Record high house prices, lower interest rates, and increased policy support are among the predictions for the Australian property market this year.

At the end of 2025, property research firm Cotality's Home Value Index surged 8.6 per cent in 2025, adding roughly $71,400 to the national median dwelling value.

Tim Lawless, Cotality's research director, told SBS News: "It was pretty clear by the end of the year, most regions were losing some momentum or losing some speed in the rate of growth."

"So more of a levelling out in many ways, but it might be setting the scene for a softer outcome coming into 2026," he said.

However, Lawless said the year's outlook remains uncertain and dependent on interest rates.

Which capital city's house prices will grow the most?

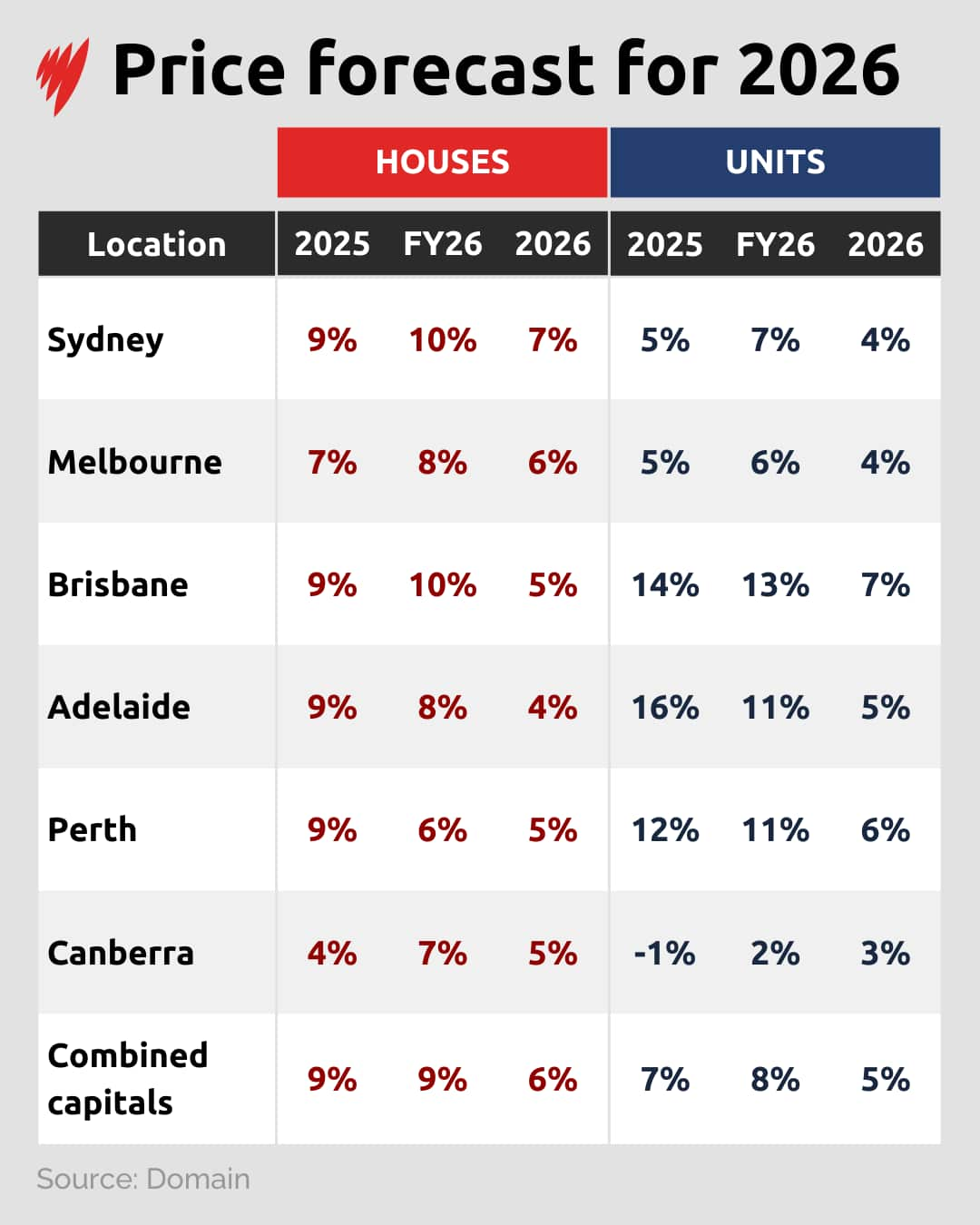

Sydney and Melbourne are forecast to have the strongest price growth, according to Domain's 2026 property forecast, while Brisbane and Perth are expected to lead unit price growth.

Unit prices are expected to outpace house prices in Brisbane, Adelaide and Perth as more buyers shift to affordable homes.

House and unit prices across the country's combined capitals are predicted to rise by 6 per cent and 5 per cent respectively, reaching a record high by the end of 2026, according to Domain.

As for the regions, Lawless from Cotality said the market is diverse, with values up 9.7 per cent compared to the capital cities' 8.2 per cent.

"Even though we did see a stronger growth outcome across regional Australia in 2025 ... it does seem that the strongest regional markets are very much skewed towards the very affordable areas that typically are very different to what we're seeing as the strongest regional markets through the pandemic," he said.

What will the rental market look like this year?

