The Reserve Bank of Australia's first board meeting of the year could deliver a rate hike — though some economists say there's a case to hold.

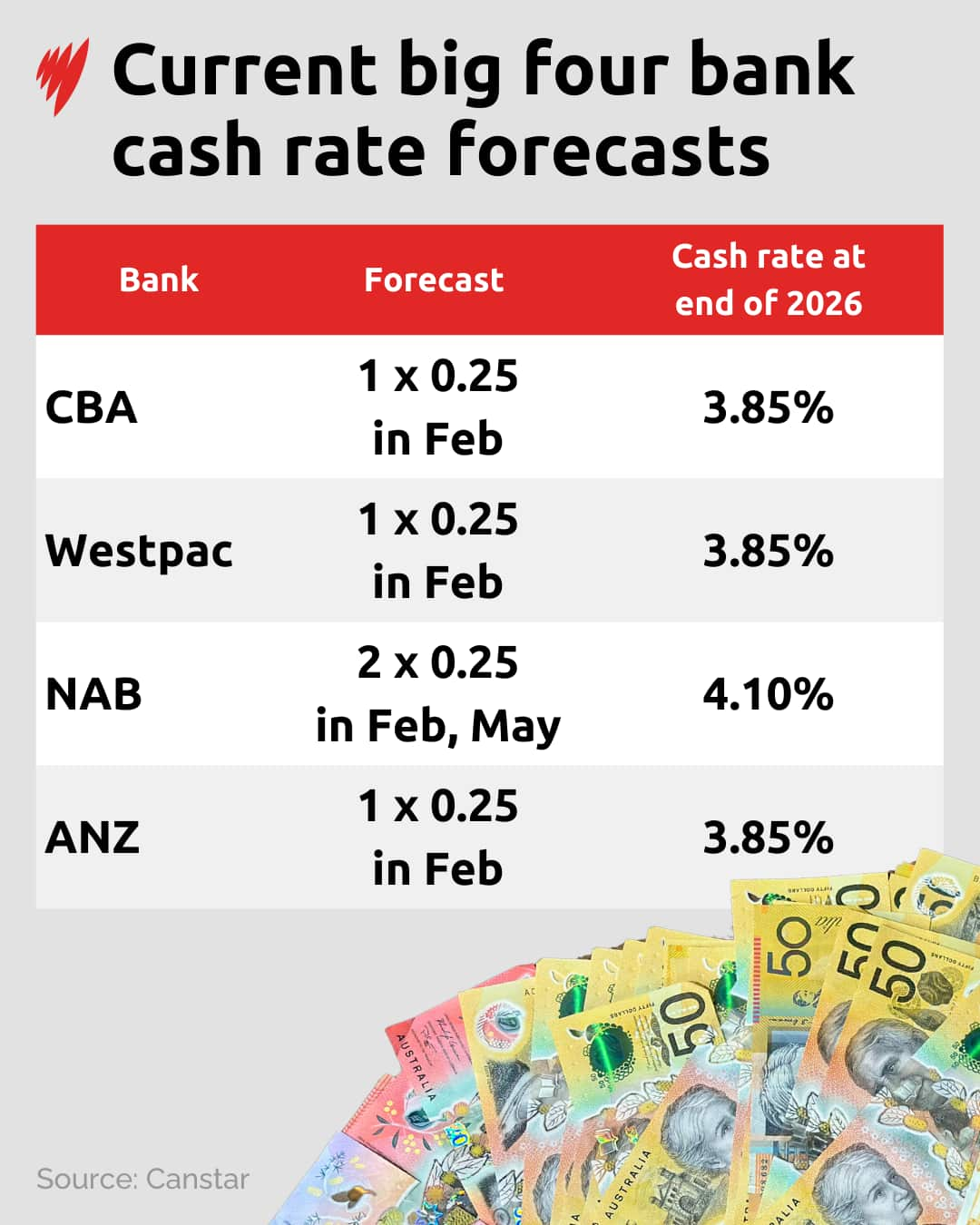

All of Australia's 'big four' banks, as well as economists from major investment banks and consultancy firms, are forecasting a hike when the RBA's monetary policy board meets on Tuesday.

