With many Australians hoping for further interest rate cuts and more potential relief from the cost of living crisis, a new forecast has raised fears financial struggles could be exacerbated next year.

All of Australia's 'big four' banks have dismissed the possibility of a rate cut in 2026, with two of them forecasting at least one increase early in the year.

Commonwealth Bank has predicted cash rates will rise by 0.25 per cent in the Reserve Bank of Australia's (RBA) first meeting next year in February, while National Australia Bank has predicted a 0.5 per cent rise in two separate hikes in February and May.

Sally Tindall, data insights director at financial comparison website Canstar, told SBS News: "[It] will be important to see how inflation is tracking, if it's still tracking in the wrong direction ... Then the RBA could choose to hike the cash rate based on that."

But she also reminded Australians "It's important to remember that these are just forecasts. They're not set in stone."

Westpac, which previously forecast one rate cut in 2026, is the last major bank to rule out the possibility, forecasting, along with ANZ, that rates will remain unchanged.

After the RBA meeting in December, when rates were left unchanged, governor Michele Bullock also warned about a possible hike next year.

"[Bullock] was putting Australian borrowers on notice, particularly those with a variable mortgage, that their mortgage rates and their monthly repayments could potentially be on the way up rather than on the way down in 2026," Tindall said.

'Renewed' cost of living crisis

Bullock's announcement came as many banks and economists expected further rate cuts before the surprise inflation number, which was released in late November.

Australian Bureau of Statistics data showed inflation across the 12 months to October jumped 3.8 per cent, up from 3.6 per cent in September.

Mortgage holders may have been negatively affected by the element of surprise.

AMP chief economist Shane Oliver told SBS News: "People with mortgages were feeling more optimistic about things because they'd seen three rate cuts and there were expectations for more."

But now mortgage holders will be feeling pessimistic, he said.

