Summer may bring more rental listings, but with demand still overwhelming supply, experts say soaring prices are cementing housing affordability as one of Australia's biggest economic flashpoints heading into 2026.

Rents for houses remain at record highs across the country, with unit prices not far behind, as Australia enters the peak lease-changeover period.

The summer months have long delivered the biggest surge in rental listings, but this year's activity has been intensified by the return of international students, new migrant workers, and local renters searching for more affordable options.

Nicola Powell, chief of research and economics at Domain, told SBS News summer consistently marks the busiest period for new leases and renewals.

"You tend to find that vacancies start to rise towards the end of the year as those listings come onto the rental market," she said.

Powell said this follows a big changeover period early in the new year, when vacancy rates are expected to dip again once that wave of activity passes.

She said this pattern reflects the calendar for universities and graduate hiring, as well as landlords' preference to advertise during the holiday period when they have more time to organise maintenance and inspections.

Still a 'landlord's market'

Even with the seasonal boost in listings, renters are unlikely to feel real relief, according to Powell.

Vacancy rates across the country remain below 2 per cent — an exceptionally tight level that continues to favour a "landlord's market".

"The rental market is still competitive," she said.

"Tenants are going to find there is more choice, but more tenants are looking for rentals at this period of time as well."

Record-low vacancies have also helped push both house and unit rents to new heights in most major cities.

"Some of our major capital cities are better than others, but I think we still have high rents. We still have house rents at record highs across all our capitals," Powell said.

"Most capital cities have high unit rents as well."