If they are right, the RBA would become the first major central bank to reverse course from a series of rate cuts as inflation eased following a surge between mid-2020 and late 2022 during the height of the COVID-19 pandemic.

Sally Tindall, data insights director at financial comparison site Canstar, said a 0.25 percentage point increase in the cash rate to 3.85 per cent would all but wipe out home loan rates below 5 per cent.

"There are now just six lenders offering fixed rates under five per cent," Tindall said.

"A February hike would almost certainly close the door on the last remaining options."

However, some believe the board may opt to keep the cash rate at its current level.

Why some economists expect the RBA to hold

AMP chief economist Shane Oliver expected the RBA to leave the cash rate unchanged, but he said a hike would likely follow soon after if inflation doesn't continue to ease.

He said that, if the board does not move today, an increase by March remains a strong possibility.

"Our initial reaction after the CPI was that they'll hike," Oliver said, referencing the Australian Bureau of Statistics' (ABS) latest release of consumer price index data last week.

"But then when we looked a bit more at the data, we thought it was a lot more complicated."

Oliver acknowledged that, across most measures, inflation remained above the RBA's 2-3 per cent target band and the labour market was still tight, with unemployment at 4.1 per cent.

However, he said recent data suggested inflation momentum was easing.

"The monthly trimmed mean inflation rate (which strips out volatile items) has progressively fallen from a high in October … to 0.23 per cent in December," Oliver said.

"I don't think you can totally ignore that."

He also pointed to slower growth in rents and new dwelling prices in December, a stronger Australian dollar reducing imported inflation, and business surveys showing output price inflation closer to the RBA's target band.

"When you run through all of that, I think it's a close call," he said.

"We put [the odds] at 51 hold and 49 hike."

A hike is not guaranteed, Westpac chief economist Luci Ellis said.

While the former RBA assistant governor expected the central bank to raise rates, there is a chance the board could wait a little bit longer.

There is a case to be made that data shows inflation is not moving further away from target and there are also arguments to be cautious given the ABS' new monthly measure has made inflation harder to interpret, she said.

But HSBC chief economist Paul Bloxham said the case to hike is a strong one.

"By not having hiked as much, and not having delivered as big a downturn, it seems the RBA should have held its cash rate higher for a bit longer," he said in a research note.

Financial markets are pricing in roughly a 70 per cent chance of a 0.25 percentage point increase.

What a rate hike could cost borrowers

For borrowers with variable-rate mortgages, the consequences of a rate hike would likely be immediate.

