While housing continues to become less affordable in most Australian cities and regions, Melbourne has thrown up some data quirks that experts have linked to state government policies, with houses now cheaper to rent there than they were 12 months ago.

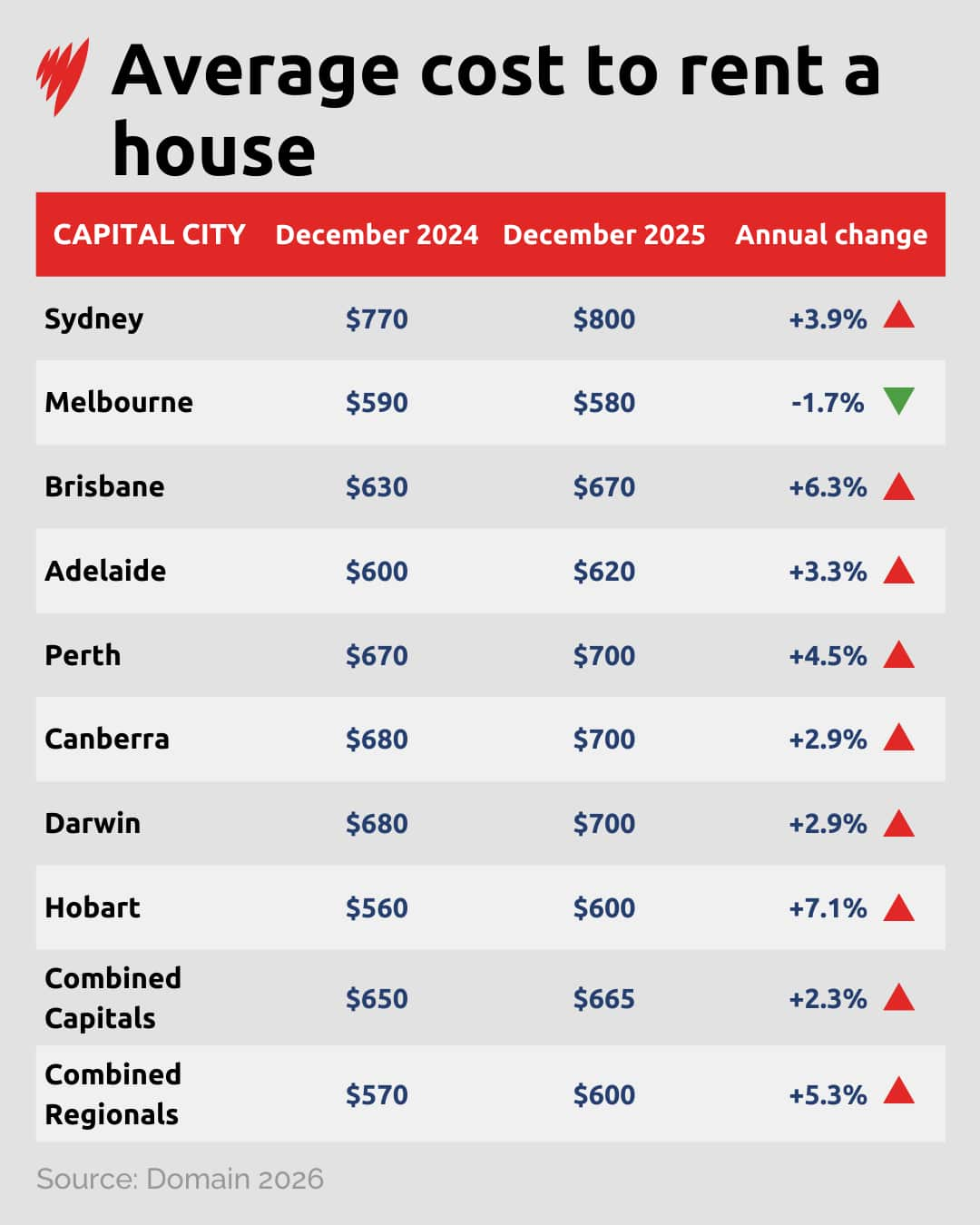

On average, the cost of renting a house or unit increased across Australia's combined capitals in the year leading up to December 2025, according to a new Domain report.

Melbourne, consistently ranked the most liveable city in the nation, is now the cheapest capital city to rent a house in at an average of $580 per week, as asking prices hit the "affordability ceiling".

