Australia is among the nations in which Islamic Finance is growing most rapidly. This is according to the recently released Islamic Finance Development Report 2018, compiled by Thomson Reuters and the Islamic Corp for the Development of the Private Sector. The report shows a global annual growth of 11 per cent in 2017 to more than US $2.5 trillion in assets.

But what exactly is Islamic Finance and how does it affect our economy and our everyday lives here in Australia?

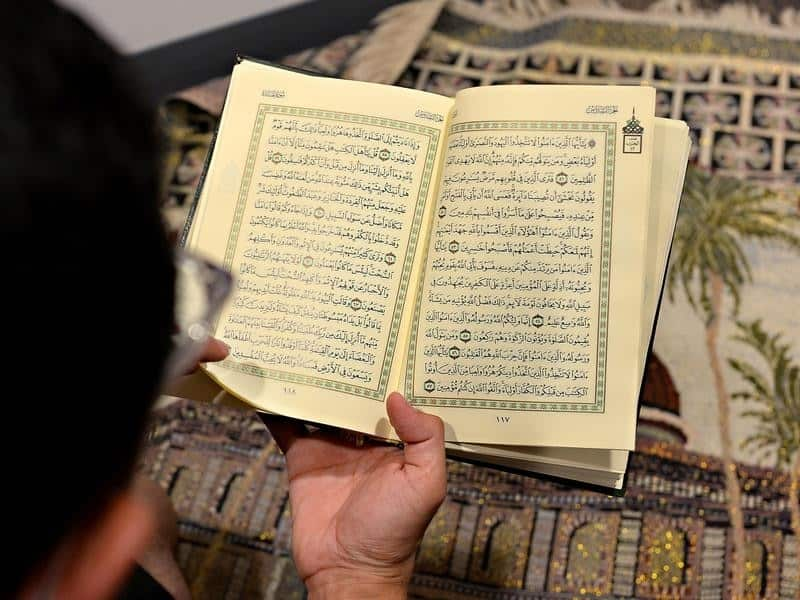

At its core, Islamic Finance allows observant Muslims to have the resources to buy houses and fully participate in the national workforce, without compromising core ethical beliefs around commerce, payment of interest, investment and debt.

According to academics and finance professionals, the growth of institutions offering Islamic Finance services can benefit the whole of Australia, particularly in providing new participants and resources to our economy.

New property buyers in a struggling sector

"Islamic principles [Shari'a] constrain the financial choices of Muslims in a number of ways, as it prohibits drawing/paying a return from/on debt," says Max Tani, Professor of finance at the University of New South Wales (UNSW) in Canberra. "For an observant Muslim, it is not possible to undertake a traditional mortgage without breaking religious obligations."

"Islamic Finance providers can structure financing in such a way to overcome this barrier, opening up financial and housing choices that would otherwise isolate Muslims from the rest of the population."

"The number of home buyers using Shari'a-compliant mortgages is growing," says MD. Arshadul Chowdhury, principal at real-estate agency Land & Lease Realty in Lakemba, a Sydney suburb whose population is made of almost 60 per cent Australian Muslims, according to the 2016 census. "As the market is going down, the growth of these financial products can somehow contribute to the sector."

Islamic superannuation

Similarly, according to Professor Tani, observant Muslim savers and super-members are effectively cut off from investing in interest-bearing debts or bonds. This, in turn, constrains choices for employees and employers alike.

"The existence of recognised and regulated super-funds that invest according to Islamic Finance principles is hence a welcome advancement, as it lessens such constraints," he says.

An example of Australian Shari'a-compliant superannuation fund is Crescent Wealth, which says in its mission statement:

"Our mission is powerful but simple: to ensure all Australians can protect and grow their retirement wealth without compromising their core values, and beliefs. Our approach actively avoids investments in industries such as gambling, alcohol, tobacco, weaponry, and interest-earning organisations."

A wider benefit

According to Tani, the existence of such recognised and regulated Islamic financial products will have positive consequences for the whole Australian society. And it could also affect their participation as members of the Australian workforce.

Tani quotes the 2016 Census, according to which there were about 600,000 Muslims in Australia - about 130,000 more than in 2011. This 27 per cent increase was the fourth largest in the period, by religious affiliation.

Although only making up 2.6 per cent of the population, Muslims account for a smaller fraction of the labour force due to their lower participation rate (56 per cent versus a national average above 70 per cent), especially among women. Yet, a participation rate of 56 per cent corresponds to about 340,000 individuals, whom, in most cases, are gainfully employed.

Australia rejects Islamic law but embraces its finance?

Some might argue that there is a double standard in Australia between a popular rejection of Islamic law in general and an embrace of Islamic Finance in particular.

"The genesis of this division lies in the shift in Australia towards neoliberal multiculturalism," according to Dr. Joshua Roose and Professor Adam Possamai in their publication Between rhetoric and reality: Shari'a and the shift towards neoliberal multiculturalism in Australia.

"One issue in particular that has cut to the heart of the debate about Muslims in Australia has been the issue of legal pluralism, and whether Shari'a, Islamic law, should be in any way formally recognised within the secular system," write the pair.

The book explores "the schism in Australian multiculturalism between explicit and publicly stated rejection of Islamic law as it relates to the personal domain on the one hand, and the embracing and promotion of Islamic Finance as opening an avenue to prosperity on the other."

According to Roose and Possamai, the framework of Australian neoliberal multiculturalism is that the cultural dimension of ethnicity, or in this case, faith, is only so valuable in the political arena as the tangible economic benefits it can offer.