Each year, Australians claim about $30 billion in total deductions against their income.

More than half of that is work-related expenses, and big chunk of it is for their cars.

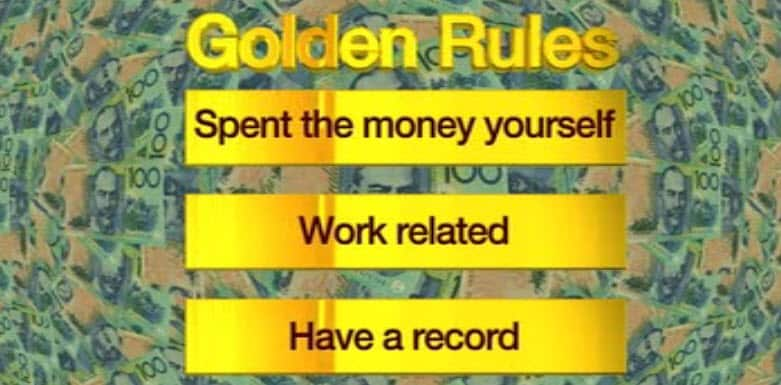

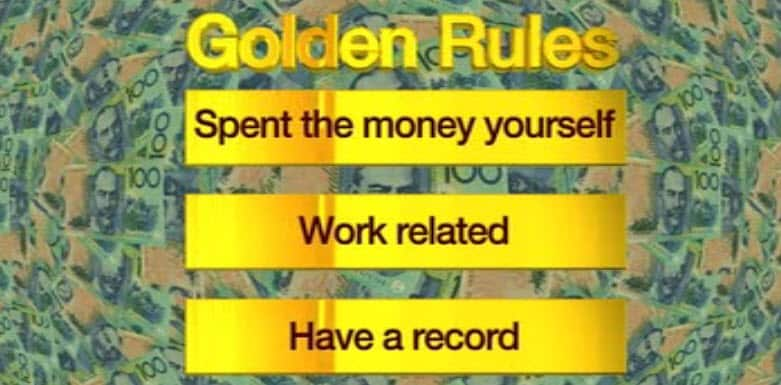

But the Australian Taxation Office (ATO) says there are three golden rules when claiming work-related expenses.

First, you need to have spent the money yourself.

Second, it must be work-related.

Third, you need a record to prove you spent the money. ATO Assistant Commissioner Graham Whyte said the tax office was there to help.

ATO Assistant Commissioner Graham Whyte said the tax office was there to help.

Source: SBS

"One of the exciting things that we're really happy to tell people about is a new tool that we have in the ATO app called My Deductions, and it really makes that easier," he told SBS News.

"People are able to record their deductions on the go."

About 350,000 people are expected to be contacted about errors and omissions in their tax returns this year.

Mr Whyte said better technology was making it easier to identify questionable claims.

"All returns that come into the tax office are scruitinised," he said.

"We use technology to do this. We have some fairly sophisticated algorithms and analytics that we use to analyse tax returns."

Mr Whyte said the tax office would also continue to look carefully at rental-property owners, with more than 100,000 contacted over the past year to clarify their claims.

"For example, where someone has a loan, their property has increased in value, they've gone out and got a further loan and tried to claim a tax deduction on that increased loan, but, quite often, what we've seen is that people have used that loan to buy a car or to buy a boat," he said.

Property-buying agent Pete Wargent said holiday-home owners would also be under watch.

"For holiday-home owners that have got accessible rental income, there'll be deductions to claim, in the same way that there are for other landlords," he told SBS News.

"The thing to remember is you can only claim costs proportionately for the period of the tax year that the property was rented out or genuinely made available for rent."

Mr Whyte said the rise of the sharing economy - services like AirBnB - also had the tax office's attention.

"We look at any new developments," he said.

"But I think the key message to people is they need to return any income that they get from these things that they're putting in place in their homes."

While larger businesses can expect to be audited every four to five years, the tax director of William Buck, Greg Travers, said there was a better chance smaller ones may be left alone if they lodged their tax returns and paid their taxes on time.

However, he said that did not mean that small businesses were limited from maximising their return.

"For all small businesses, you should be looking at your depreciation," Mr Travers said.

"There are a lot of people who underclaim their depreciation, either on things that they're not using anymore in the business or just at lower rates than what the tax office would allow.

"Look at your trading stock, because, again, there are different ways you can value that, and, if you can get stuff that you might still hold but is really not worth what you paid for, get the deduction for that."

Share