The cost of renting a house in Melbourne fell by 1.7 per cent over the year, the only drop of any property type in any Australian city, according to the report.

The fall in value will have mixed results for renters, landlords and investors in Victoria, while the country grapples with a national shortage of new properties and low vacancy rates.

What's caused values to fall?

The cost of renting a house in Melbourne fell $10 per week in the 12 months to December 2025, saving tenants $520 per year.

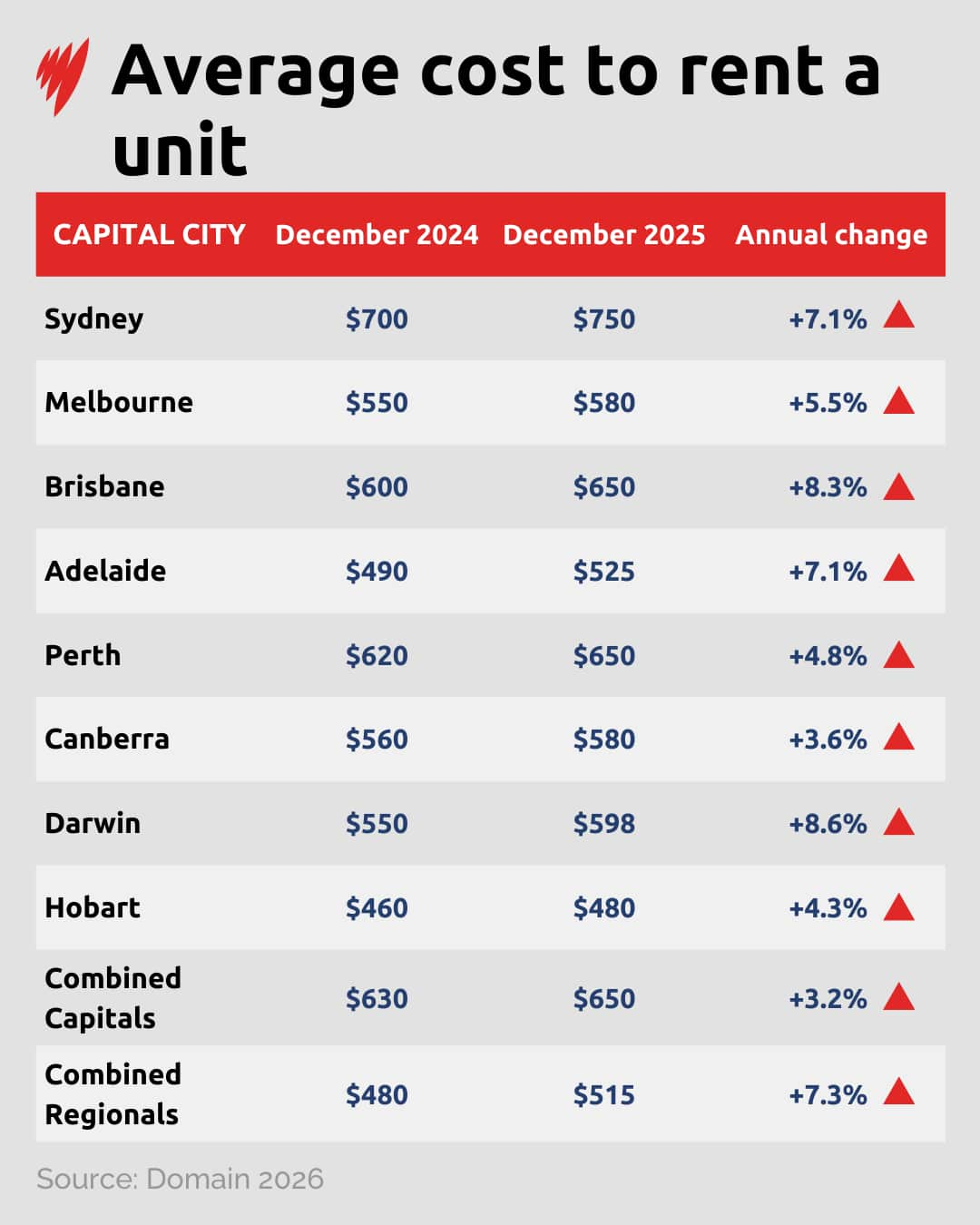

Yet units became more expensive in the city, rising from an average of $550 per week in December 2024 to $580 a year later — on par with house rents.

