Increasing inflation and a "hawkish" approach to reducing it could lead to the first interest rate rise in more than two years, economists say.

It comes after inflation jumped on Wednesday, with the big four banks — Commonwealth, Westpac, NAB and ANZ — now all predicting a rate hike when the Reserve Bank of Australia's (RBA) monetary policy board convenes for its first meeting of the year on Tuesday.

The latest figures from the Australian Bureau of Statistics (ABS) showed headline inflation rose to 3.8 per cent in the year to December, up from 3.4 per cent in November. Meanwhile, the trimmed mean — which strips out volatile items — also edged higher to 3.3 per cent from 3.2 per cent.

The RBA's target band for inflation is 2-3 per cent.

David Bassanese, chief economist at Betashares, anticipates the central bank will raise the cash rate following next week's meeting, giving banks a green light to raise interest rates.

"It's probably going to feel the need to rein in demand somewhat, and the way it does that is by raising rates."

RSM Australia economist Devika Shivadekar said a cash rate increase this year was a matter of when, not if, describing the RBA as "hawkish" and "stern" in its goal of reducing inflation.

"Next week's decision in my opinion is a close 55 to 45 in favour of a rate rise, with the RBA potentially opting to move pre-emptively and hike now rather than risk having to tighten more forcibly later," she said.

She said that anything more than a 0.25 percentage point increase, the most common incremental changes in recent years, would be "overkill".

How would repayments increase if rates rise?

A 0.25 percentage point hike, which ANZ and Westpac joined in forecasting on Wednesday, would add about $90 in monthly repayments for an owner-occupier with a $600,000 mortgage.

For a $750,000 mortgage, an increase of that level would increase repayments by about $112 a month, while those with a $1 million home loan would fork out $150 more.

Given recent labour market and household spending data has also been running hotter than expected, the upside surprise on inflation is likely to heighten fears of a rate hike at the RBA's meeting.

"We think the RBA will conclude that demand is running ahead of supply and that an interest rate adjustment would help ensure inflation returns to the target," ANZ head of Australian economics Adam Boyton said.

Westpac chief economist Luci Ellis also expects a February rate rise, but does not think it will be followed with further hikes.

Before the inflation release, traders were pricing in the chance of a February rate hike at about 60 per cent, after a drop in the unemployment rate heightened the RBA's fears about a lack of spare capacity in the labour market.

Immediately following the release, market-implied odds of a rate hike climbed to more than 70 per cent, senior investment strategist at Global X Marc Jocum said.

Jocum believed a hawkish hold remained the most likely scenario for February, "but the risks around that call are clearly skewed and mounting toward a rate hike".

