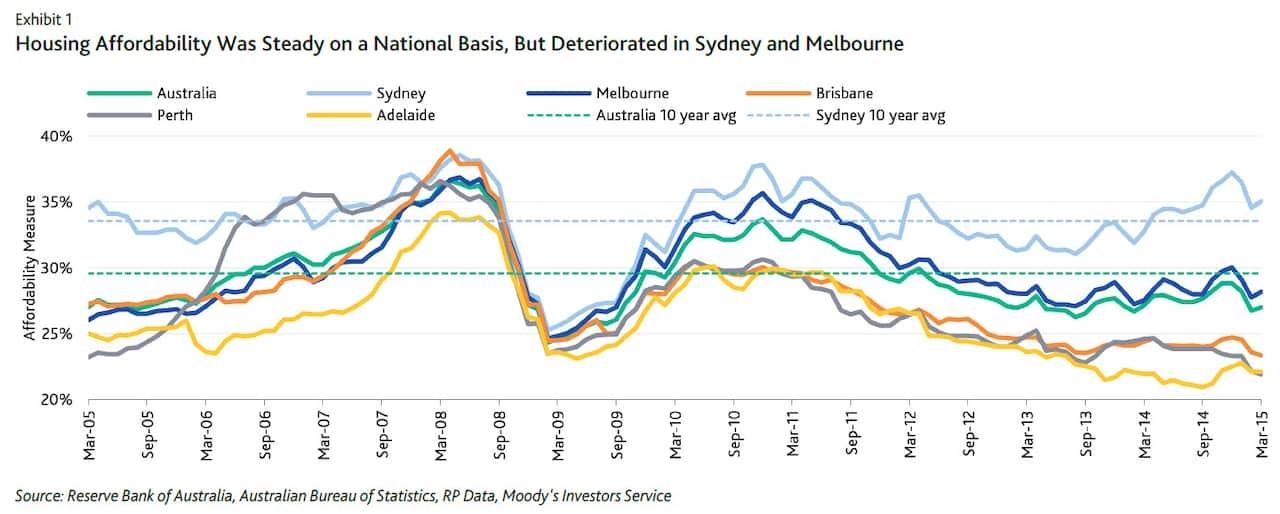

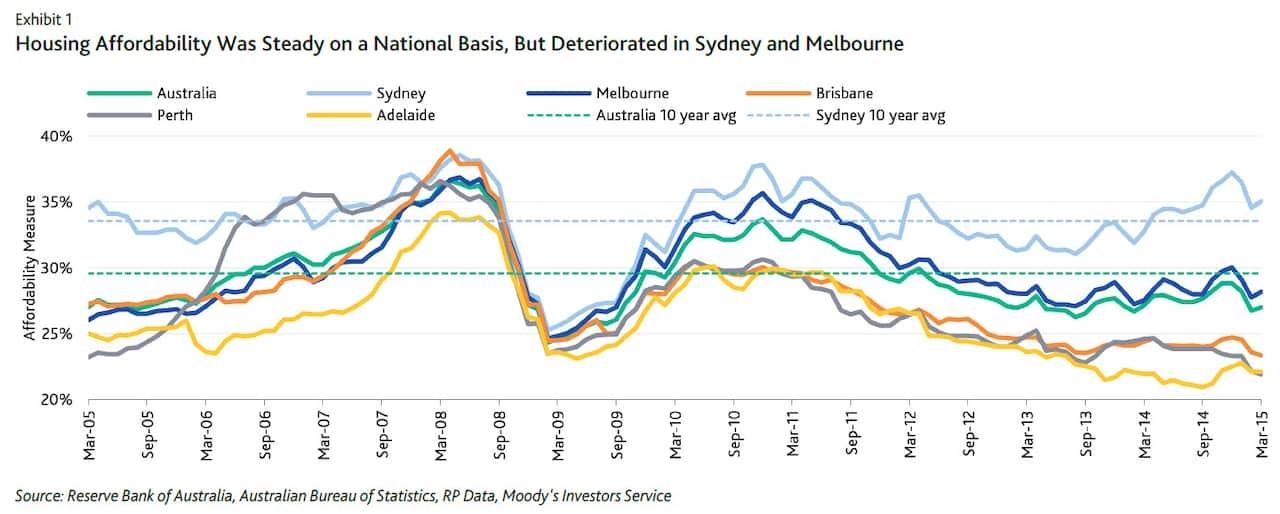

Moody's Investor Services has found that low mortgage interest rates have helped keep housing affordability steady on a national level offsetting the impact of higher residential property prices.