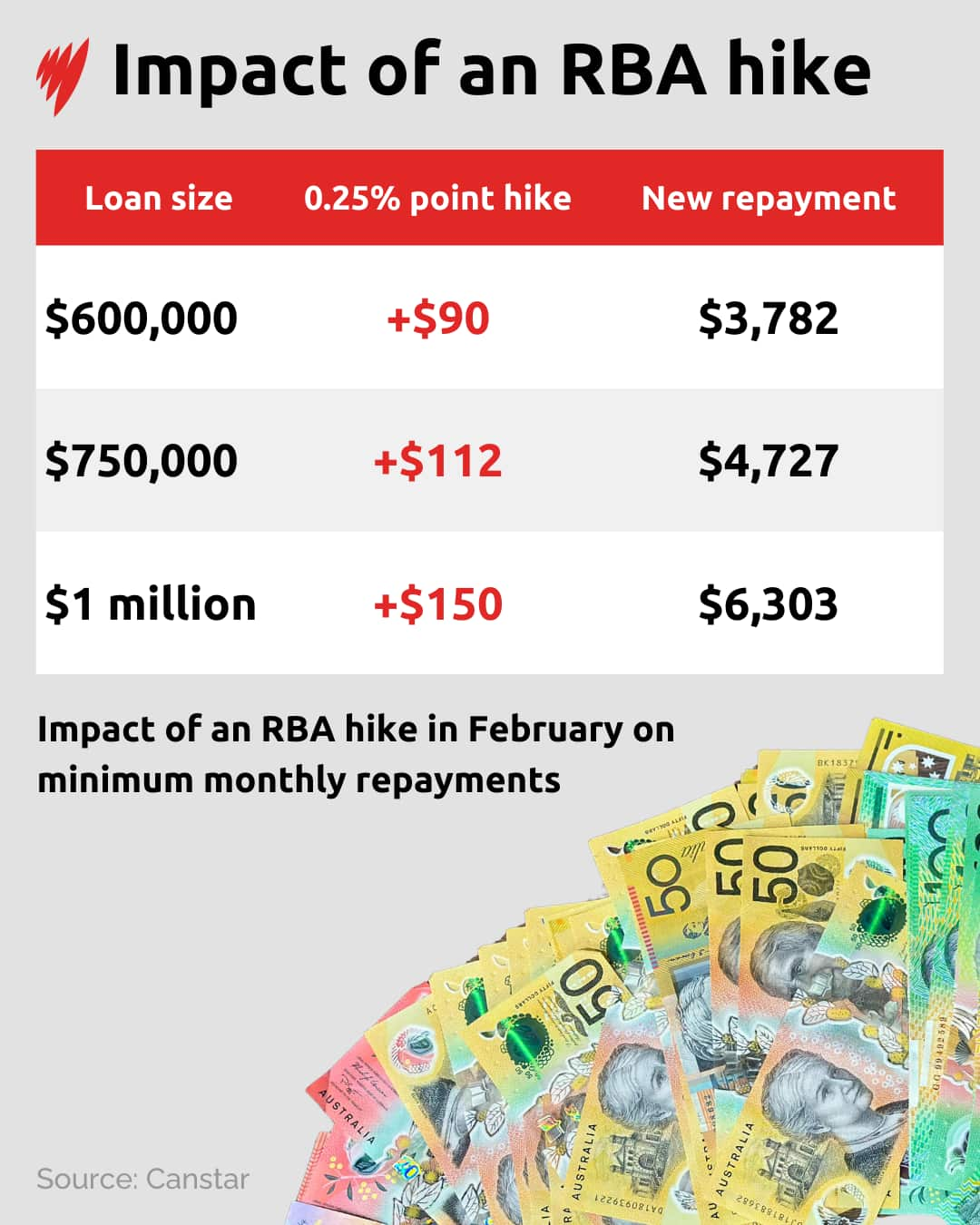

Canstar analysis shows that a 0.25 per cent increase would lift minimum monthly repayments across a wide range of mortgage sizes, increasing pressure on household budgets already strained by elevated living costs.

Tindall said the impact would depend on how borrowers responded to last year's rate cuts.

"In 2025, we saw three cash rate cuts, and a number of variable borrowers didn't actually lower their minimum monthly repayments," she said.

"That meant they were paying more than required and building an important buffer."

However, she acknowledged that many had reduced repayments out of necessity as grocery, fuel and essential costs rose.

"For those families, the pressure has intensified," Tindall said, warning that further increases could push some households into repayment stress.

She said Canstar's big four bank forecast data showed broad agreement on a near-term hike, but less clarity on how far rates might rise through 2026.