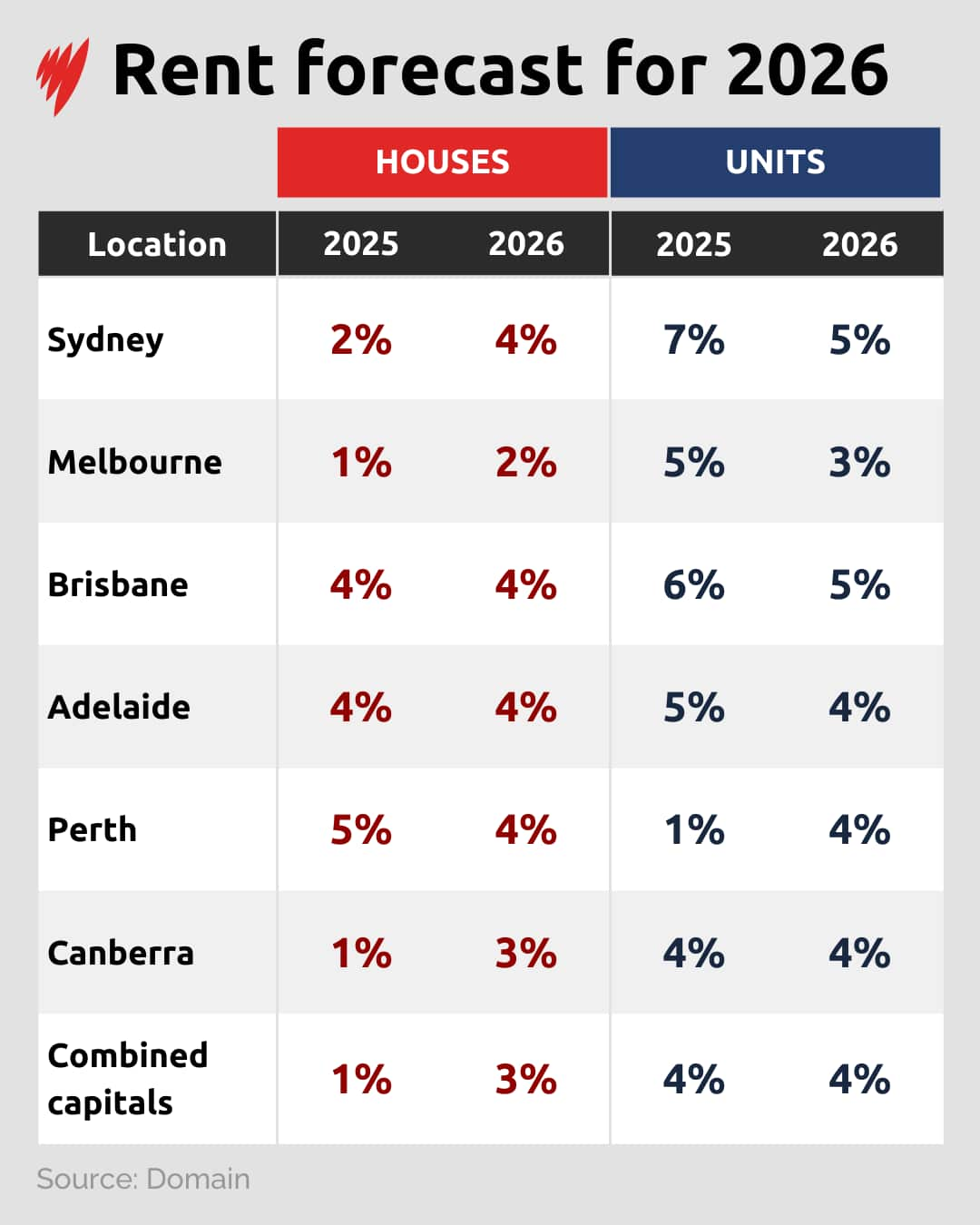

According to Domain, rents will rise in Sydney, Melbourne and Canberra, reflecting rising household incomes and tight rental supply.

Following years of rises, Perth's rental market is showing signs of moderation this year.

In most capital cities, unit rent prices are expected to rise slightly faster than house rents, reflecting affordability pressures and stronger demand for smaller, more affordable dwellings.

But Lawless said with vacancy rates nationally at 1.7 per cent, there won't be much of a rise.

How will policies impact the market?

Lawless said first home buyer incentives are "distorting the market to some extent".

The lower quartile of home values is rising the fastest, particularly after the announcement of the 5 per cent home deposit scheme.

"Even when we simply split out properties that are above or below the expanded deposit guarantee price caps, it's really clear there's been a divergence in growth trends even a month prior to the scheme going live," Lawless said.

First-home buyers and investors actively buying these types of homes are creating a funnel of demand.

Domain's forecast report stated that, by enabling purchases with a 5 per cent deposit and no mortgage insurance, house prices could rise by up to 6.6 per cent in the first year.

For some jurisdictions, the introduction of policies — such as Victoria's ban on rental bidding — that protect renters may impact investors seeking to buy.

What are banks predicting?

The Reserve Bank of Australia (RBA)'s first policy meeting of the year is scheduled for early February. Back in December, RBA governor Michele Bullock flagged a possible rate increase if inflation could not be contained.

On 2 January, the Australian Securities Exchange 30 Day Interbank Cash Rate Futures February 2026 contract was trading at 96.32, indicating a 36 per cent expectation of an interest rate increase to 3.85 per cent at the RBA meeting.

"Well, clearly, a higher interest rate environment is a net negative for housing markets and housing demand. It probably also sends a bit of a shudder through sentiment, which is really important for housing markets or any sort of purchasing decision that's on a high financial commitment," Lawless said.

Any good news for Australians looking to enter the market?

Approvals and commencements for dwellings rose through 2025, according to Domain — indicating an increase in supply for 2026.

On top of this, population growth is slowing, which means fewer additional people per new dwelling, prompting a rebalance of the market.

Vacancy rates are expected to slightly increase from record lows to more sustainable levels.

A slow but steady recovery in household incomes is underway, which may provide some relief to both buyers and renters in 2026.

For the latest from SBS News, download our app and subscribe to our newsletter.