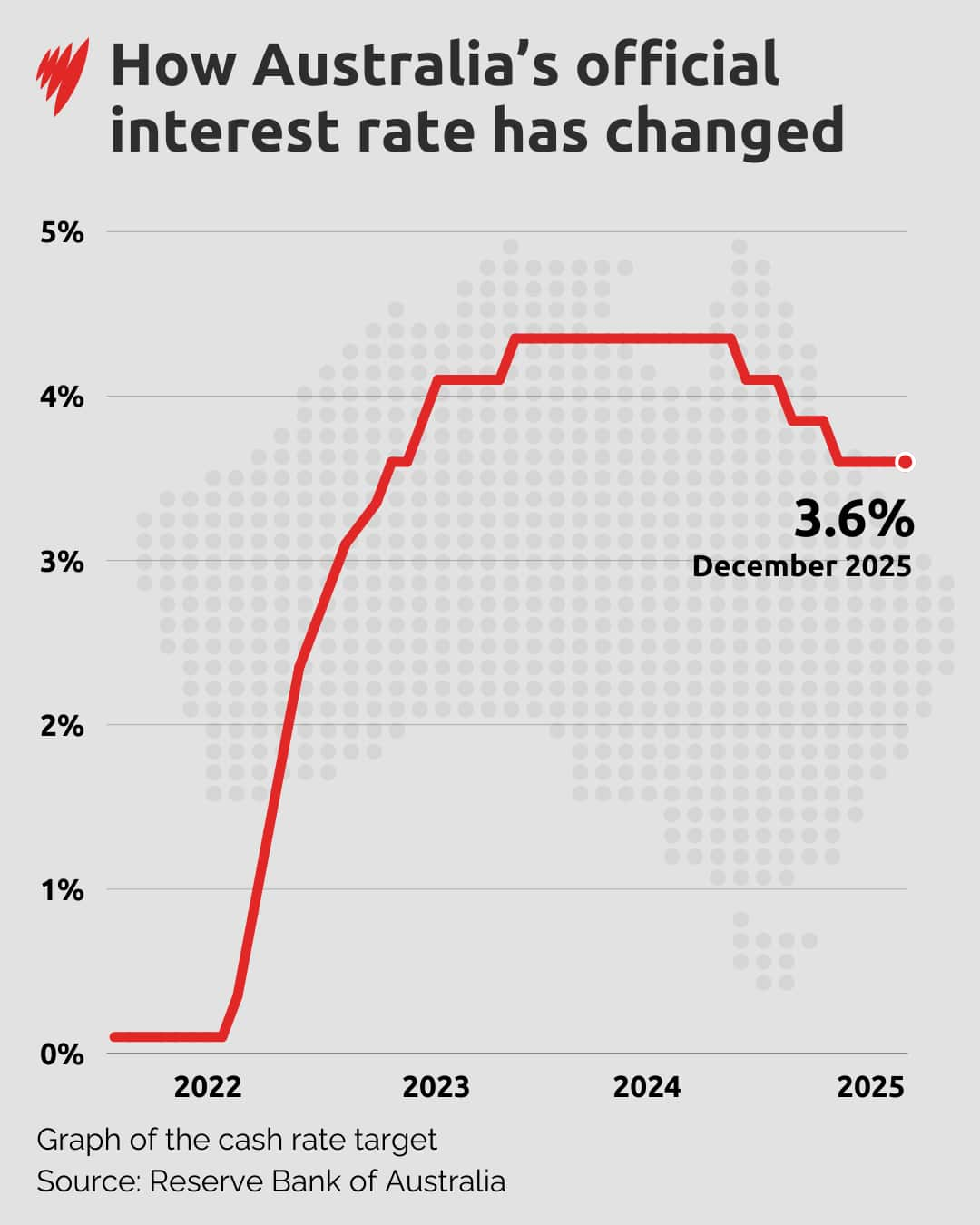

The RBA has not increased the cash rate since November 2023.

What pushed inflation higher?

The rise in the CPI was driven by housing, up 5.5 per cent, followed by food and non-alcoholic beverages, up 3.4 per cent, and recreation and culture, which rose 4.4 per cent, the Australian Bureau of Statistics (ABS) said.

Electricity costs rose 21.5 per cent in the 12 months to December, largely because of state electricity rebates in Queensland and WA being used up by households.

Shivadekar said that some sectors that experienced price increases would have been impacted by seasonal factors.

"We do know people travel during the school holidays. We know there are Christmas sale periods, so there's more hiring, more temp jobs created," she said.

"It's more seasonal demand than entrenched overheating."

Bassanese echoed this assessment, saying: "An increase in things like accommodation, hospitality services, restaurants and takeaways could be a one-off thing, thanks to events like the Ashes [cricket series].

"We also saw above-average tourist-related spending."

The RBA kept the cash rate unchanged at 3.6 per cent for a third time at its last meeting in December, with governor Michele Bullock all but ruling out further mortgage relief in the new year.

"I don't think there are interest rate cuts on the horizon for the foreseeable future," Bullock said after the last meeting.

— With additional reporting by the Australian Associated Press.

For the latest from SBS News, download our app and subscribe to our newsletter.