When Pat — not their real name — received a rental increase from their real estate agent, they couldn't believe it.

The Sydney house they share with three others has leaks in the roof, several broken doors, a washing machine with defunct plumbing — meaning the household needs to use a laundromat — as well as what Pat describes as "large-scale" damage to the home's foundation.

"We had a couple of tiles collapse earlier in the year and it took a month to get it fixed up," Pat told SBS News.

"When the plumber came in, he was like, 'This is large-scale damage to the property and it's dangerous. I don't like you guys using this bathroom and this shower because there's a danger you'll just fall through'."

"That was a bit scary to hear," they said. "But nothing's really been fixed. It's pretty dire."

When Pat and their housemates were notified of a $70-a-week rental increase, they decided to end the lease.

"Our response to the rent increase would have been different if the house had been cared for."

Now, they're worried about finding a new rental to move into. Despite all housemates working full-time, Pat says they're all still struggling to manage rent in Australia's most expensive rental market.

"It's not the most extreme rent increase I've ever experienced, but it's tough at the moment," they said. "It feels pretty disheartening."

Pat said they had fears that challenging the rent increase would backfire.

"I feel like if we say we feel the rent increase is unfair because of the lack of care shown to the home, I'm worried they're going to kick us out or say that we're difficult tenants to the next place we try and rent."

Rental affordability hits record low

Pat's experience reflects a broader trend unfolding across the country.

