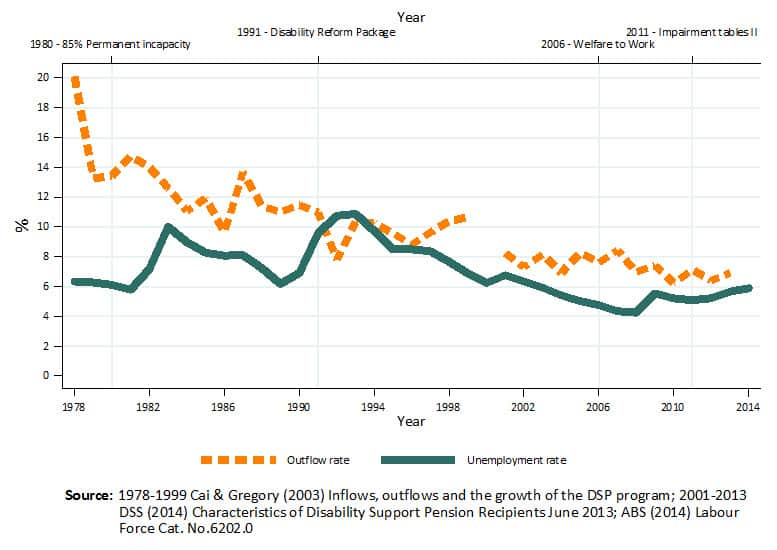

In contrast to DSP, Newstart is an `activity tested’ payment. To receive it recipients need to be engaged in job search or participation in education and training. Diverting new claimants onto Newstart is intended to maintain their attachment to the labour force. This is important as the probability of leaving payment falls the longer a recipient remains on it. This partly explains why the rate of exit from DSP continued to decline despite the strong jobs growth that followed the recession of the early 1990s.

Tightening eligibility for DSP and ensuring that those with a capacity to work are activity tested were important reforms, however these only applied to those making new claims and not to those already on DSP. There is the danger that this `grandfathering’ of past reforms has left many people on DSP who may have a similar work capacity to those who were diverted onto Newstart for no other reason than the date of their claim.

The current government’s moves to retest the under 35s who entered DSP between 2008 and 2011 is the first time that a government has sought to align the eligibility of existing recipients with new claimants – even if only for a relatively small percentage.

The under 35s are a good place to start. If they can be assisted into employment they have decades of their working lives ahead of them and they are also those most likely to have had some recent work experience. Ensuring that they do not become disengaged from the labour market is an important policy objective.

However, there remains the question of whether Newstart is the best place for people with disabilities – some of whom will have a work capacity that is part-time at best. While Newstart is activity tested, its lower maximum rate and tougher means test is more appropriate for those who can reasonably be expected to obtain full-time work. It is not the best place for those with disabilities that might preclude them from full-time work and who, through no fault of their own, may take longer to find a job.

There is a case for expanding the scope of DSP retesting. However, with 18 per cent of those on DSP having been on it for over 20 years, the government needs to be realistic about the employment prospects of those who have been out of the labour force for very long periods of time.

Matthew Taylor is a Research Fellow at the Centre for Independent Studies. He was a guest on Insight earlier this month and tweets @mattnomics.