The government faces renewed pressure to slash the capital gains tax discount, a move that would largely target property investors, and one it is not ruling out.

Calls to review property taxes grew on Tuesday after the Reserve Bank of Australia raised the cash rate by 0.25 percentage points to 3.85 per cent — its first increase in over two years — citing a pickup in inflation.

The government is considering a broader suite of reforms ahead of the May budget, but so far Treasurer Jim Chalmers has remained mostly tight-lipped when asked about any changes to capital gains tax (CGT).

"We've made it very clear that we consider there to be inter-generational issues in housing, but our focus there is on building more homes, on supply," he said on Wednesday.

"Our focus on tax is about cutting income taxes and introducing a standard deduction and legislating better-targeted super concessions and lifting the low-income super tax offset, and doing the work that we've commissioned on multinational taxes."

Chalmers pointed to the ongoing work of a Senate committee formed in November to review CGT arrangements, which is expected to deliver its findings in March.

Treasury estimates the revenue forgone from CGT discounts in 2025-26 will grow to $21 billion, according to tax expenditure figures released in December.

The figure soars to $80 billion over the forward estimates, which offer budget predictions until 2028-29.

Earlier this week, the Australian Council of Trade Unions (ACTU) joined a growing chorus of advocates pushing for the capital gains tax discount to be cut, arguing it would give Australians "a better shot at home ownership".

What is the capital gains tax?

The CGT discount is applied when you sell an asset like a house after owning it for at least 12 months.

You can claim a 50 per cent tax discount on any profit made from the sale of assets, which include stocks, bonds, jewellery and real estate.

That means if you have a profit of $300,000 when you sell your home, only half, or $150,000, would be considered a capital gain and subject to the tax.

This capital gain is then added to your total income for the year and taxed at your standard income tax rate.

The ACTU would like to see this discount reduced to 25 per cent.

The CGT was last reformed by the Howard government in 1999, with then-treasurer Peter Costello arguing it would increase investment in venture capital and assets.

Until 2021, Labor's policy platform included a promise to halve the CGT. It took the idea, alongside a change to negative gearing, to the 2016 and 2019 elections.

Who benefits most from the CGT?

Roughly 2.2 million Australians own at least one investment property, according to the latest Australian Tax Office data.

