On paper, Emily Clements is doing everything right.

The 32-year-old Perth single mother works part-time in administration while raising two neurodivergent children.

She budgets carefully, covers only the basics, and — like many single parents receiving benefits — works the maximum hours she can before her carer payment begins to taper. But she's still slipping behind.

Four years ago, Clements paid $380 a week for a three-bedroom rental. Today, she pays $850 for a home further from the city.

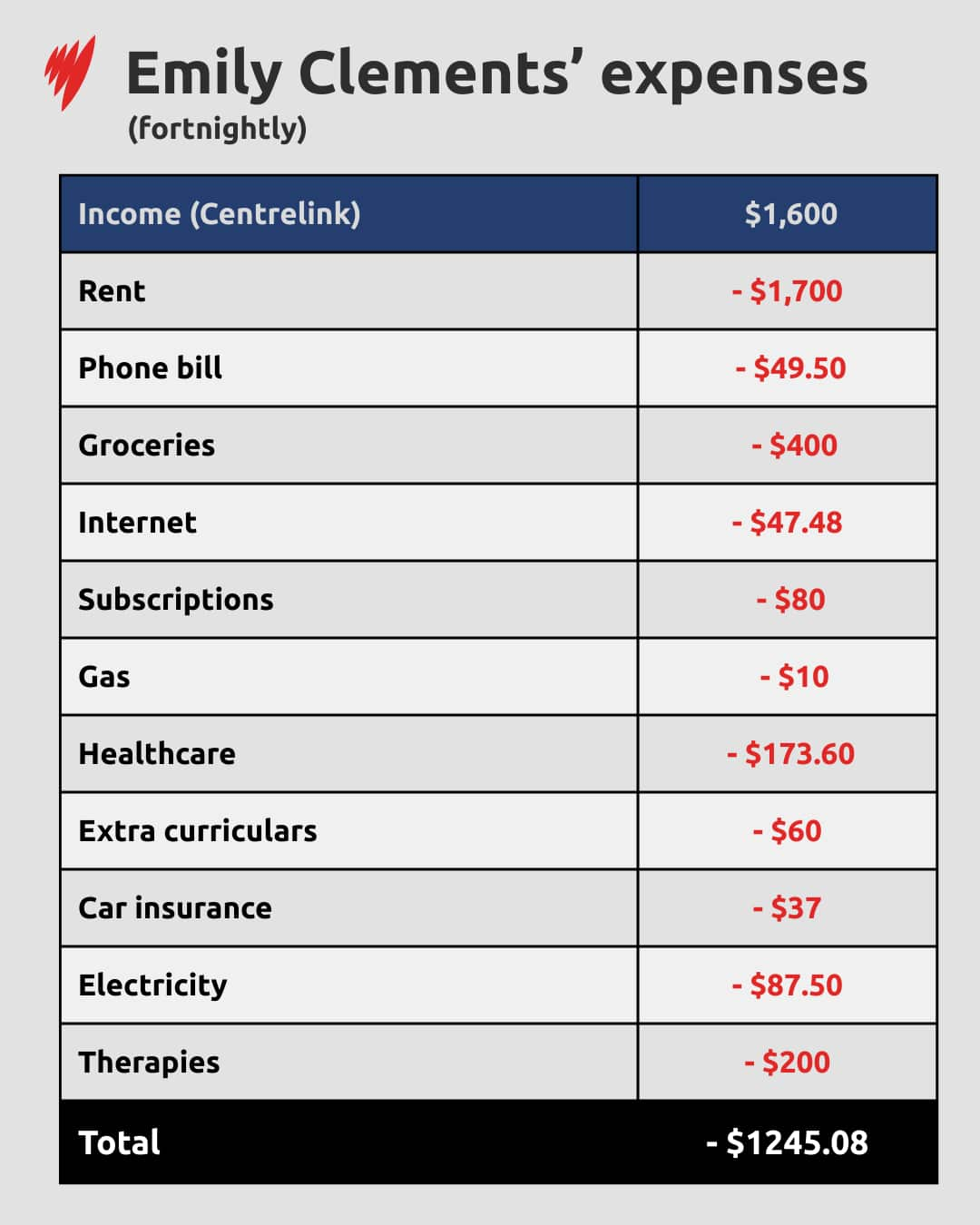

"My Centrelink payment is $1,600 a fortnight, but my rent is $1,700, so already everything has gone to paying the rent," Clements told SBS News.

