Key Points

- A Canstar survey reveals fewer Australians have a non-property related personal debt.

- At the same time, those saddled with debt owe more than in previous years.

- Experts say short-term loans carry risks.

Fewer Australians have a personal debt, but for those who do, the figure is climbing.

That's the finding of a national survey by financial comparison site Canstar, which says in a new report personal debt from credit cards, buy now pay later (BNPL) schemes, and education have risen in 2025, contributing to the "meteoric rise" of financial pressures facing Australians.

The average personal debt carried by Australians, not including mortgages, rose to $17,634 this year, up from $15,179, Canstar said.

Meanwhile, the proportion of Australians with a personal debt excluding a property loan fell from 35 to 33 per cent.

Canstar's annual consumer pulse poll of 2,000 people found housing remains the top concern, followed by the price of groceries, electricity and gas.

While not a top worry for respondents, experts said personal debt can come "at a very high cost" when factoring in interest and fees, when compared to other forms of debt.

Sally Tindall, data insights director at Canstar, said it could take "tough decisions" for Australians to reduce their debts.

"It's positive to see fewer people in debt; however, of those that are, the total amount owing is moving in the wrong direction. If that's you, make 2026 the year you knock down what you owe," she stated in the survey.

Good debt vs bad debt

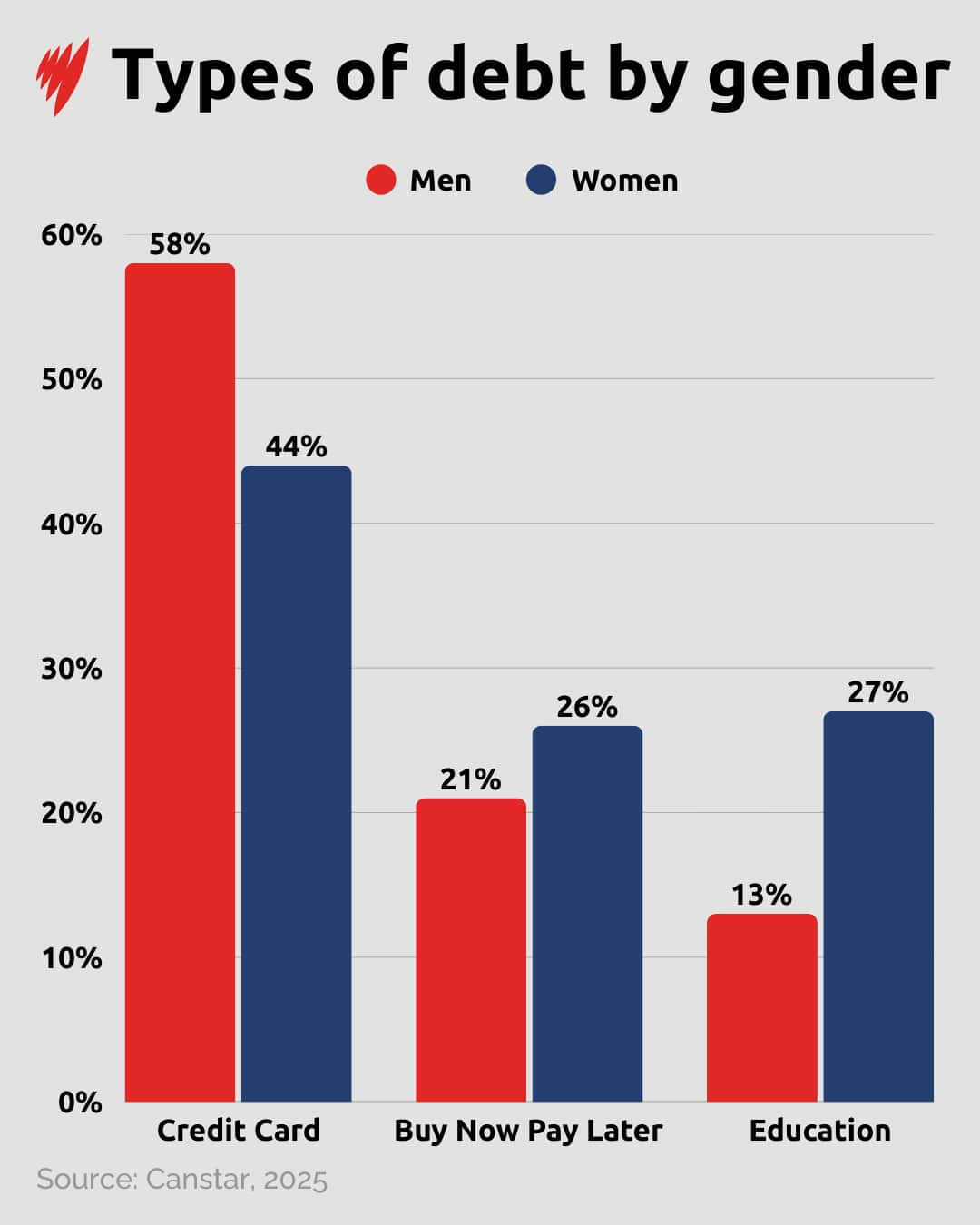

Of those with a debt, men are more likely than women to carry credit card debt at 58 per cent compared to 44 per cent.

However, women carry a larger share of higher education loans and BNPL-related costs.

Mardy Chiah, an associate professor of finance at the University of Newcastle, said taking on a short-term debt is "rarely beneficial".