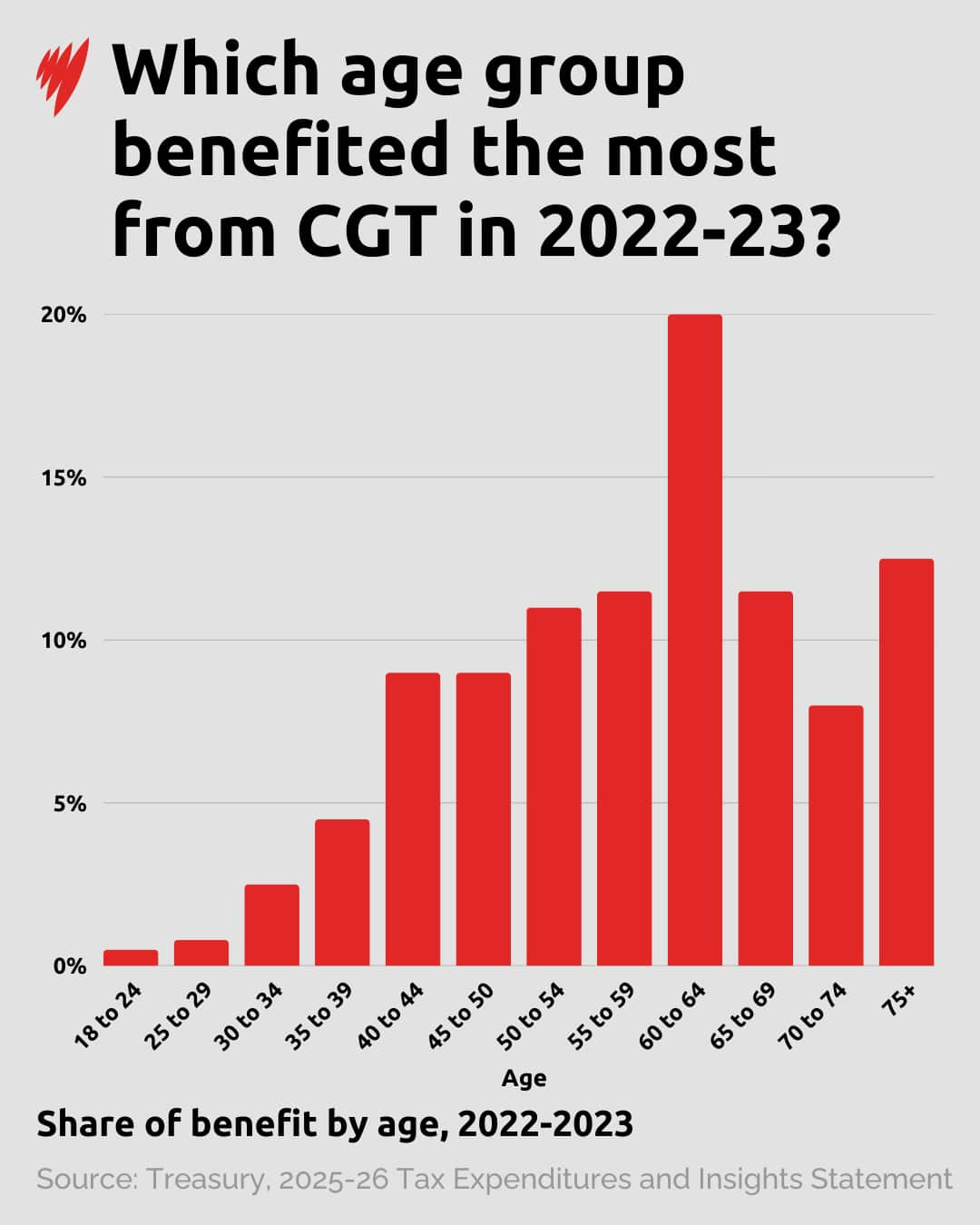

Unsurprisingly, Australians aged 60 to 80, commonly known as boomers, are the largest beneficiaries of the existing CGT system, as they have a higher proportion of assets.

One-fifth of the 830,000 Australians who used the discount in 2022-23 were aged 60 to 64.

Meanwhile, less than 10 per cent of the recipients were Australians aged 25 to 40.

The data reflect a generational inequity, with people below 29 making up less than 5 per cent.

Housing Minister Clare O'Neil said young people had a right to be "angry about housing", labelling it the "biggest intergenerational issue" across the country.

"Our housing system is basically designed to support people who have gotten into the market much earlier than most of the young people of today were even alive," she told ABC on Thursday afternoon.

While unwilling to talk about tax reform, she highlighted that Labor had a $45 billion housing agenda to address the challenge.

Could house prices fall with CGT changes?

Tim Thornton, director of the School of Political Economy, says restrictions on CGT and negative gearing would be essential to relieve pressure on housing markets.

"This would reduce the income of investors rather than mortgage holders," he told SBS News.

"Such tax concessions should really only be permitted in instances where investors are constructing new housing stock rather than just bidding up the price of old bricks and mortar."

However, Rich Insight economist Chris Richardson warns housing prices won't magically drop if the CGT is tweaked.

"The main reason to do it is that we can and we should tax better," he said.

"It is not the be-all and end-all around housing prices, and to some extent, people keep looking for a magic wand that can be waved and or a magic group that can be blamed. Sadly, it is not that simple."

According to his modelling, changing concessions to the CGT would only reduce housing prices by between one and four per cent.

Opposition finance spokesperson James Paterson argues a change to CGT is a "grab for revenue" for a government that can't control its spending.

"Time for the government to exercise just a little fiscal discipline to rein in their spending, take pressure off inflation and interest rates and keep faith with the election commitments they took to the Australian people," he told reporters on Thursday.

For the latest from SBS News, download our app and subscribe to our newsletter.