"I don't save anything. I don't have any savings."

Without help from her father, she said she would be homeless — and her children would lose access to the therapies they need.

"I try not to think about it ... because it makes me feel like a huge failure," she said.

"It's never been on my radar that I couldn't provide for my kids.

"We had to cut back on their necessary therapy … we don't go on holidays, we don't really leave the house much, we don't eat out."

The clock is ticking on stability

This may be Clements' last Christmas in her home. With her lease expiring in less than three months, the risk of eviction looms large.

She said she's stopped going to open houses altogether because the anxiety has become overwhelming.

"At the recent openings I went to, there were over 40 people at each," she said.

"I remembered overhearing one woman having a conversation with the agent, and she said she had $600,000 from selling her home and was willing to pay a year's rent upfront.

"That's who I'm competing with."

It hasn't always been like this.

Clements grew up in a stable, middle-income household, and through much of her twenties, renting was a practical way to save for a deposit.

But Perth's rental market — once the country's most affordable — has become so distorted that even former homeowners are re-entering the market as renters, displacing those with the fewest options.

A crisis years in the making

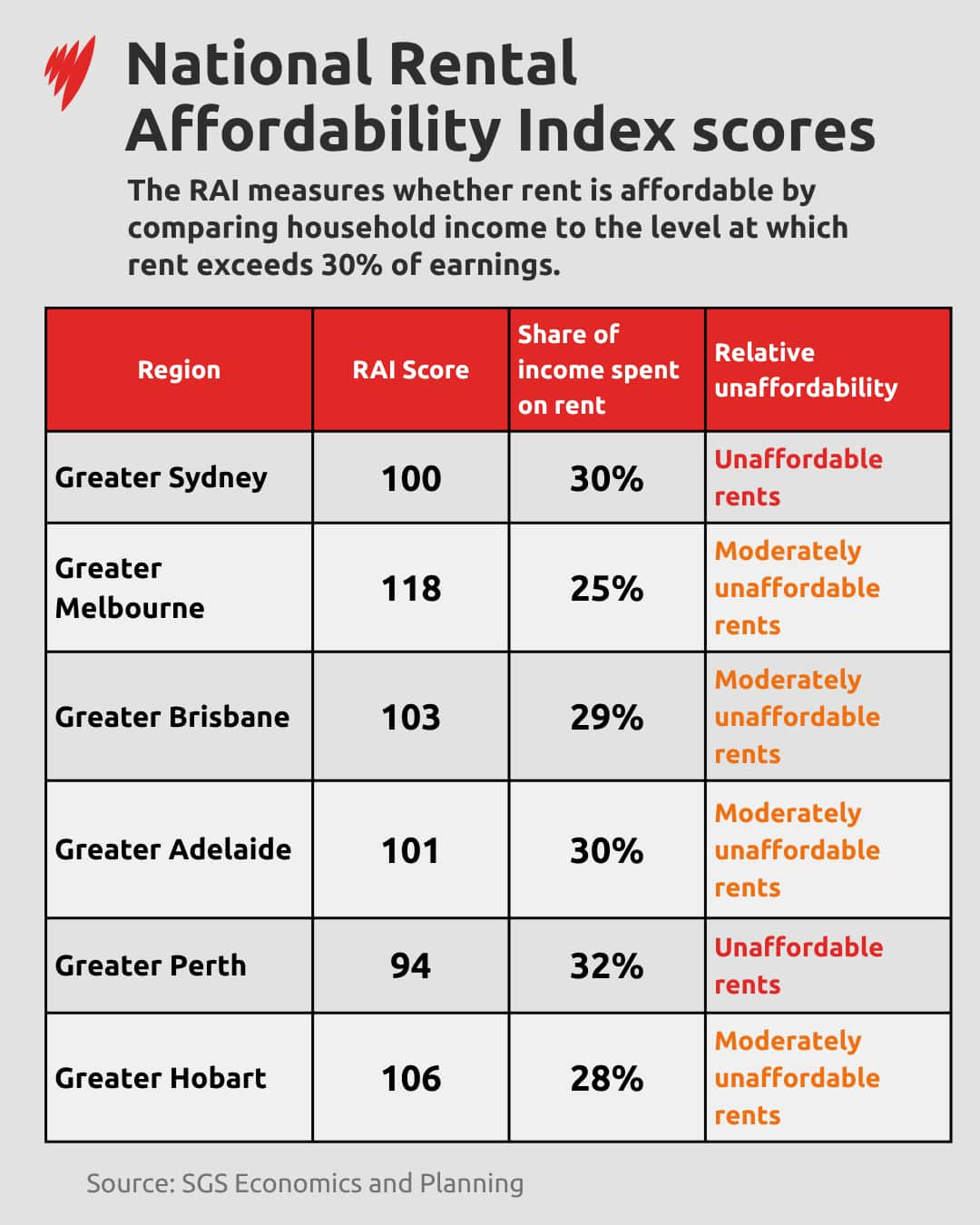

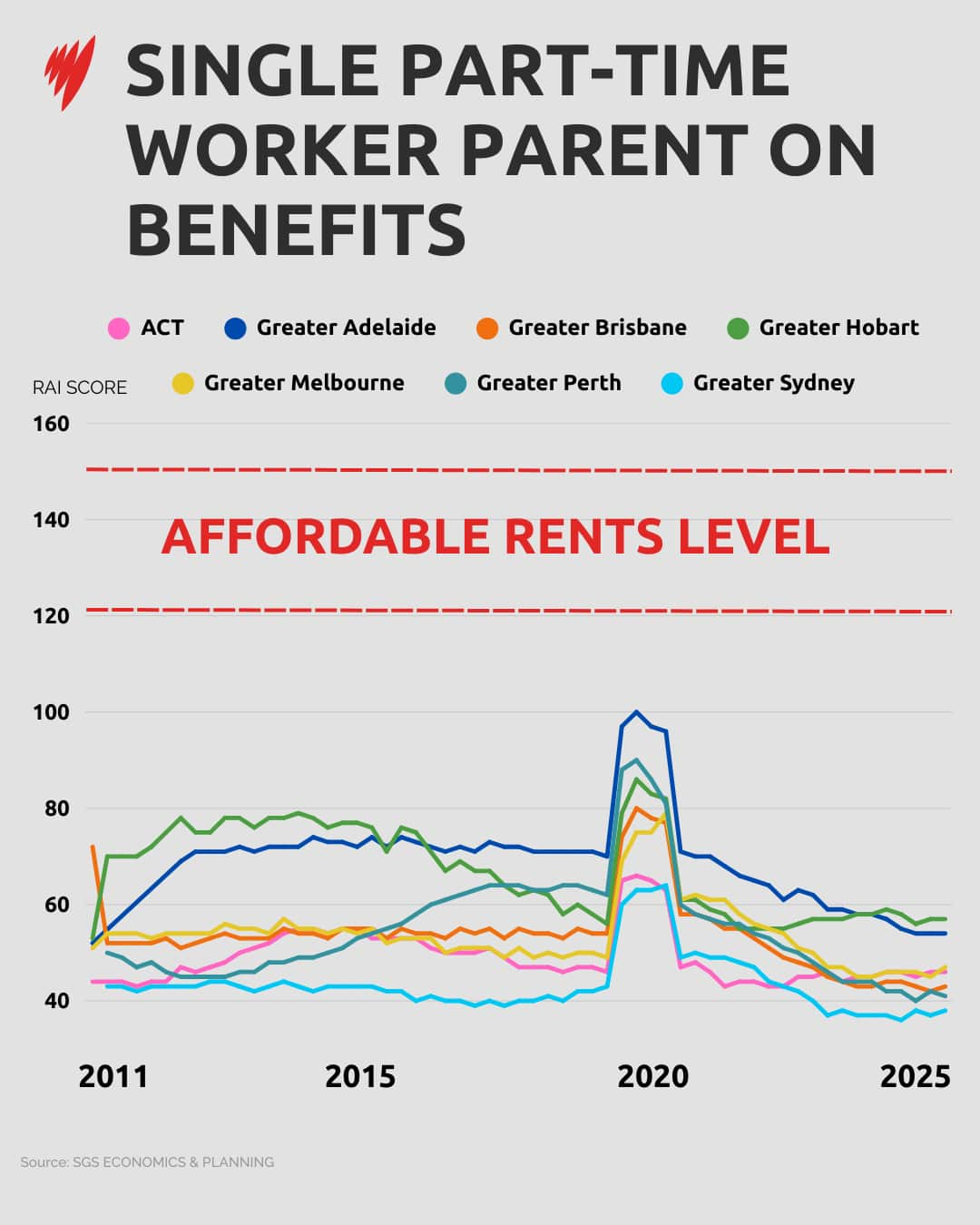

The 2025 National Shelter–SGS Rental Affordability Index (RAI) confirms what renters already know: affordability has collapsed nationwide.

