Reserve Bank of Australia (RBA) governor Michele Bullock says "temporary factors" partially drove up recent higher-than-expected quarterly inflation figures, but there may be more inflationary pressure than the central bank initially believed.

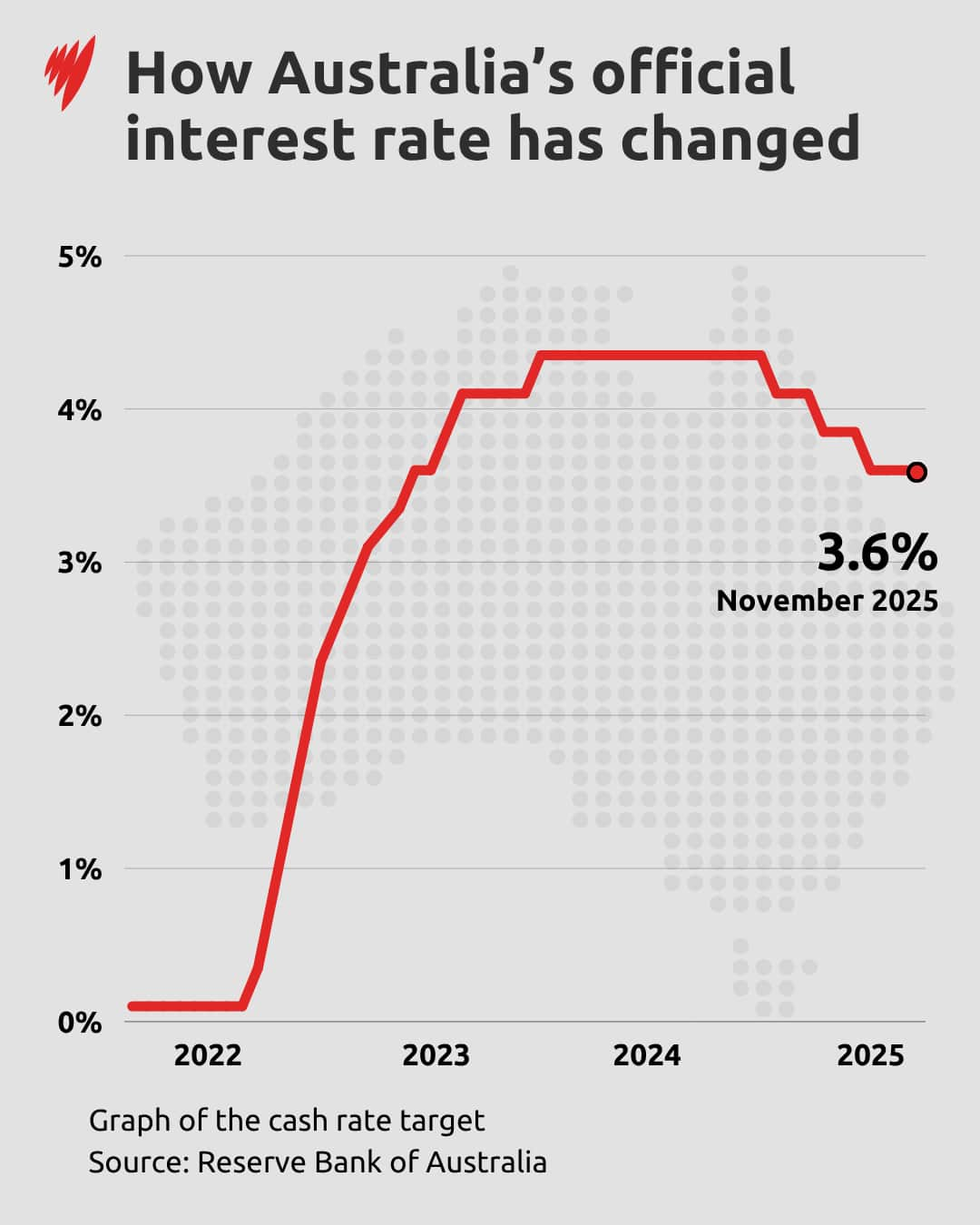

The RBA left the cash rate target on hold at 3.6 per cent for the second time in a row at its board meeting on Tuesday, repeating a decision it made at its previous meeting in September.

"With private demand recovering and labour market conditions still appearing a little tight, the board decided that it was appropriate to maintain the cash rate at its current level at this meeting," the board said in its statement alongside the announcement.

"Financial conditions have eased since the beginning of the year, but it will take some time to see the full effects of earlier cash rate reductions.

"Given this, and the recent evidence of more persistent inflation, the board judged that it was appropriate to remain cautious, updating its view of the outlook as the data evolve."

Treasurer Jim Chalmers said in a statement on Tuesday that while "millions of Australians would've wanted to see more rate relief", the decision was widely expected following the surprise surge in last week's inflation figures.

In its recent data for the September quarter, the Australian Bureau of Statistics measured the consumer price index at 3.2 per cent, above the Reserve Bank's inflation target band of 2 to 3 per cent.

Underlying, or trimmed mean inflation, the RBA's preferred measure of price movements, rose 1 per cent over the September quarter — higher than the Reserve Bank's forecast.

Annual trimmed mean inflation rose to 3 per cent, up from 2.7 per cent in the June quarter, marking the first time annual trimmed mean inflation had risen since December 2022.

Bullock, speaking to reporters on Tuesday afternoon, said the RBA board believed some of that increase was "driven by temporary factors such as travel costs, council rates and fuel, and we don’t expect some of these to continue".

"We are, however, taking signals from stronger price increases that may suggest more inflationary pressure in the economy than we thought before," she added, citing the cost of new dwellings and market services both increasing by more than expected.

Bullock said the board had not considered a cut this time around. Asked about future cuts or increases, Bullock said "anything's possible" but that she believed "we're at the right spot we need to be at the moment" to respond to risks.

Bullock said the central bank was not "wedded religiously to a particular path" on rate decisions, and that it was trying to "actively analyse the data as it comes through".

Reserve Bank revises inflation forecast

Alongside the announcement, the RBA updated its inflation forecast. It now expects underlying inflation to remain at 3.2 per cent until at least the middle of 2026, before easing back to 2.7 per cent by the year's end.

That's up from the RBA's most recent predictions in August that the trimmed mean would ease to 2.6 per cent by the end of this year.

"We expect inflation to be above 3 per cent for much of next year before declining to around the middle of our target range by late 2027," it said in Tuesday's forecast.

Bullock said: "We know forecasts are uncertain and the further out you go, the more uncertain they are."

The RBA has cut the cash rate three times this year, each time by 0.25 percentage points. The first came in February, when it cut the rate from a 13-year high of 4.35 per cent to 4.10 per cent, and marked the first rate cut in five years.

The rate was lowered to 3.85 per cent in May, and then again in August to 3.6 per cent, where it has sat since late September.

The RBA board will meet for the final time this year in December.

— With additional reporting by the Australian Associated Press.

For the latest from SBS News, download our app and subscribe to our newsletter.