Sydney mother of two Sinta Velasco is the breadwinner of her family at the same time as supporting elderly relatives in the Philippines.

At 45 years old, she's decades away from retirement age but is already finding the idea of saving enough to live comfortably daunting.

"As a single-income household, we've really had to think about small and big expenses. I know every dollar adds up," Velasco told SBS.

She's part of a growing number of Australians worried about the cost of retirement, which new research suggests is getting more expensive.

The cost of a comfortable retirement is on the rise

The rising cost of living has seen the annual cost of a comfortable retirement climb by more than $13,000 in just five years, according to the latest Association of Superannuation Funds of Australia retirement standard.

Australian couples aged 65 and over now need more than $75,000 a year to retire, while singles need $53,000.

Analysis from AMP has uncovered that some groups are more vulnerable than others when it comes to feeling financially confident.

AMP's retirement expert Ben Hillier said rising inflation has heightened concerns for people saving for retirement, especially women.

"We're seeing, unfortunately, some concerning data, especially around gender. Females are far less confident about their retirement than males," he told SBS News.

"Only two in five women are confident about retirement compared to three in five males. And even more concerning perhaps are those single females, especially those with children, who are amongst the lowest levels of confidence of all Australians."

Hillier said that women are often juggling work while caring for children and, at times their own parents, more so than men.

"Quite clearly from the research, there's an unfair gender split in terms of who's carrying the most of that burden between looking after the children and also looking after the parents," he said.

"And of course that's going to translate into not being able to focus on the future and consequently having lower levels of confidence."

'Sandwich generation' the least confident about retirement

Sinta Velasco is also a member of the 'sandwich generation', a group that cares for both children and their ageing parents.

AMP data found this group of Australians in their 40s, and juggling caring for relatives, were the least confident about retiring, with less than two in five feeling financially secure.

While her husband is out of work, her single income is stretched supporting their children as well as the couple’s parents.

"We look at, for example, how we can cut down on some subscriptions," she said.

"And just being wiser in terms of everyday decisions like eating out, cutting down on that. We're just trying to be as prudent as possible and to live below our means."

Velasco has now lived in Australia for eight years and said it's particularly important for migrants to find social support and financial advice when it comes to retirement planning.

"I feel like if I'm stuck, I could ask professionals like financial advisors, 'these are my concerns, what do you think I should focus on?'"

Which Australians are confident about their retirement?

The AMP research found several inequities when assessing Australians' thoughts on retirement and affordability.

Partnered Australians were more confident about retiring than singles, with 60 per cent of those in relationships feeling secure compared to just 40 per cent of those not in a couple.

Single mothers were among the least confident about retiring, with less than 20 per cent of single women with children in their 40s feeling financially prepared.

Meanwhile, divorced or separated women were also less confident than their male counterparts.

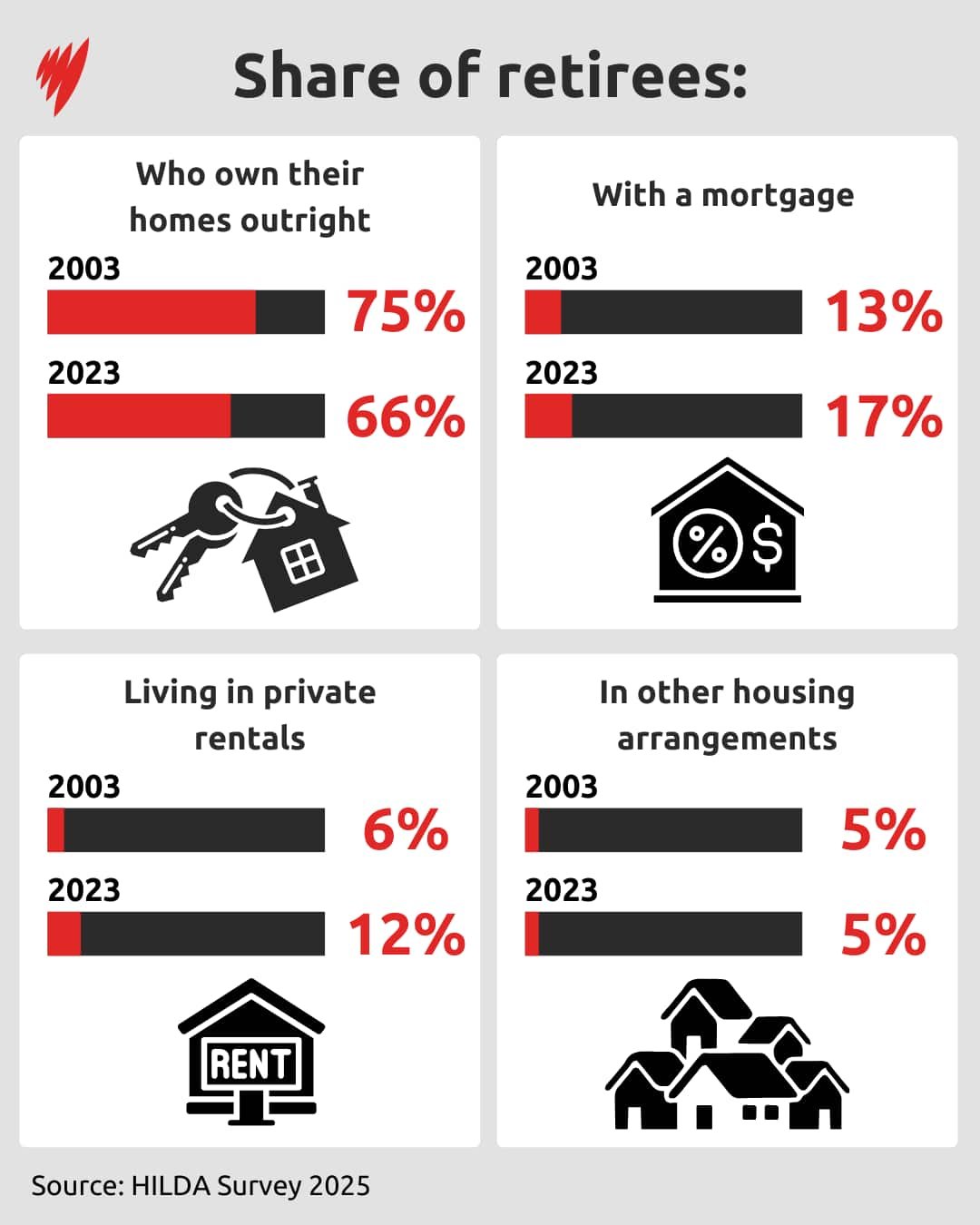

Hillier said the financial challenges facing these groups can be compounded further if they are renters and don’t own their own homes.

"A retirement can last 20, 30, even 40 years. And so being exposed to the rental market during that period of time without some sort of bedrock of property wealth behind you really makes that particular group are quite a lot more vulnerable."

For the latest from SBS News, download our app and subscribe to our newsletter.