The Moody's Australian Housing Affordability Measure calculates the share of income needed, on average, to make monthly mortgage loan repayments.

Jennifer Wu, Moody's Structured Finance Manager, says "the housing market has really been supported by the low interest rate environment, but across all states, the trend is slightly different."

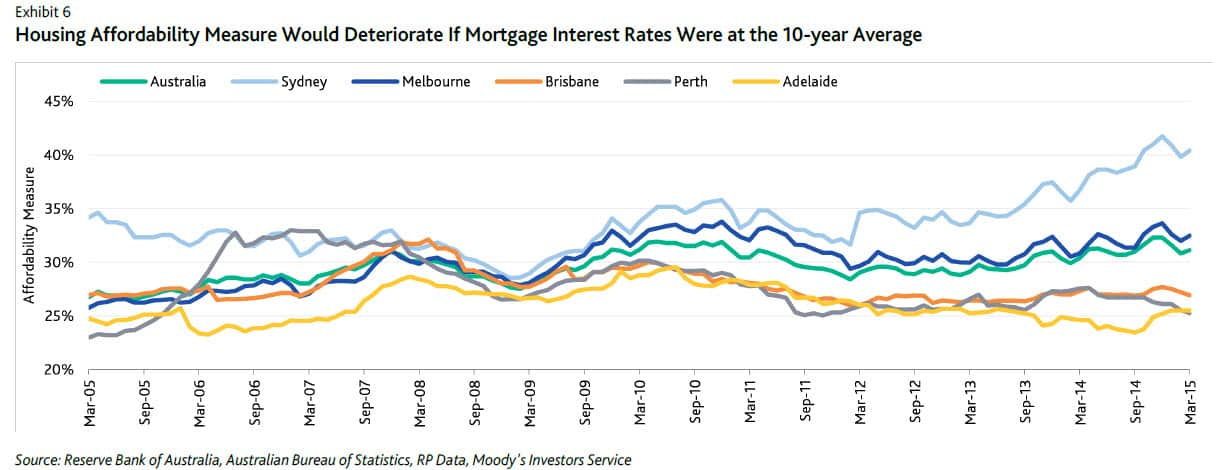

It found as of March 2015, Australian households with a home loan needed 27 per cent of their income to make repayments, which is the same as the previous 12 months and more surprisingly is lower than the 10-year average of 29.6 per cent.

Sydneysiders however are spending more, up from 32.8 per cent to 35.1 per cent, which is also higher than the city's 10-year average of 33.6 per cent.

"For Sydney, the major causes of your deterioration in affordability is to do with your house prices," said Jennifer Wu.

"Over the year we have seen an increase of about 12 per cent for Sydney house prices, versus a very average household income increase of about 1.5 per cent."

Those with a mortgage in Melbourne are also paying more, relatively to income, up from 27.5 per cent to 28.2%. Affordability has improved though in Brisbane. Home owners there only need to use 23.4 per cent of their income, down from 24.4 per cent to cover a mortgage repayment, and it was even better in Perth, down from 24.6 per cent of income, to 21.9 per cent.

Affordability has improved though in Brisbane. Home owners there only need to use 23.4 per cent of their income, down from 24.4 per cent to cover a mortgage repayment, and it was even better in Perth, down from 24.6 per cent of income, to 21.9 per cent.

It remained steady in Adelaide at 22.1 per cent.