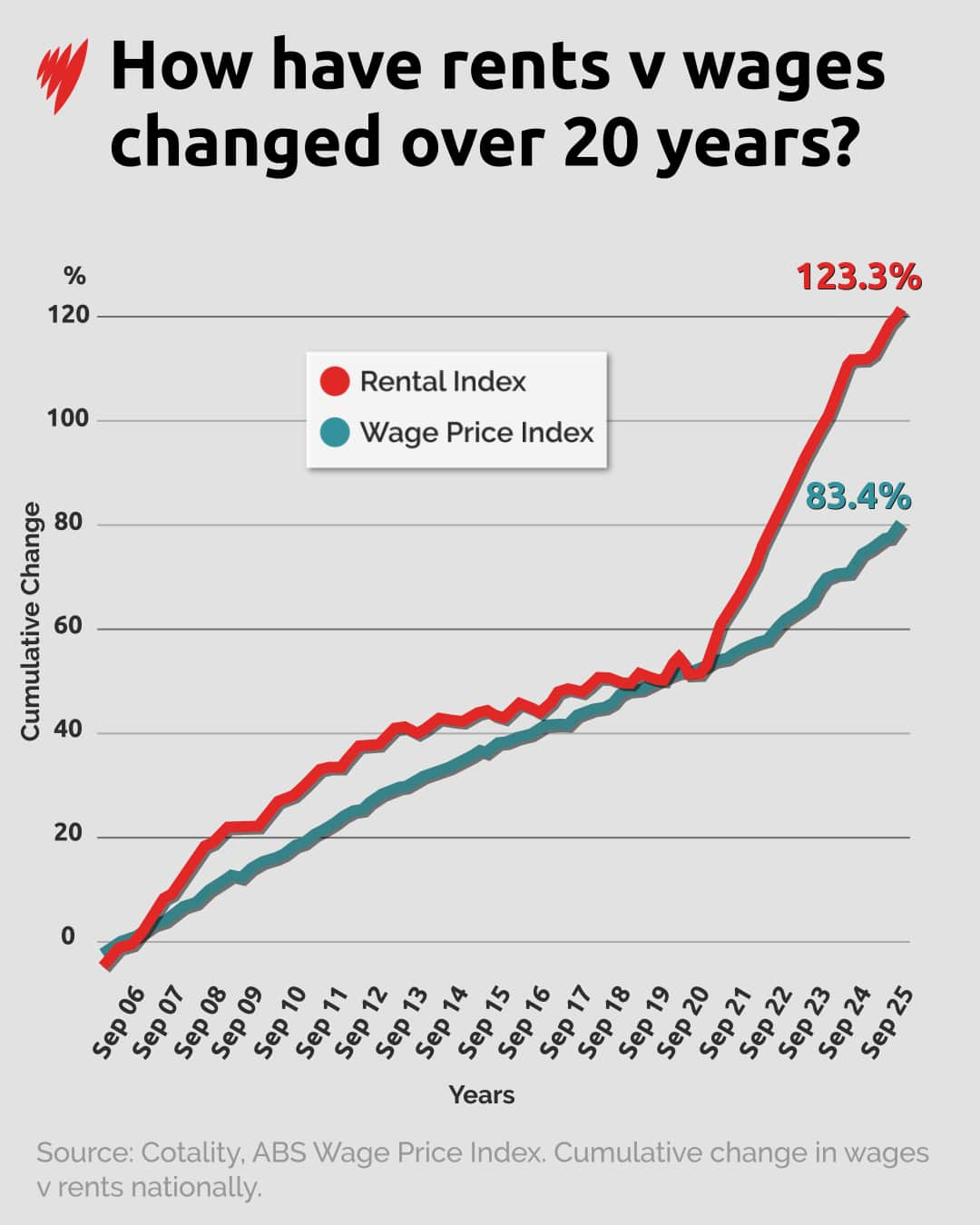

The cost of renting in Australia has risen at more than double the pace of wages over the past five years, pushing rental affordability to record lows.

