Highlights

- Scamwatch reported over $22.1 million in losses suffered by the CALD community last year

- Scammers communicate in the native language of potential victims to build trust

- Azam Noor, a small business owner fell for one such scam that sounded legitimate to him

Melbourne's Azam Noor, a small business owner of Pakistani origin, initially ignored some calls from local mobile numbers which tried to lure him with their discount offers on utility bills. The offers then flashed up on his WhatsApp. He decided to give them a shot by paying a small bill at a discount of 30 per cent. The caller promised to pay the balance. It sounded too good to miss. And it worked.

Many migrants in Australia have unknowingly become victims of such phone scams in which callers win trust in their native language.

A report by the Australian Competition & Consumer Commission (ACCC) on targeting scams reveals that last year, people from culturally and linguistically diverse (CALD) backgrounds made over 11,700 reports of scams to Scamwatch to report over $22.1 million in losses.

Azam is just one of the many victims trapped in a discount billing scam.

He started by paying small utility bills at discounted rates and also received confirmation of full payment. But what happened next was enough to make him realise that he had become a victim of a scam that sounded legitimate.

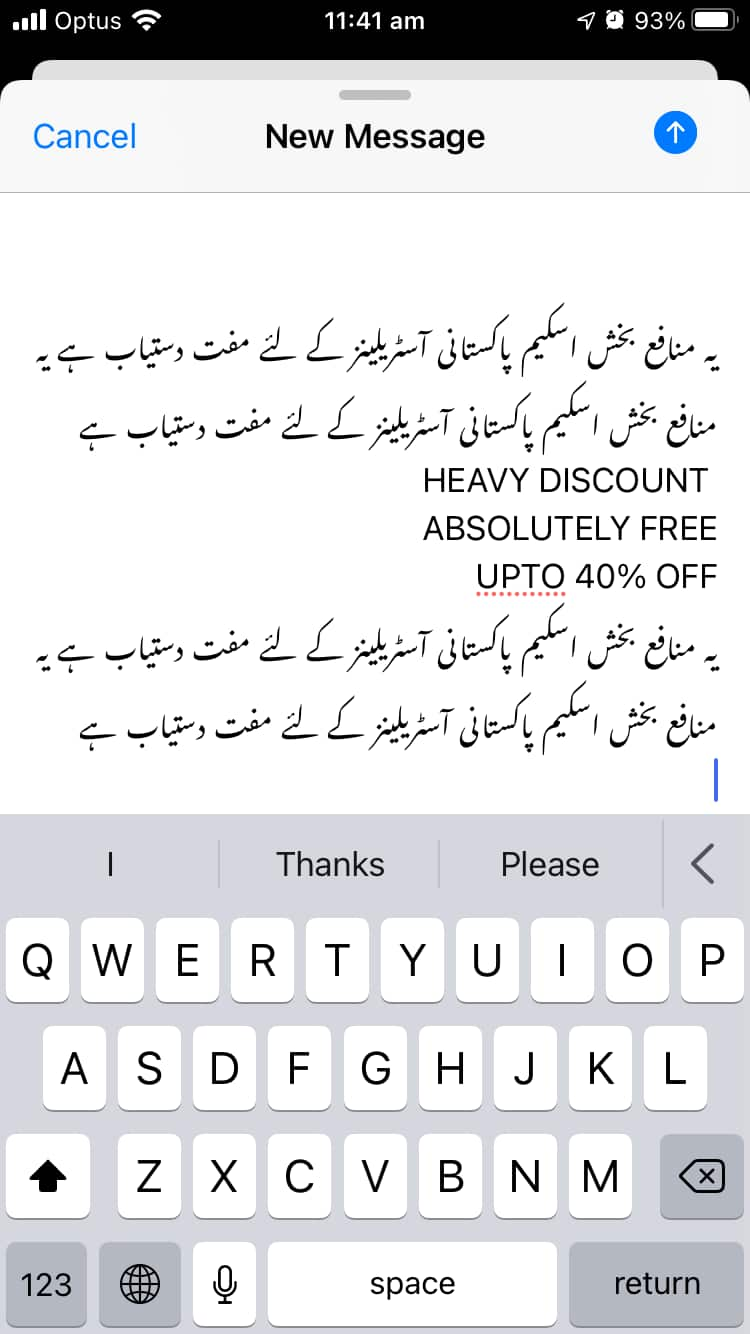

Azam fell for this scam when he heard the person at the other end of the phone was speaking in his native language, Urdu.