Melbourne unit prices are cheaper on average per week than Sydney ($750), Brisbane and Perth (both $650), Darwin ($598) and on par with Canberra. Only Hobart and Adelaide have cheaper unit prices at $480 and $525 a week respectively.

Domain's chief of research and economics, Nicola Powell, told SBS News that housing supply has been stronger in Melbourne compared to other cities.

"I think supply choice has been much better for tenants," she said.

"And what that means from an asking rent perspective is landlords are having to be much more realistic on the price point they place on their home."

Melbourne had the highest vacancy rate of any capital in December at 1.6 per cent.

More first home buyers, fewer investors

Federal and state government policies have also made a difference.

The new national first-home buyers scheme — which allows all first-home buyers to put down a deposit of 5 per cent — has reduced demand for rentals as tenants look to purchase their first property, Powell explained.

State taxation changes affecting Victorians who own, or are looking to buy, investment properties have led to an increase in the fees investment property owners pay.

Powell said these changes have led to people offloading investment properties in the last couple of years and choosing to invest in other states.

The proportion of investment in Victoria is one of the lowest in the country.

"It's sitting at just under 34 per cent of loans being financed to investors," Powell said.

"NSW sits at 46 per cent. So you can see there's a vast difference in participation rates from investors."

Property Council research shows that investors are currently looking away from Melbourne due to its "harsh tax settings", and instead choosing states with less punitive property charges.

Andrew Lowcock, Victorian deputy executive director of the Property Council, told SBS News that Melbourne's liveability has traditionally been underpinned by strong private investment in housing, infrastructure and amenity.

He said for rents to stay low, investors need to be kept onside.

"With that pipeline of investment dropping away, it is becoming harder to deliver the homes that current and future Victorians need," Lowcock said.

"If Victoria wants to stay competitive, we need to do more to encourage investment and create the conditions that encourage more homes to be built."

National data

Powell predicted that the cost of renting in Melbourne would remain stable due to the "affordability ceiling" — the maximum a population can pay — being reached.

"We're certainly not seeing any indication that we're going to see rent suddenly start to accelerate," she said.

According to Domain's December rental report, the most expensive houses per week in Australia are found in Sydney at $800.

This was followed by Darwin, Canberra and Perth, where renting a house cost $700 per week on average.

The cost of renting a unit has increased across the board since December 2024.

Sydney has the highest average weekly unit rent at $750, followed by Brisbane and Perth at $650 respectively.

"Overall competition for rentals is still quite strong, but I think affordability is increasingly capping how far and how fast rents can rise," Powell said.

"We have to remember that Australia is still operating in a landlord's market, which means vacancy rates are below two per cent across every single capital city."

How can cities be both liveable and affordable?

When grading Australian cities on metrics like health care, education, and infrastructure, Melbourne comes in first place, according to the Economist Intelligence Unit's 2025 Global Liveability Index.

In 2025, Melbourne was ranked the fourth most liveable city in the world, followed by Sydney in sixth place and Adelaide in ninth.

Kate Raynor, an urban planning expert with the University of Melbourne's Life Course Centre, explained why Melbourne ranks so highly.

"Melbourne does public spaces and public transport connectivity and safety in the public realm really well," she told SBS News.

"There is less air pollution and historically has been quite affordable."

She explained that Melbourne has a diversity of housing types and densities, which helps improve affordability as it's easier for people to move up and down the property ladder.

On top of its varied housing stock, Victoria approves more new homes than other Australian states, Raynor said.

According to 2025 Australian Bureau of Statistics data, Victoria accounted for 5,215 new home approvals in November out of the 18,406 reported nationwide. NSW followed with 4,848, while Queensland approved 4,558.

Does Melbourne offer lessons for other cities?

Cost of living presents challenges to liveability, Raynor said, which can make balancing a desirable area and cost-effectiveness difficult for governments.

"You want to be building amenities and infrastructure, but at the same time not drive people out with escalating prices," she said.

She said all cities, not just Melbourne, need to invest in more social housing and medium-density housing to continue thriving and keep renting affordable.

"Invest in social housing, because that is where the need is greatest, that's where the housing stress is greatest, and that is the most obvious and direct route from someone who is at risk of homelessness or severe housing stress into housing stability," she said.

With any new housing also comes the need for transport infrastructure, she added, so that people aren't "locked in" to outer and developing suburbs.

For the latest from SBS News, download our app and subscribe to our newsletter.