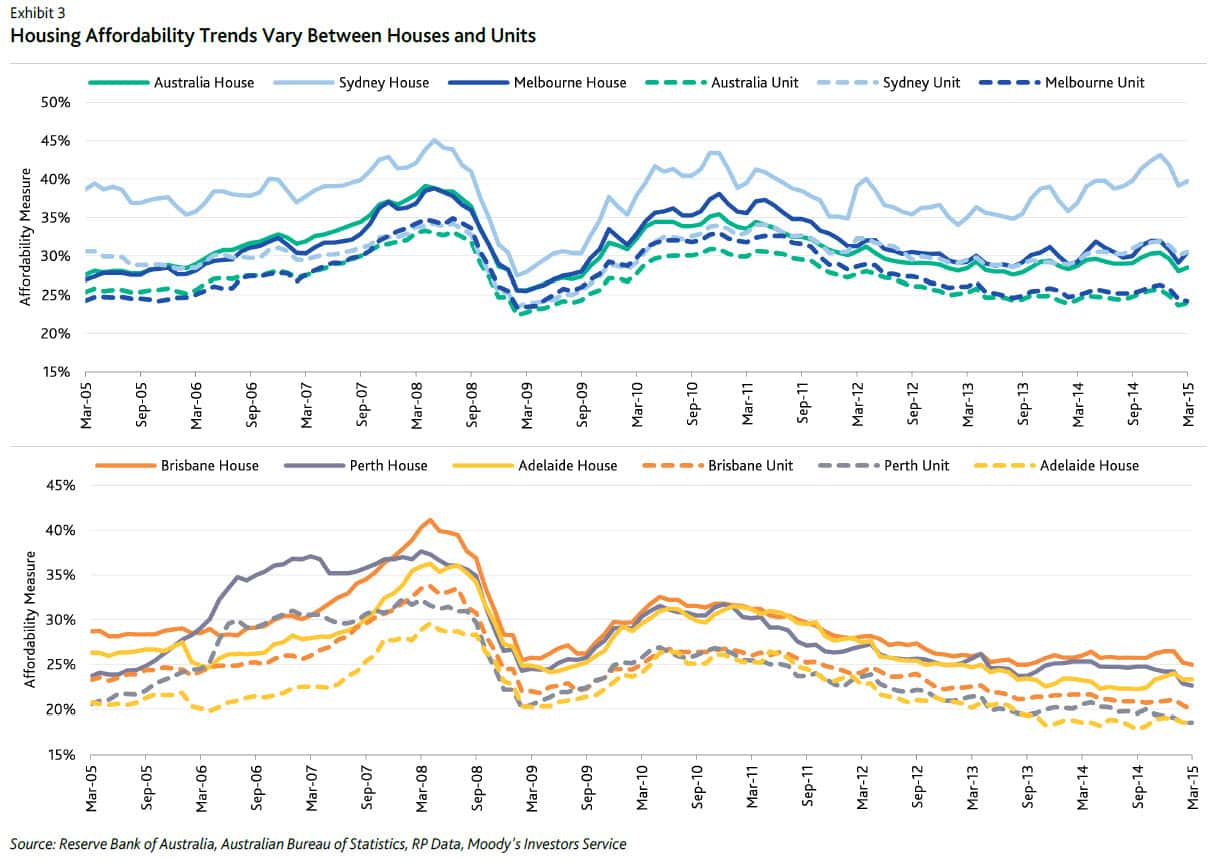

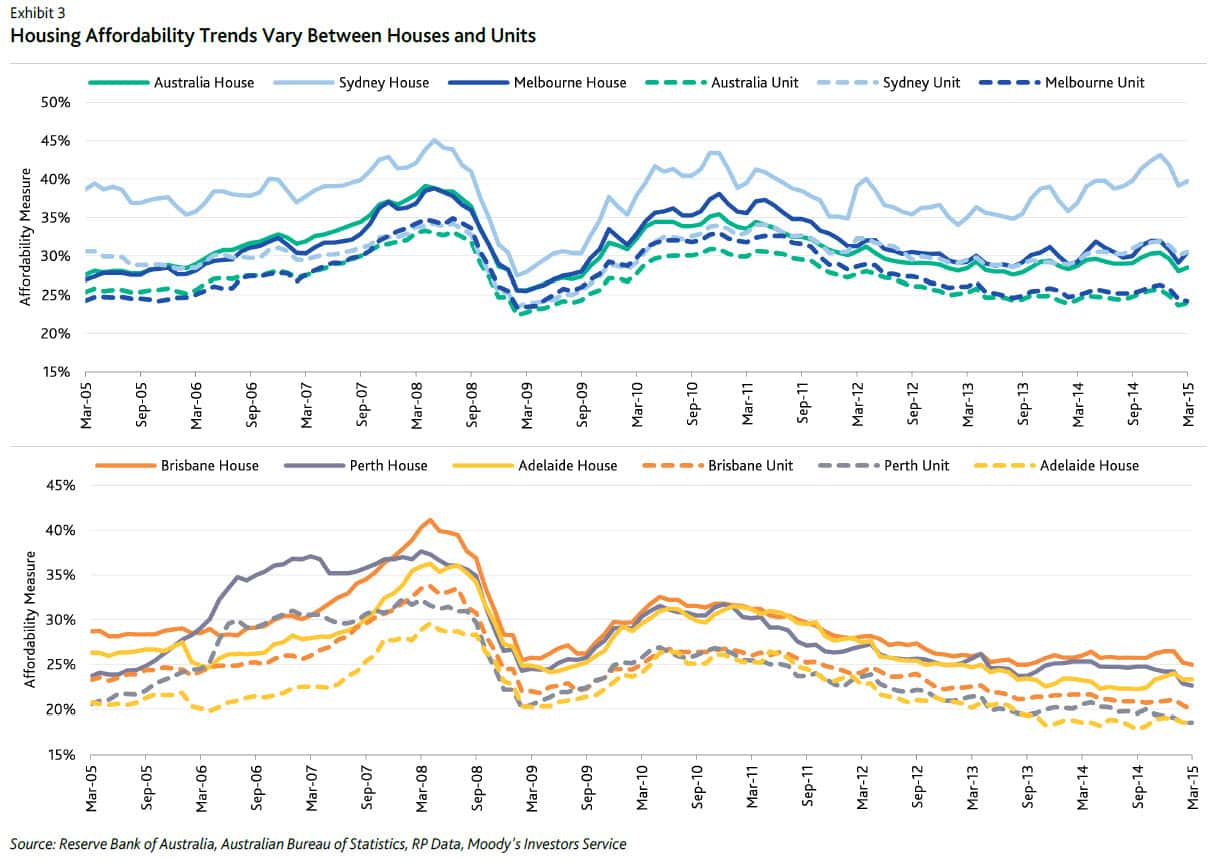

Sydneysiders are also paying more for apartments. Median prices rose 8.7 per cent in the city, compared with 2.4 per cent nationally. Affordability for units in all other capital cities improved or was steady. Moody's takes in three variables to determine affordability; house prices which are rising, standard variable rates which have fallen, and average household income.

Moody's takes in three variables to determine affordability; house prices which are rising, standard variable rates which have fallen, and average household income.

