Facebook may be developing its own digital dollar but the Reserve Bank of Australia doesn't believe cryptocurrencies will catch on for actual payments any time soon - if ever.

In a 5,800-word paper published in the RBA's Bulletin publication on Thursday, four RBA analysts say they see "little likelihood of a material take-up of cryptocurrencies for retail payments in Australia in the foreseeable future".

Cryptocurrencies face a trade-off known as the "scalability trilemma" where they can at best offer two of the three properties of decentralisation, scalability and security, the authors say.

For example, the authors say Bitcoin can process 10 transactions a second, while Australia's New Payments Platform that powers BPAY's instant Osko payment system can handle 1,000.

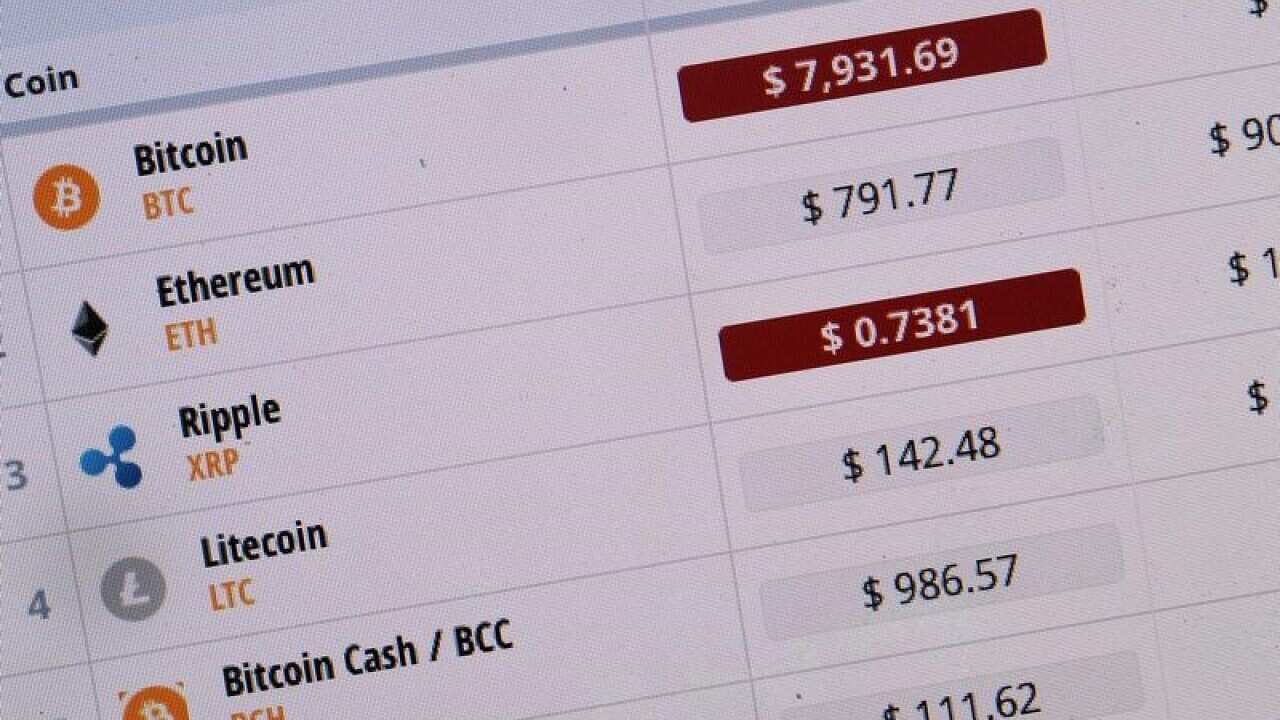

Payment policy department analysts Cameron Dark, David Emery, June Ma and Clare Noone also cite the well-known issues with wild price swings of cryptocurrency.

The "stablecoins" backed by traditional currencies, like Facebook's new Libra coin unveiled this week, aim to solve this volatility issue but those may not appeal to the "crypto-libertarian" enthusiasts who mistrust the traditional banking system, they say.

RBA Governor Philip Lowe famously pondered creating an "eAUD" in a speech in December 2017 - at the height of the Bitcoin bubble - but said a convincing case for issuing Australian dollars on the blockchain had not yet been made.

Thursday's analysis seems even more negative, with the authors concluding that while the distributed ledger technology underpinning Bitcoin will likely continue to evolve, innovation also continues to occur in the traditional financial system.

"As long as the Australian dollar continues to provide a reliable, low-inflation store of value, and the payments industry continues to work on the efficiency, functionality and resilience of the Australian payments system, it is difficult to envisage cryptocurrencies presenting a compelling proposition that would lead to their widespread use in Australia," they write.