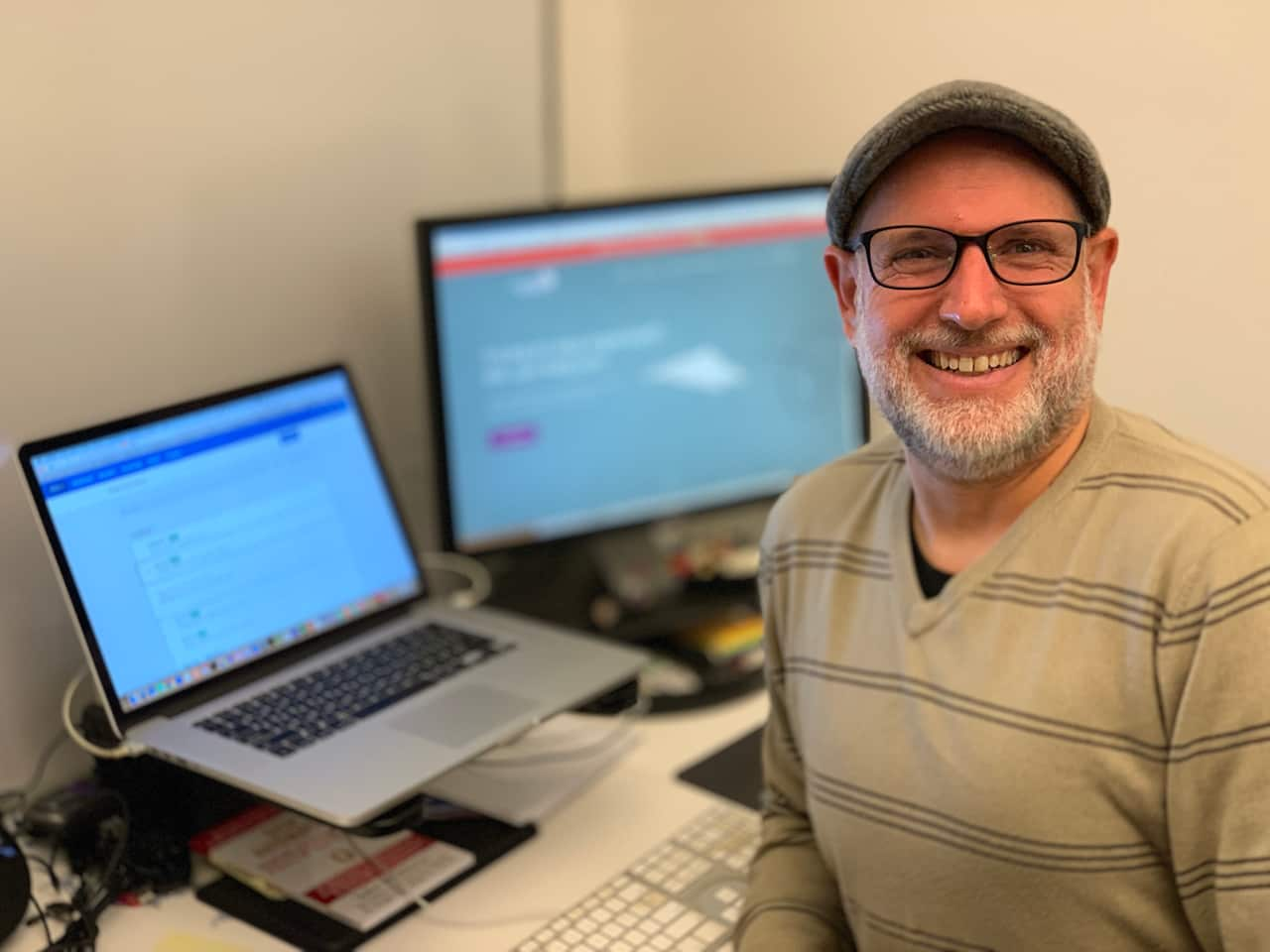

Mahmood Hussein runs a drone training business in Perth, working with some of Australia’s largest companies.

He is among millions of small business owners struggling with late payments from clients.