Perth has overtaken Sydney as the nation’s least affordable capital for the second year in a row, with median rents now consuming 32 per cent of the average renter household's income — well above the 30 per cent housing-stress threshold.

In 2020, that figure was 21 per cent.

Across the rest of the country, the picture isn't much brighter.

Sydney and Adelaide follow close behind, with households in both cities spending around 30 per cent of their income on rent.

Regional WA has slipped sharply too — moving from 'affordable' in 2020 to moderately unaffordable, with renters now paying 28 per cent of their income.

Brisbane and Adelaide have hit their lowest affordability levels on record, while the ACT remains the only jurisdiction considered 'acceptable', largely because its residents earn higher-than-average incomes.

Meanwhile, in regional Queensland, rents are consuming more than 30 per cent of household income, making it the least affordable regional market in Australia.

The Northern Territory is not included in the report as adequate rental data has not been sourced to develop indices.

A generation pushed into permanent renting

Over the past decade, more Australians — especially women and single parents — have been locked into lifelong renting.

Between 1995 and 2020, renter households increased from 26 to 31 per cent, while the share of public housing tenants halved.

Over the same period, rents grew faster than mortgage repayments.

Renters now spend at least 20 per cent of their income on housing, compared with 15.5 per cent for homeowners with a mortgage.

But the RAI measures rent alone — not food, utilities, transport, medical bills, or school costs.