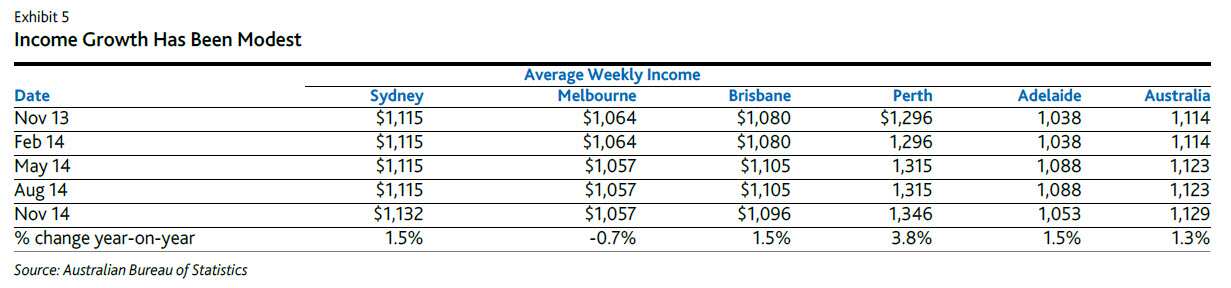

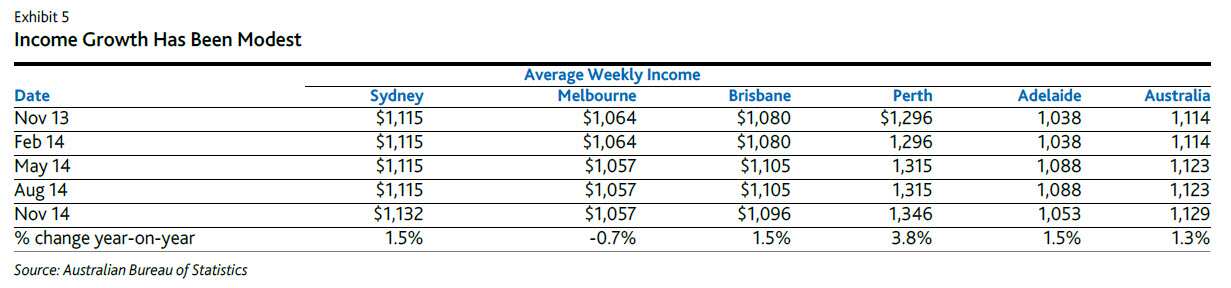

Household income has mostly grown, but that growth has been modest.

Year on year, average weekly incomes rose nationally by 1.3 per cent from $1,114 to $1,129. People living in Perth saw the biggest rise up 3.8 per cent to $1,346, while those living in Sydney saw incomes increase by 1.5 per cent to $1,132.

People living in Melbourne saw their incomes fall by 0.7 per cent to $1,057. Analysts at Moody's expect the Reserve Bank of Australia to cut the official interest rate from 2.25 per cent to 2 per cent sometime this year. That would reduce the average standard variable mortgage rate which currently stands at 5.65 per cent and is already much lower than the 10-year average of 7.18 per cent.