“We actually have to work off our overdraft or we have to get a loan because we’ve still got wages to pay, we’ve still got bills to pay,” he told SBS.

Mr Hussein was born in Pakistan, migrating to West Yorkshire in England with his family when he was seven years old. The mechanical engineer has worked for large organisations internationally, moving to Australia 21 years ago to run a mining services company.

Since branching out into business himself four years ago, he says he has felt a power shift.

Mahmood Hussein (right) runs Global Drone Solutions in Perth. Source: Supplied

“I’ve been in business a long time, so we make sure that [our suppliers] get paid on time.

"But large businesses don’t seem to understand that. Unfortunately, you’re just treated as a multi-million dollar organisation, and you might only be doing $50,000 to $60,000 worth of business with them a year.”

It’s estimated that more than half of all small business invoices are paid late, with $115 billion being held back by larger companies each year, according to a study of more than 150,000 businesses by online accounting company Xero.

That’s on top of already-lengthy payment terms.

Mahmood's business often struggles with late payments. Source: Supplied

“They have put in place payment terms of a minimum 60 days, ideally 90 days. For a small organisation like ours, that plays havoc with our cash flow,” Mr Hussein said.

Small Business Ombudsman Kate Carnell says it is unacceptable.

“Small businesses have to pay their staff, their suppliers, their landlords in seven, 14 and at most 30 days, and they're finding big business blowing out payment times to 60 and 90 days. Big businesses can't use small businesses as cheap banks.”

The Government is aware of the issue and is working to speed up payment times.

Small business owners have until 6 March to give feedback on the federal government’s Payment Times Reporting Framework legislation, which aims to make payment terms more transparent.

Under the draft laws, businesses with a turnover of more than $100 million will be required to publish information on how fast they pay suppliers.

Minister for Employment Michaelia Cash says Australia is on the right path to economic recovery. Source: AAP

“This will be a landmark reform which will encourage fairer and faster payment times for small businesses,” Small and Family Business Minister Michaelia Cash said last week.

Business owners are being urged have their say.

“This framework will require big businesses to be upfront and honest about the time it takes to pay small businesses, to help small businesses choose who they supply,” Ms Carnell said.

“Small businesses are having to give a discount to be paid in 30 days or less, which simply isn't reasonable”.

Migrants affected

One-third of Australian small businesses are owned by migrants, and navigating fair payment terms can be particularly challenging for those who don't speak English as a first language.

New arrivals starting a business without capital can face greater cash flow issues and may be more willing to negotiate terms.

Global Drone Solutions delivers training for some of Australia's largest companies. Source: Supplied

The Federation of Ethnic Communities Council of Australia says people from culturally and linguistically diverse backgrounds face additional obstacles in a whole range of areas.

"Proportionally, more CALD Australians operate small businesses than the broader Australian population, meaning late payments impact more Australian families from CALD backgrounds than other Australians," FECCA chairperson Mary Patetsos said.

"Many successful business owners face language barriers as well as a paucity of awareness of their rights and what the avenues of recourse are if they are treated unfairly."

Digital Invoicing

A growing number of business owners are turning to technology to speed up the process. Electronic invoices, or e-invoices, allow customers to pay instantly via a link, rather than following the instructions of a PDF invoice and manually transferring funds.

Simon Foster set up Australian invoice manager Squirrel Street.

Software expert Simon Foster, from Squirrel St, says businesses should get cloud accounting software. Source: Supplied

The business hires long-term unemployed people to processes paper invoices for electronic storage.

“It means when you are issuing an invoice to a large supplier it’s going directly into their accounting system,” Mr Foster said.

“Then they can push a button and pay you.”

Online accounting firm Xero says switching to online payments reduces administration errors and speeds up payment times.

“The arrival of e-invoicing in Australia means we now have the technology solution to deliver faster payment times from big business to small business," said Xero’s Small Business Advocate, Angus Capel.

Mr Hussein's business has come up with its own strategy to minimise late payments.

“About two weeks before the invoice is due we send them an email and follow up with a phone call, saying ‘we’re just making sure you’ve got everything and the payment will be processed'."

“That’s where we found some of our challenges were, someone’s got a query but nobody’s bothered to contact us."

Share