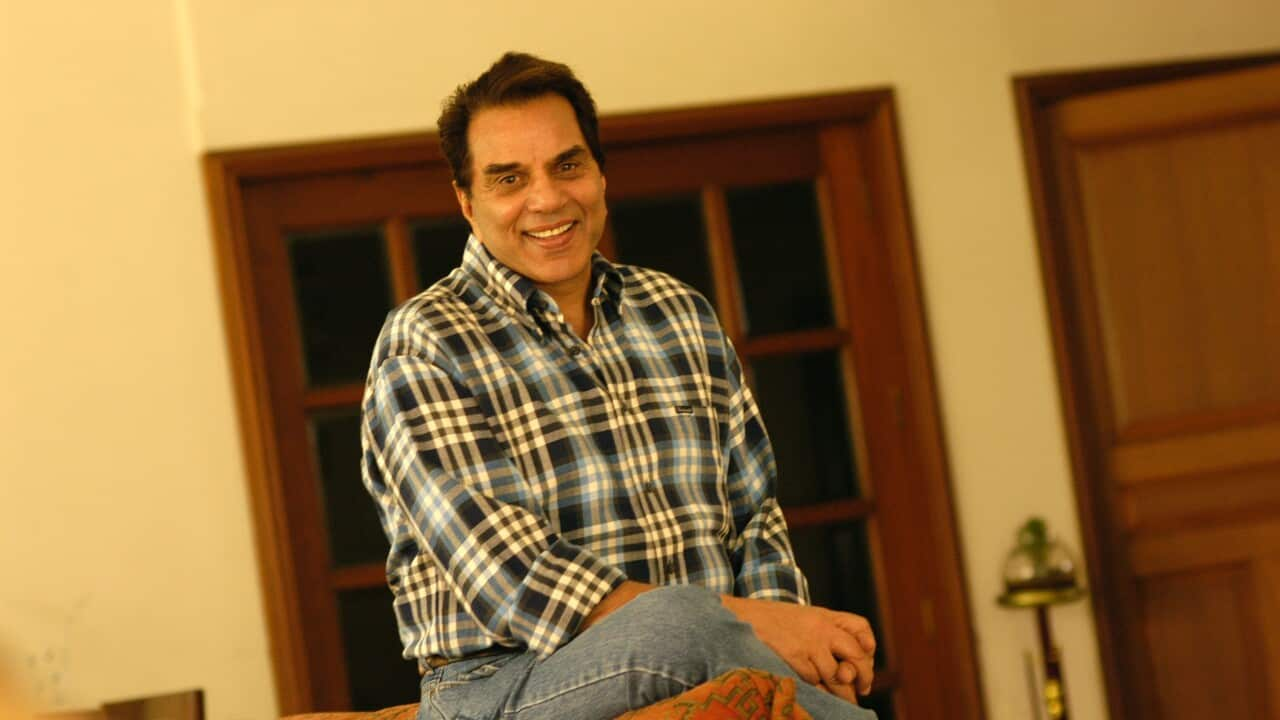

There are some stark differences and it is important to know them, says Afif Tahir, Sydney-based insurance broker.

Highlights:

- Assess your needs before taking insurance

- You can pay an insurance premium from your super fund.

- In most personal insurance policies, you do not get a tax benefit.

Mr Tahir suggests that one can inquire about personal insurance through a broker, just like you consult a broker for a home loan.

He says brokers can advise about products available in the market according to one's needs.

"in India, you get paid when the policy matures in case of personal or life insurance. But for this, you have to pay a very high premium. Here in Australia, you can take more cover for less payment. But you get nothing if you don't make a claim," Mr Tahir says.

According to Mr Tahir, it is much cheaper to take personal insurance in Australia than in India.

"And you can also pay the insurance premium from your super fund," he says.

Afif says that you should take care of some things while taking insurance, for example;

- What are your needs?

- How much debt you have. For example loan, credit card payment etc.

- What is the settlement rate of the company you are taking insurance from?

"You just need to choose the right policy," he says.

Listen to the podcast:

Tune into SBS Hindi at 5 pm every day and follow us on Facebook and Twitter