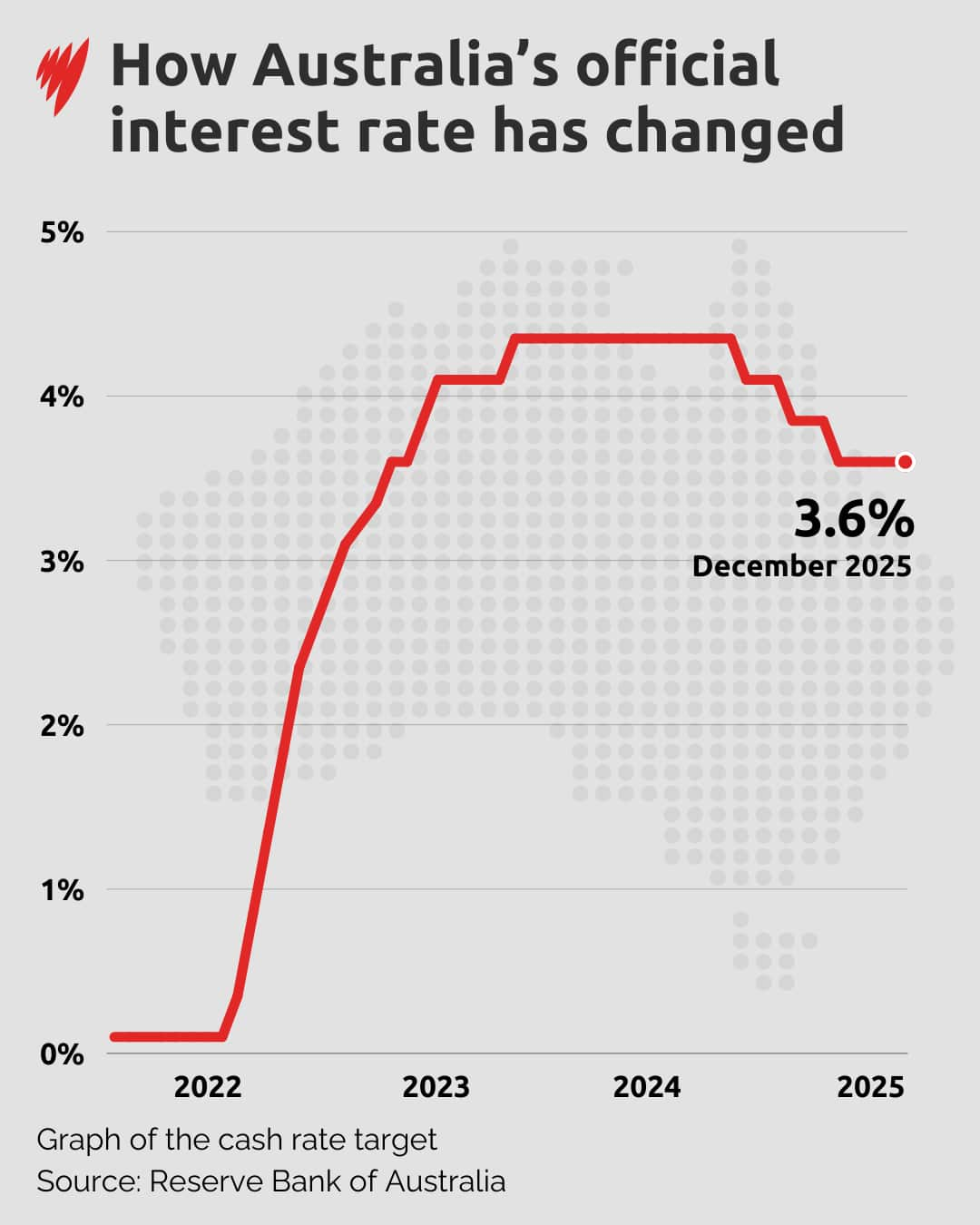

Since 2022, interest rates have increased 13 times, while there have only been three rate cuts, leading to larger mortgages for homeowners.

"Mortgage these days is, in many cases, the biggest component in a household budget," Oliver said.

"If the interest rates start going back up again, then they can have a big dampening impact on spending and lead to renewed talk about a cost of living crisis.

"As interest rates go up, you would feel your cost of living rising again."

Paying more in the supermarkets

But mortgage holders will not be the only group that might be impacted with experts warn a potential rise in interest rates could affect consumer goods.

Andrew Grant, an associate professor of finance at the University of Sydney Business School, suggests higher inflation may lead to a cycle of rising interest rates, forcing businesses to pass those costs on to consumers.

"The real question is around the degree to which this happens," he told SBS News.

"For people who are just not worried about the cost of housing, whether they own their house already or they're not intending to participate in the rental market, it will just mean that probably the inflation is gonna flow through to the cost of everyday items," Grant said.

"Rents go up for business owners, and they'll have to charge more for customers, as they need to overcome the cost of living themselves."

He said this pattern might impact "a large proportion of the population that are living pay cheque to pay cheque".

"Increasing interest rates or increasing inflation might mean that they're paying a little bit more at the supermarket each week, they're paying a little bit more for their electricity and energy bills, and other utilities," Grant said.

Cost pressures push more Australians into hardship

Finder's Cost of Living Pressure Gauge — which tracks the financial burden on Australian households monthly — shows a significant jump in financial stress from 57 per cent in October 2019 to 77 per cent in October 2025.

A June report from Anglicare Australia also paints a stark picture of how little is left after basic expenses for some workers. A full-time minimum wage worker has just $33 remaining after paying for rent, food and transport, according to the report. A single parent on the minimum wage is left with just $1, even with government assistance, while a household with two full-time workers and two children has only $5 left each week.

Kasy Chambers, executive director of Anglicare Australia, said any increase in the cost of living will "affect people on the lowest incomes".

"We are basically seeing poverty climbing the income ladder ... And that's the difficulty that we're seeing, and that's what we'll see more of," she told SBS News.

"I think we'll be seeing this get worse for more families before we see it get better, because the only thing we can really rely on to make a big difference is housing costs, and they don't seem to be going anywhere quickly."

For the latest from SBS News, download our app and subscribe to our newsletter.