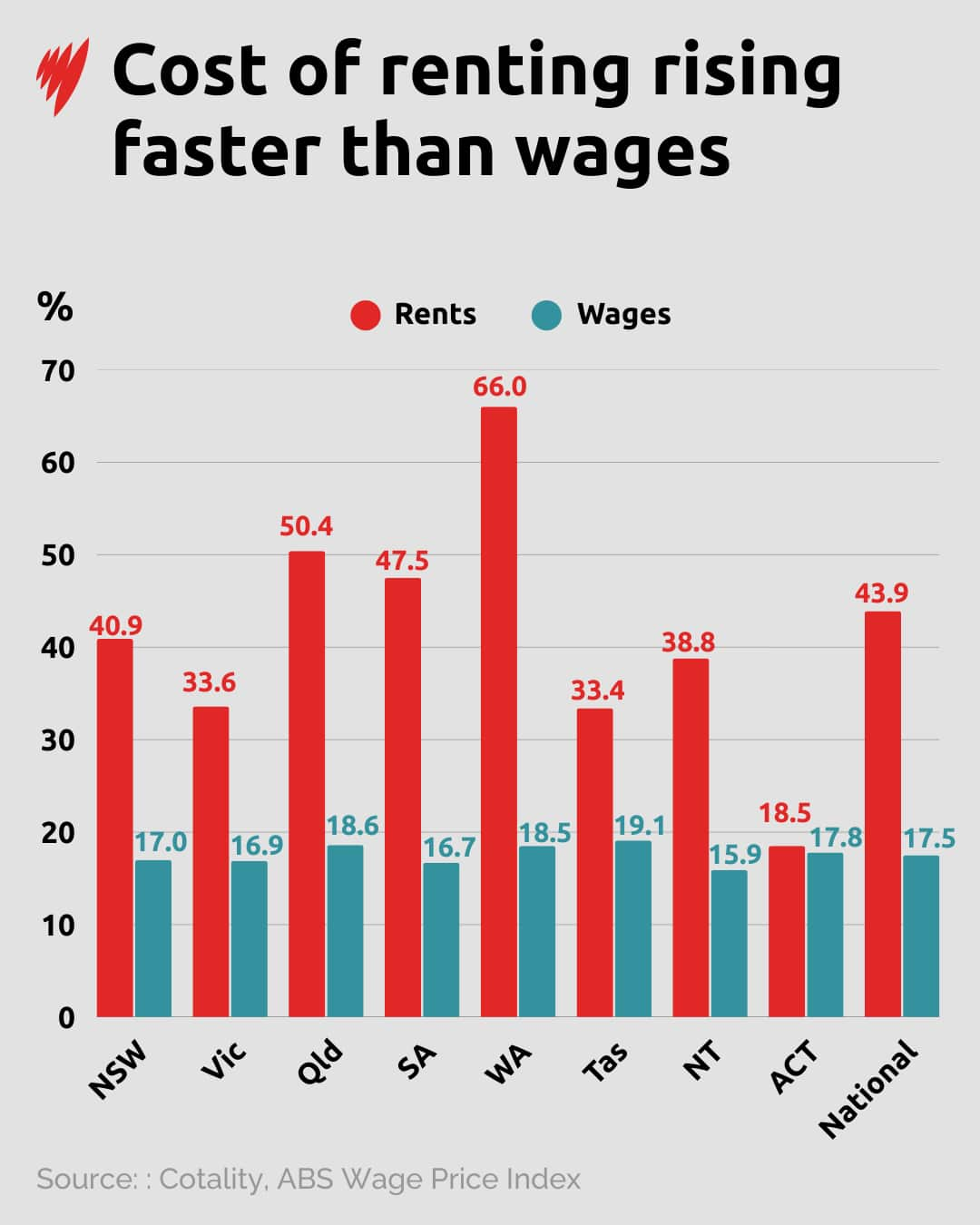

New analysis by property research firm Cotality found national rents rose 43.9 per cent in the five years to September 2025, compared with wage growth of 17.5 per cent over the same period.

As a result, rental households are now spending an average 33.4 per cent of their pre-tax income on rent — the highest level on record. That compares with a decade average of 29.2 per cent and a recent low of 26.2 per cent in the September quarter of 2020.

Housing is generally considered affordable when renters spend no more than 30 per cent of their income on rent.

The widening gap reflects persistently low vacancy rates, shrinking household sizes, and a lack of new housing supply coming online, Cotality said.

Western Australia hit hardest

WA recorded the sharpest rental growth in the nation, with rents climbing 66 per cent over five years, while wages rose just 18.5 per cent.

"Nowhere is the pressure more evident than in Western Australia, where rents have climbed by around two-thirds in just five years," Cotality research director Tim Lawless said.

"Even with wages growing a little faster than the national average, they have come nowhere near keeping up with housing costs in that state."

The ACT was the only market where rent and wage growth were close to aligned, with rents rising 18.5 per cent and wages increasing 17.8 per cent over the five years to September 2025.

"In the ACT, income growth has managed to track rental growth more closely, which has helped contain the deterioration in affordability compared with other parts of the country," Lawless said.

A bleak outlook

Cotality's analysis shows rental growth has been accelerating since mid-2025, with demand continuing to outstrip supply.

"With vacancy rates still around record lows in many markets and new housing completions running below what is needed to meet population growth, it is hard to see rents materially easing in the near term," Lawless said.

"Unless wage growth accelerates meaningfully, or we see a step change in rental supply, the risk is that affordability will deteriorate further for lower-income households in particular."

He said measures to boost housing supply — including more build-to-rent developments, incentives for private investment, and planning reforms to allow greater density in well-located areas — would be critical to easing pressure on renters.

"Closing the gap between rent and income growth will require a coordinated effort across governments, industry and investors," he said.

"The sooner we can bring more supply to market, the sooner renters will start to see some relief."

For Pat, that outlook offers little reassurance.

Despite having a secure full-time job and a stable income, Pat says it's still "really difficult" to find somewhere to live in Sydney.

"If you're single and you're trying to find somewhere to live, that's a big part of your income. It's a substantial part of my pay each week," they said, adding that each move has pushed them further away from the city.

For the latest from SBS News, download our app and subscribe to our newsletter.