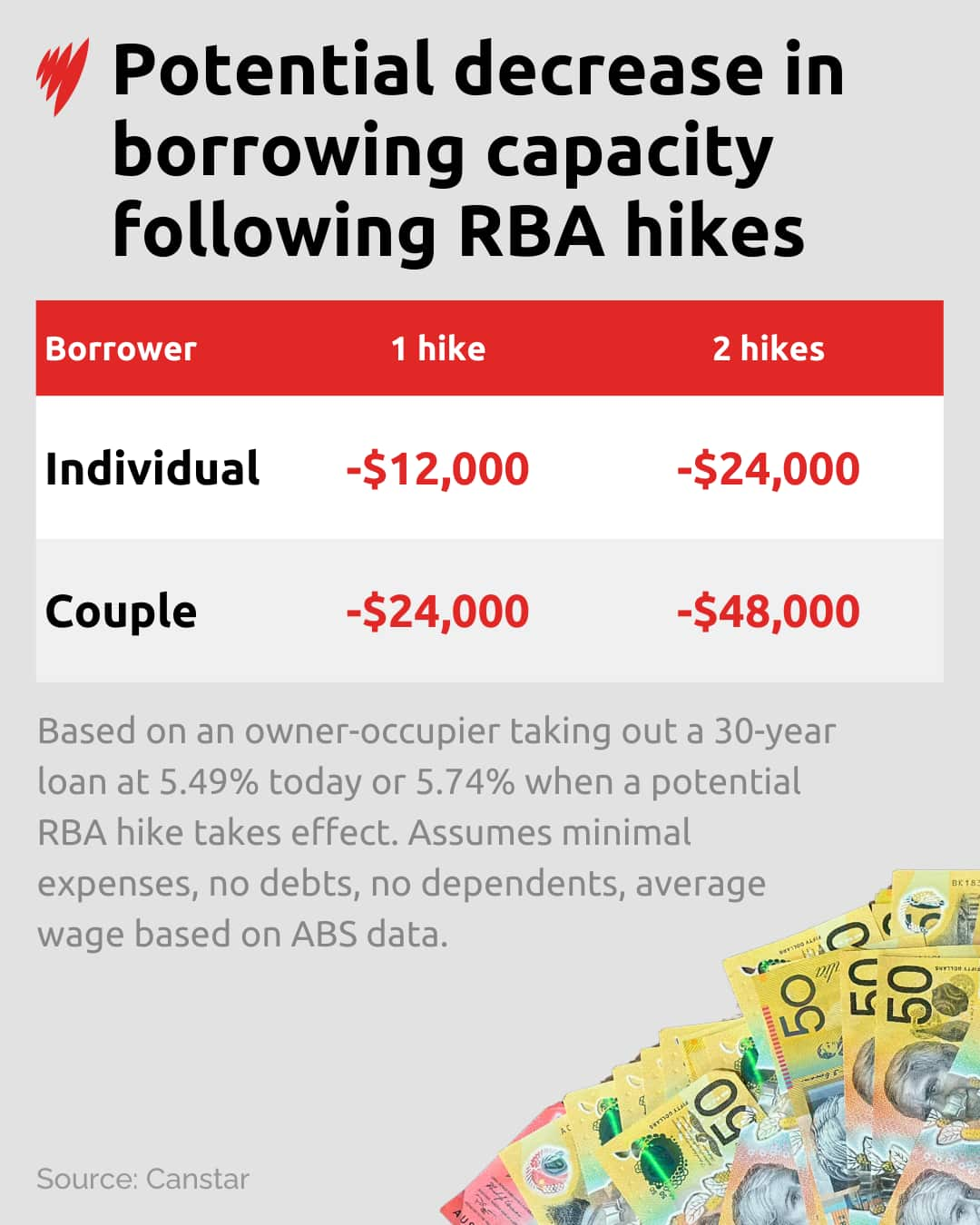

Canstar modelling also shows how higher rates would reduce borrowing capacity for new buyers, while loan-size analysis highlights how repayment pressure escalates quickly for larger mortgages.

"Prepare your budget as if we're going to see more than one rate hike," Tindall said.

"It's better to be overprepared than fall short."

Spending risks and housing pressures

Oliver said the RBA would also be weighing how quickly higher rates could hit consumer spending.

A pickup in household consumption late last year was partly driven by the three rate cuts in 2025 and expectations that more relief was coming, he said.

"There is a danger here that if we now move into rate hikes, we could see a setback in consumer spending," Oliver said.

Beyond household budgets, the decision also carries broader consequences for housing.

Housing Industry Association chief economist Tim Reardon said higher rates risk worsening housing inflation by constraining new supply, adding that, while not the only factor, housing costs remained the most persistent driver of inflation.

"We are seeing house prices rise due to a scarcity of housing," he said. "Higher interest rates exacerbate that scarcity and make the problem worse."

He said the burden of higher rates would fall disproportionately on first home buyers and renters, the latter of which would feel the pain as landlords passed on higher repayment costs to their tenants.

"Raising rates to slow rental and home price growth is perverse," he said. "It adds to supply shortages and inflationary pressure over the long run."

— With additional reporting by the Australian Associated Press.

For the latest from SBS News, download our app and subscribe to our newsletter.