For many single-parent households like Clements', those essentials push budgets far beyond the numbers on a graph.

Her daily choices — therapy or groceries, petrol or school excursions — rarely show up in national indexes. But they define her reality.

A new life in Australia, but always renting

On the opposite side of the country, in Sydney's south-east, Charlotte Karlsson-Jones has lived with rental insecurity for most of her adult life.

She arrived from Malmö, Sweden, at 19.

Two decades on, the 42-year-old architecture graduate is still renting.

She works part-time, earning $2,000 a fortnight.

Her fortnightly rent is $1,200 — 60 per cent of her income.

"For me, to be able to get a home loan has almost been impossible," Karlsson-Jones told SBS News, adding that banks see her as high-risk.

"As a single mum, it is just impossible. Every year it is getting worse."

Her two children are 12 and seven, and, like Clements, she pays for food, fuel, activities, school costs and therapy on top of rent.

She has tried to access government support, including Rent Choice Assist, but her initial applications were rejected.

She eventually appealed the decision and was approved — but not without lasting worry.

"I feel like a lot of systems we currently have sort of wait for you to be homeless. And then they kick in to support you," she said.

"The trauma and the long-term effect of experiencing that ... it takes years to recover.

"For a long time, older women have been at the highest risk," Karlsson-Jones said.

"I think we need to address it way earlier in a woman's life. Especially after we've spent so much of our time looking after the people we care about and love."