"Interest rates on personal loans and credit cards are typically high if not paid within the interest-free period, making them costly and difficult to justify for discretionary spending," he told SBS News.

Chiah explained there is good debt and bad debt.

Good debt is used to invest in assets that generate future value, such as property and education.

Whereas a bad debt is used for immediate consumption or a depreciating asset, like a car or a BNPL loan.

"Everyone should strive to reduce bad debts," he said.

Dangers of buy now, pay later

Using a BNPL scheme can be convenient but puts people at risk of late payments and fees, which are effectively a "very high interest rate", Chiah said.

"If you make a $100 purchase and pay a $5 monthly account management fee for two months before fully repaying, the total fee is $10, equivalent to 10 per cent of the purchase price for just two months," he said.

"Annualised, this would represent a very high cost of 60 per cent interest rate per annum."

Chiah warned BNPL providers can encourage overspending and impact credit scores and borrowing capacity for delayed or missed repayments.

The costs of these debts add more pressure on Australians trying to pay off their property.

"Housing remains the nation's top financial concern. Whether it's mortgage repayments or rents, the meteoric rise to what is, for most people, their biggest financial expense has been difficult to shoulder," Tindall said.

Some are managing to save

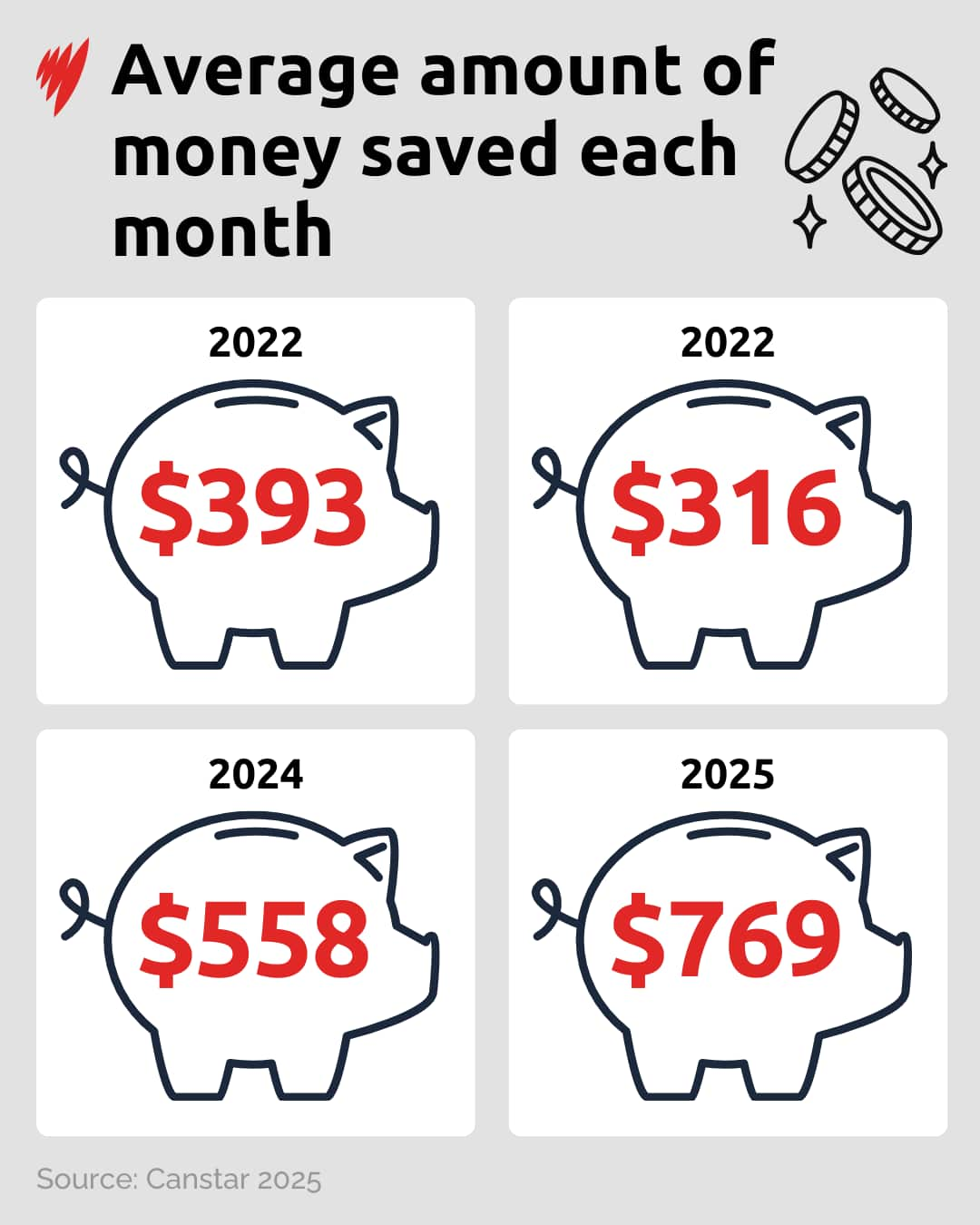

Despite cost of living concerns, Australians are continuing to save, according to the survey.

The number of people saving each month in 2025 jumped to 68 per cent, up from 62 per cent in 2024 and 51 per cent the year before.

The average put away each month has risen to $769, up from $558 in 2024.

While more Australians are saving, there is a clear gap between men and women.

The average total saved or invested, excluding the family home and superannuation, was $42,945 for women, compared with $58,326 for men.

For the latest from SBS News, download our app and subscribe to our newsletter.