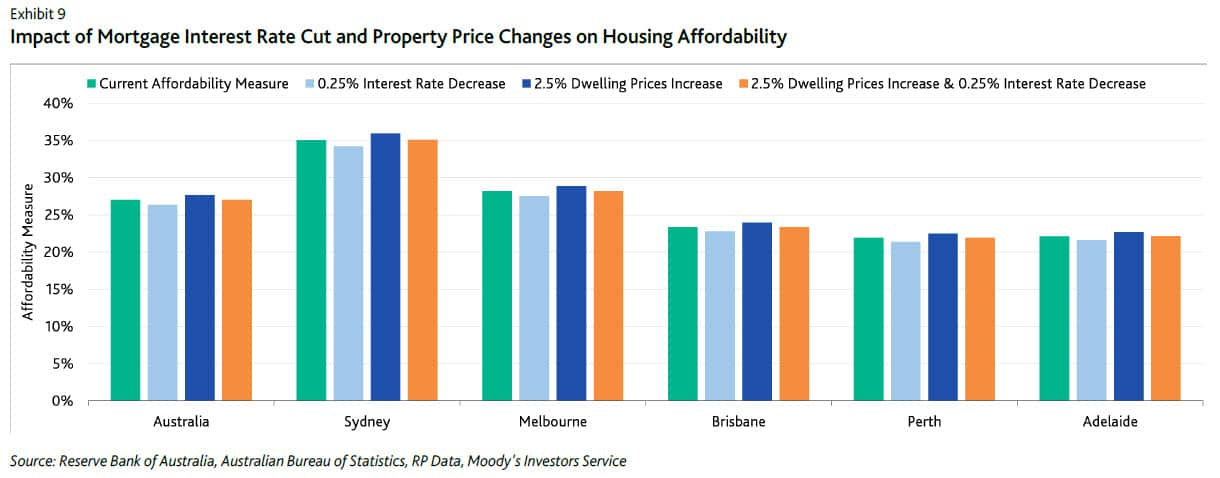

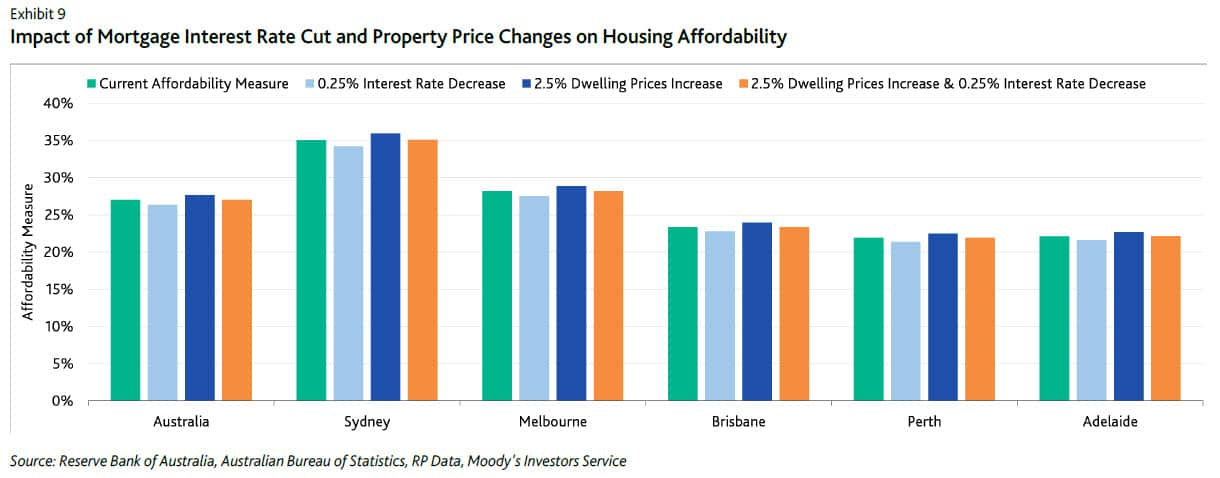

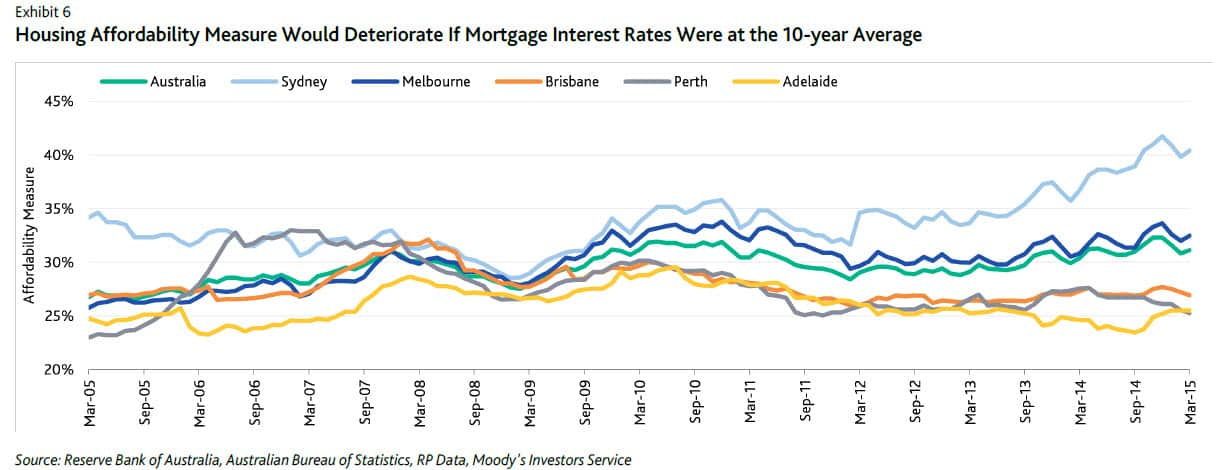

Analysts at Moody's expect the Reserve Bank of Australia to cut the official interest rate from 2.25 per cent to 2 per cent sometime this year. That would reduce the average standard variable mortgage rate which currently stands at 5.65 per cent and is already much lower than the 10-year average of 7.18 per cent.

Jennifer Wu says, "If we see interest rates decrease, and provided that nothing has changed, and the trend that we are currently seeing continues, I would expect that affordability will continue to worsen, primarily in Sydney and Melbourne." That is assuming a 2.5 per cent increase in home values at the same time. If rates were at 7.18 per cent, Moody's says the national affordability measure would be at 31.1 per cent, close to the highest level of the last 10 years. For Sydney though, it would surge to 40.4 per cent.

If rates were at 7.18 per cent, Moody's says the national affordability measure would be at 31.1 per cent, close to the highest level of the last 10 years. For Sydney though, it would surge to 40.4 per cent. In its study, Moody's has also applied a number of other scenarios.

In its study, Moody's has also applied a number of other scenarios.

If house prices rose 10 per cent, it found Sydney's affordability measure would rise 3.5 per cent compared to a deterioration of 2.7 per cent nationally. In other words, Sydneysiders would need to pay a higher rate compared to income.