Weekly rents remain high

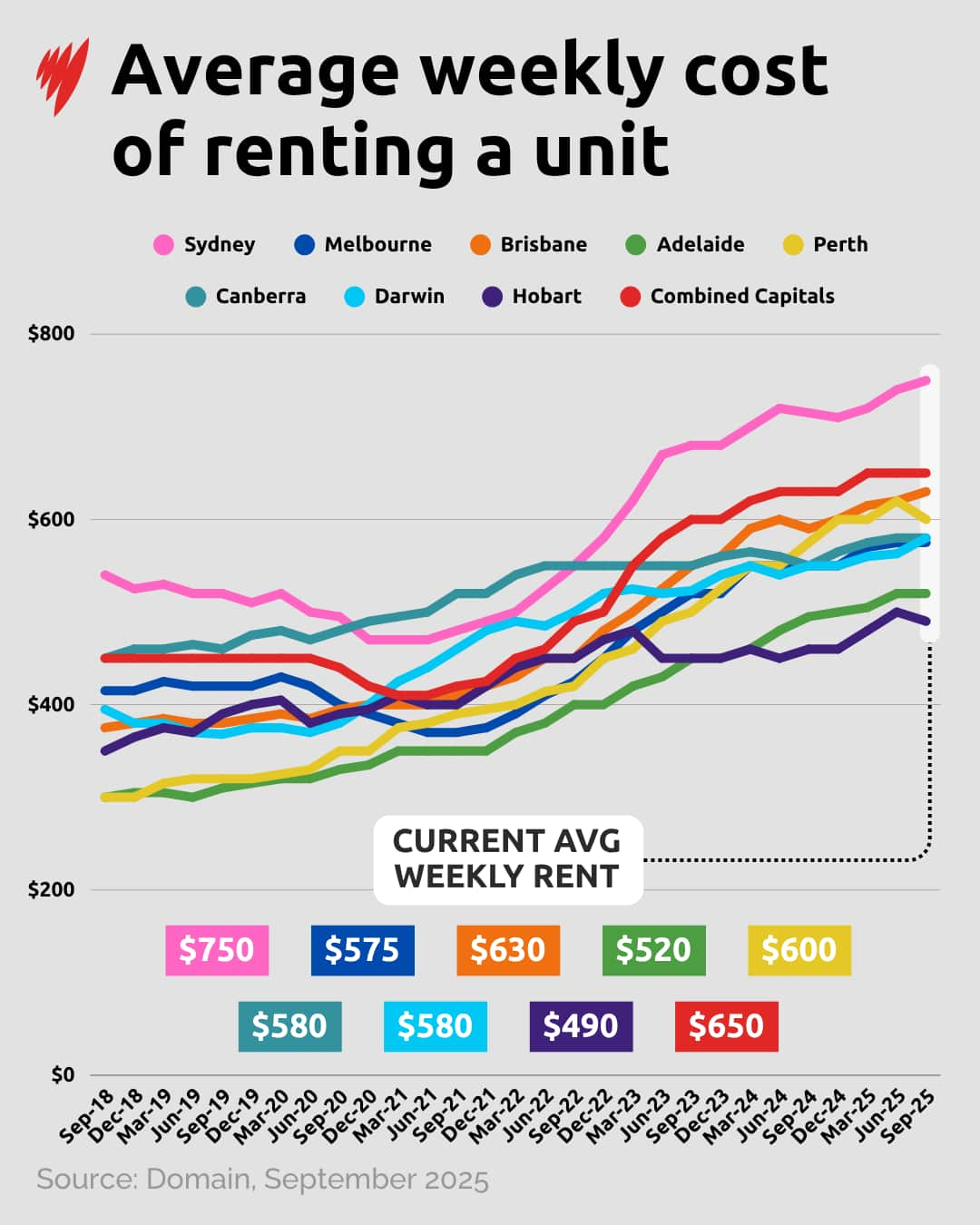

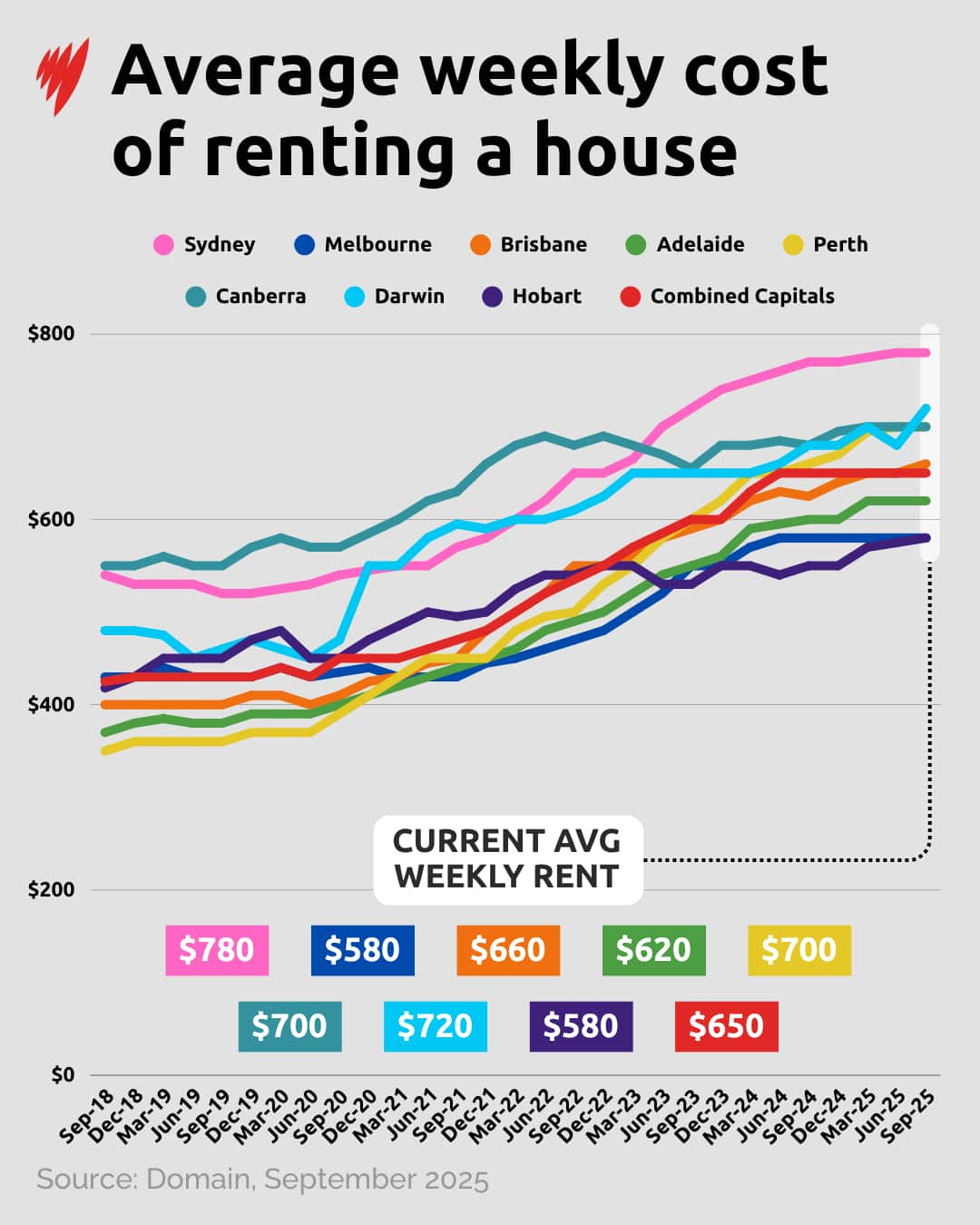

Data from Domain shows rents for houses and units have steadily increased over the seven years to September 2025.

Sydney remains the most expensive city for units, averaging $750 a week, while Hobart is the cheapest at $490.

For houses, Sydney again tops the list at $780 a week. Hobart and Melbourne share the lowest average house rents at $580.

Across the combined capitals, the average weekly rent for houses and units sits at $650.

Powell said the government's new first-home buyers' scheme could reduce pressure on the rental market — but not immediately.

"The scheme could take some element of demand away from the rental market, but whether or not it'll be felt as quickly as this changeover season is to be determined," she said.

"Over time, we should see more tenants transitioning to being homeowners. That's the aim of this policy."

Negotiating your rent in a tight market

Despite strong competition, this moment of higher supply may give tenants a brief window to negotiate — particularly those with a reliable payment record or long-term tenancy.

Leanne Pilkington, president of the Real Estate Institute of Australia, told SBS News both tenants and landlords should familiarise themselves with their rights, review comparable rental prices and start conversations early.

"Tenants should know their rights and start lease talks early," she said.

"Landlords should keep properties in top shape, follow the rules, and give proper notice for rent or lease changes."

She said landlords can increase rent according to state and territory rules, but they are required to provide proper written notice to tenants and adhere to the required notice periods.

Tenants, on the other hand, can negotiate before signing a lease renewal or accepting a rent increase.

"They can ask for a lower rent, get more information, or suggest terms based on what's fair in the current market or their personal situation," Pilkington said.

Subletting on the rise — and the risks

