In a submission to the Attorney General’s Department the Law Council said the same safeguards offered to local companies needed to be offered to foreign investors.

“In addition to certainty and transparency, principles of fairness and due process should not be compromised unnecessarily,” the submission read.

“Foreign investors should not be discriminated against unfairly based solely on prejudice and without credible evidence that their foreign ownership has contributed to national security concerns.”

Related reading

China blasts Australian blocking of Ausgrid sale

The Council also called for specific investment guidelines for potential foreign investors around which types of asset investment would attract national security scrutiny.

Foreign investment in infrastructure, especially coming from Chinese companies, has been an ongoing contentious issue in Australia.

In January the Attorney General’s Department announced the formation of a new Critical Infrastructure Centre to provide coordinated security risk assessment and advice on investment.

The federal government in August last year intervened to prevent the New South Wales government from granting a 99-year lease of electricity provider Ausgrid to a joint bid by Chinese government-owned State Grid Corp and Hong Kong-listed Cheung Kong Infrastructure.

At the time federal Treasurer Scott Morrison cited national security concerns in blocking the sale.

(File photo) Australia's Treasurer Scott Morrison. Source: AAP

‘Australia is going to get a bad reputation’

The federal government last year announced the Foreign Investment Review Board would conduct stricter review processes for critical infrastructure assets.

China is only the seventh largest country in terms of total foreign investment in Australia, but it attracts by far the most attention.

Investment by Chinese companies is also growing. In the 2014-2015 financial year, the latest figures provided by the Foreign Investment Review Board, China was the country with the most new investment.

Related reading

Morrison OK with foreign investment law

Paul Barnes, director of the Australian Strategic Policy Institute's risk and resilience program, said the establishment of a new government centre was welcomed, but it was important not to over emphasis national security investment concerns.

“I think it is important to look at what is in the national interest more broadly,” he told SBS News.

“Some of the criticality will be related to security issues. Though there are more based on whether the company is going to be providing maintenance and investment in the reliability and the resilience of that system”. Economist James Laurenceson, deputy director at the Australia-China Relations Institute at University of Technology Sydney, said he supported the Law Council’s suggestion of specific government guidelines for each area of investment.

Economist James Laurenceson, deputy director at the Australia-China Relations Institute at University of Technology Sydney, said he supported the Law Council’s suggestion of specific government guidelines for each area of investment.

File image of Ausgrid's headquarters (AAP) Source: AAP

He said it was important not to repeat what happened with the Ausgrid sale, where Chinese investors were encouraged to bid by the state government and then blocked by the federal.

“Australia is going to get a reputation as a pretty unpredictable place to do business,” he told SBS News.

“We are talking millions and millions of dollars that these companies spent on advisors, setting up the funding for these bids, then at the end being told you’re a national security threat.”

“What we need to do is provide clarity to foreign investors about where they can bid and where they can’t and those sectors where they can fully expect to have challenges in terms of national security. At least that way they can take it into account.”

Related reading

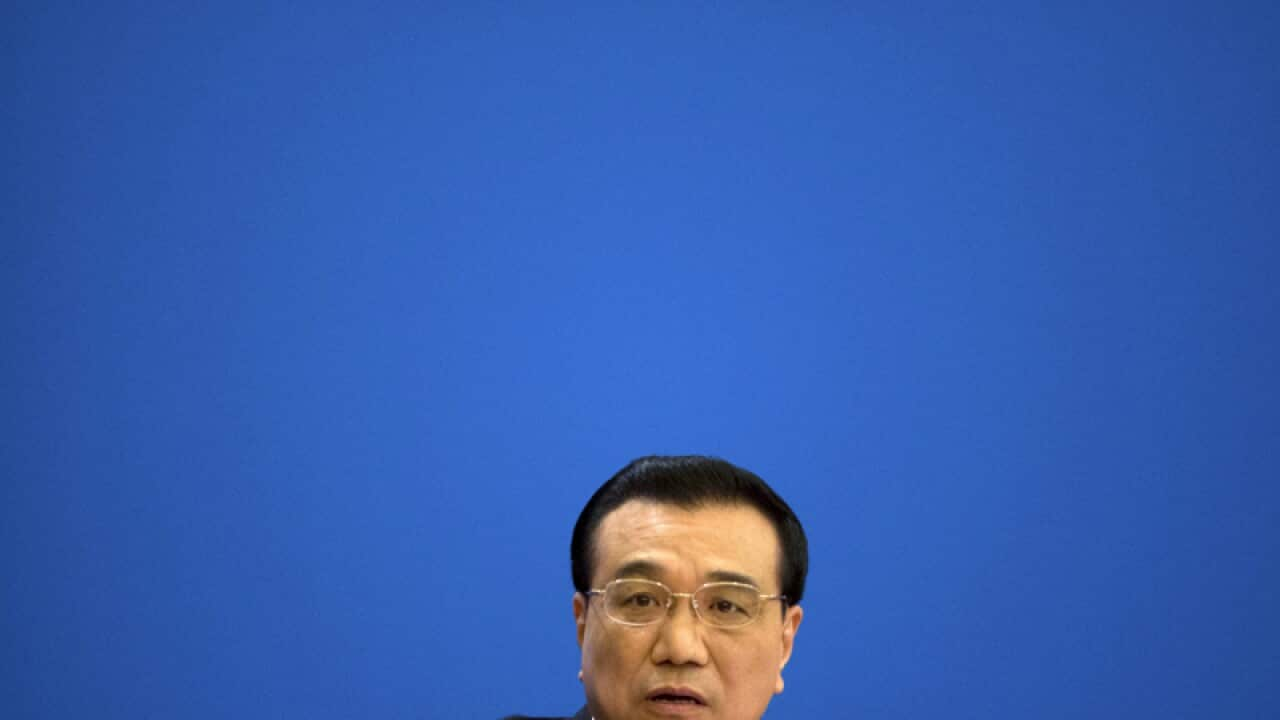

China's premier seeks investment assurance

Share