She said the crisis has deep roots.

"I've met people who've been in social housing for more than 10 years," she said.

"And even when they first applied, their waitlist was already over a decade long."

The wealthiest state, the worst rental affordability

Robert Pradolin, executive director of housing advocacy group Housing All Australians, said rental stress is now threatening the workforce itself.

"From cafes and hotels to hospitals and childcare centres, businesses across WA are struggling to find staff because there's nowhere affordable for them to live nearby," Pradolin said.

"Even WA's community services sector — the very people supporting our most vulnerable — can't recruit or retain staff because workers can't afford to live in the regional communities they serve," he said.

Housing, he argues, is "critical economic infrastructure".

Perth cafe owner Ie-Tehn Kwee said the crisis is reshaping how small businesses operate.

"Generally, we can see the rental prices are extremely high now," he told SBS News.

"It definitely has some impact … on people that work for me."

Kwee sees the strain on staff and customers.

“Anecdotally, I am aware of people moving back in with parents or … trying to find alternative solutions."

Long commutes are becoming normal.

"In an industry like mine, you start work at 6am. If you are living an hour away, you are waking up at 4am," Kwee said.

"The issue is that there are less houses available than people need to live in them. And some people own way more houses than they can live in."

Kath Snell, CEO of Perth-based housing advocacy group Shelter WA, said the latest figures confirm a worsening trend.

"It's mind-boggling that Australia's wealthiest state has the worst affordability for renters," she told SBS News.

"This crisis is no longer confined to those on the lowest incomes. It's climbing the ladder and affecting working families."

Snell said WA needs 5,000 additional social and affordable homes per year, alongside rent caps, minimum standards, limits on short-stay rentals and the end of no-grounds evictions.

"The WA government is making progress, but we need ambition that matches the scale of this crisis."

In a statement to SBS News, the WA Housing and Works Minister John Carey pointed to the state government's record investment in public housing.

"Across the nation, there continues to be pressures on housing and rental markets, and WA's nation-leading economy and rapid population growth adds to the pressure," he said.

"Our government is rolling out an ambitious $5.8 billion housing investment, adding more than 3,800 social homes since 2021.

"This record investment in public housing is about ensuring vulnerable West Australians, including victims of domestic violence, single parents and people with disabilities have a place to call home."

Last year, the WA government adopted some rental reforms, including limiting rent increases to once per year, allowing pets and minor modifications in rentals, as well as a new process to resolve disputes without the need to go to court.

Advocates welcomed the changes but warned they weren't significant enough to make a difference until rent increases were capped, and no-fault evictions were scrapped.

Carey said the state's Rental Relief Program has helped more than 3,600 households avoid evictions and that recommendations for a second phase of rental reforms are expected to be finalised for consideration later this year.

"Our government continues to do everything it can to ensure Western Australians have safe and secure homes and access to essential services to support their needs."

The Federal Government's Envoy for Social Housing and Homelessness Josh Burns said Australia’s housing crisis “has been decades in the making” and will take time to turn around.

"As the Rental Affordability Index shows, the work we are doing to boost supply across the housing spectrum is making a difference," he said.

"That's why we are working with the states and territories and the community housing sector to deliver 55,000 social and affordable homes for people who need it.

"We know there is more work to do, but we are getting on with the job of building more rental homes, more support for first home buyers, and unlocking more social and affordable homes for people who need it."

'I just want a future for them'

Clements says she isn't asking for a miracle — just the chance to build a life where she can save, plan, and avoid living one notice away from crisis.

"If [my children] came up to me and asked me for something, most of the time it's a no straightaway," she said.

"Or it takes me months to save up for."

"I don't want to lie to my kids," she said.

"It's such a complicated question … why they can't just have $10 on Roblox, or buy an ice cream on a hot day."

In Sydney, Karlsson-Jones feels that burden stretching across generations.

She said that as a first-generation immigrant, her parents aren't in the property market, so she's "already far behind".

"That will affect my children's future, and their opportunities to get into the property market as well."

For the latest from SBS News, download our app and subscribe to our newsletter.