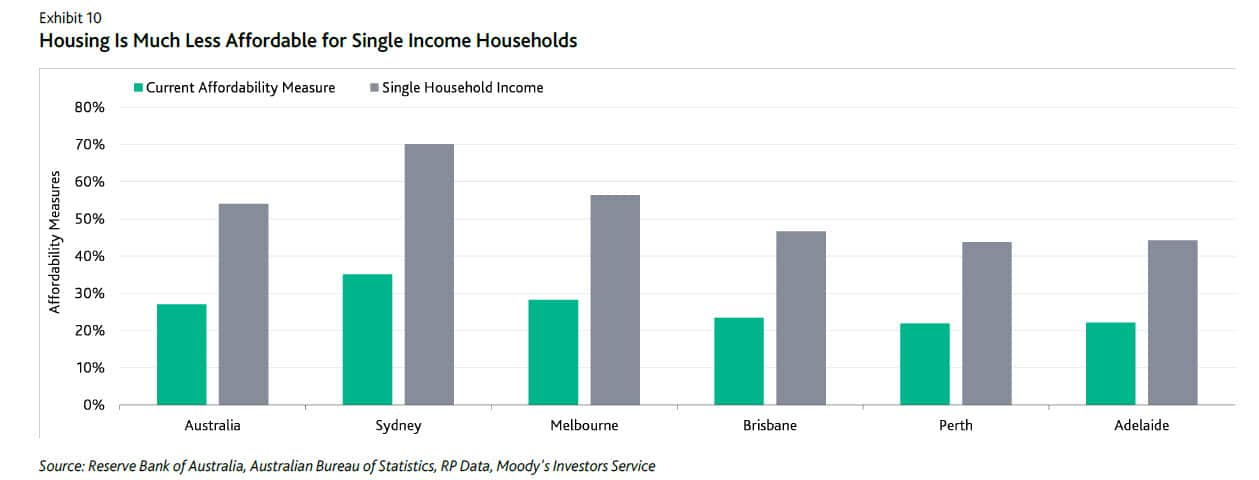

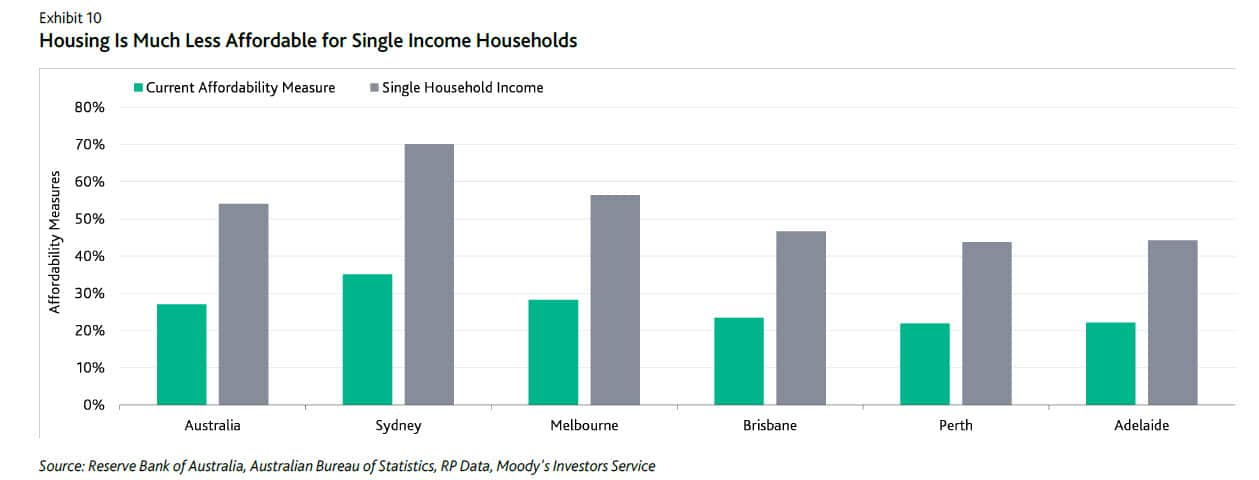

Those on a single income have it the toughest.

Moody's says for those households on a single income, 70 per cent of their earnings are used to service monthly mortgage repayments in Sydney, which it says, is not sustainable. That compares with just over 50 per cent nationally.

Share