With rising costs prompting some renters to consider subletting for the first time, Pilkington warned failing to follow legal requirements can lead to disputes, fines, or broken leases.

In most states and territories, tenants must obtain their landlord's written permission before subletting or adding occupants.

Some leases prohibit subletting altogether, while others allow it with specific conditions.

"When putting the agreement in writing, it should clearly address: rent or contribution to utilities, access to shared spaces, length of stay, notice periods, responsibilities for cleaning, guests, noise and property maintenance and what happens if something is damaged or lost," Pilkington said.

What does this mean for 2026?

Experts say this year's supercharged summer market suggests affordability pressures will remain acute in 2026, even as new policies aim to gradually shift some renters into homeownership.

Kaytlin Ezzy, an economist at property analytics group Cotality, said it is "unlikely" property prices will fall in the near term.

"The same factors that have supported value growth over the past few months, including restricted advertised supply, lower borrowing costs and the expansion of the First Home Guarantee scheme, will likely continue to support growth in 2026," she said.

Ezzy said government policies around housing are likely to push values higher, unless they are specifically designed to increase supply or reduce demand.

"The expanded first home guarantee schemes, for example, while great at helping some first-time homeowners get into the market, have placed pressure on home values, not only from said first-time buyers but also from speculative investors chasing capital gains in these areas," she said.

While property prices show no sign of falling, renters may experience some relief in the months following summer, when competition for rentals tends to decline, according to Ezzy.

"After rising on average around 9 per cent between December and March, the rolling 3-month count of new rental listings typically eases into a quieter winter period, declining on average by 8.5 per cent between March and June."

For the latest from SBS News, download our app and subscribe to our newsletter.