He asked for more details about the “scheme” that revealed that participants are offered up to 40 per cent discount on utility bills, car registration, and even HECS loans.

When he searched for the details of the company, he found it was registered under the name Bulk Bargains and also had an ABN that was valid.

Azam was asked to deposit his utility bill at a discounted rate at an ATM with the given account number and the rest was to be paid by the discount provider. Overcoming his initial hesitation, he decided to test the waters.

A few days later, the utility company confirmed the full payment of his bill, giving him some confidence. Azam now paid some bigger bills with the same discount scheme, which were also processed successfully.

He was paying 60-70 per cent of his bill amounts and the rest of the tab was being picked up by Bulk Bargains, which also sent Azam receipts. His online utility accounts showed no outstanding charges. The discount offer was working for Azam and he thought all was well.

After two months, Azam received the first pending payment notification of his water bill. He soon found out that the balance amount (that he thought was paid by Bulk Bargains) was reversed to the original bill. After that, he started receiving pending payment notifications from many other bills, which he had already paid.

Azam contacted each of them and sent them the payment details.

Azam says that he contacted Bulk Bargains and they said there was some glitch in their system, which had probably led to this. They promised to fix it by repaying the bills and even asked Azam to introduce the scheme to his friends. But Azam was by now in touch with his banks, which had made him aware of the scam.

Azam told SBS Urdu that he was lucky the banks helped him retrieve 80 per cent of his money and explained to him how discount payment scams work.

Scammers pay the balance amount by credit card but after some time, they get that refunded by chargeback.

A chargeback takes place between the cardholder’s and retailer’s banks. When a cardholder asks for a chargeback, the retailer’s bank may agree to pay the money back to the cardholder’s bank. Read more here about chargeback.

SBS Urdu queried ACCC about such scams. An ACCC spokesperson said that scammers are targeting more and more CALD communities in their native language with such fraudulent schemes.

The spokesperson also mentioned that scammers are getting more sophisticated and it can be difficult to identify a scam when such tactics are used.

Scammers contact victims in their native language in an attempt to build trust

ACCC recommends:

- Always contact your financial institution when you suspect a fake payment issue that needs recovery

- Report any fake or suspected transaction to your financial institution first

Australian Banking Association provides a summary of steps for consumers when making a complaint to their bank

What is phone spoofing?

The ACCC spokesperson told SBS Urdu that phone spoofing is a common tactic used by scammers as it allows them to change their caller ID, disguise their identity and location. While spoofing can be used by businesses for legitimate reasons, scammers may use it to impersonate someone, a business, or a government agency to appear like a legitimate caller from a familiar location and attempt to get money or information from the call recipient.

Why do scammers prefer Whatsapp?

The ACCC spokesperson said that Whatsapp and other encrypted messaging sites are commonly used by scammers for dating or investment scams as these messages are harder for authorities to access and trace.

“We have recently seen a new technique called ‘romance baiting’, where a scammer will use a dating and romance scam to lure the victim into an investment scam,” the spokesperson added.

Can the legitimacy of suspected businesses be verified?

The ACCC spokesperson advised consumers to verify the legitimacy of an investment opportunity by checking the Moneysmart website’s Do Not Deal With list.

The spokesperson also emphasised the importance of the identity verification of the caller through other methods. "Try and verify the identity of a contact by calling the relevant organisation directly, or through another independent source like an online search but don’t use the contact details that the potential scammer has provided to you,” the spokesperson elaborated.

Tips and advice by ACCC:

- Be cautious if you are contacted unexpectedly by someone asking for money or offering a business opportunity, as it may be a scam

- Never give your details to an unsolicited caller offering financial or investment opportunities

- Don’t take financial advice from someone you have only met online and never give financial or personal details to a stranger

For information about various scams and reporting, refer to Scamwatch.

- Learn How to Bookmark SBS URDU's website or make it your home page.

- SBS Urdu is broadcast every Wednesday and Sunday at 6 PM (AEST).

- How to Listen

- COVID 19 Latest Updates in Urdu

- Install “SBS Radio” mobile app