That's a wrap

Thanks for tuning in to our running coverage of today's RBA decision. Here's a recap of what we learned today:

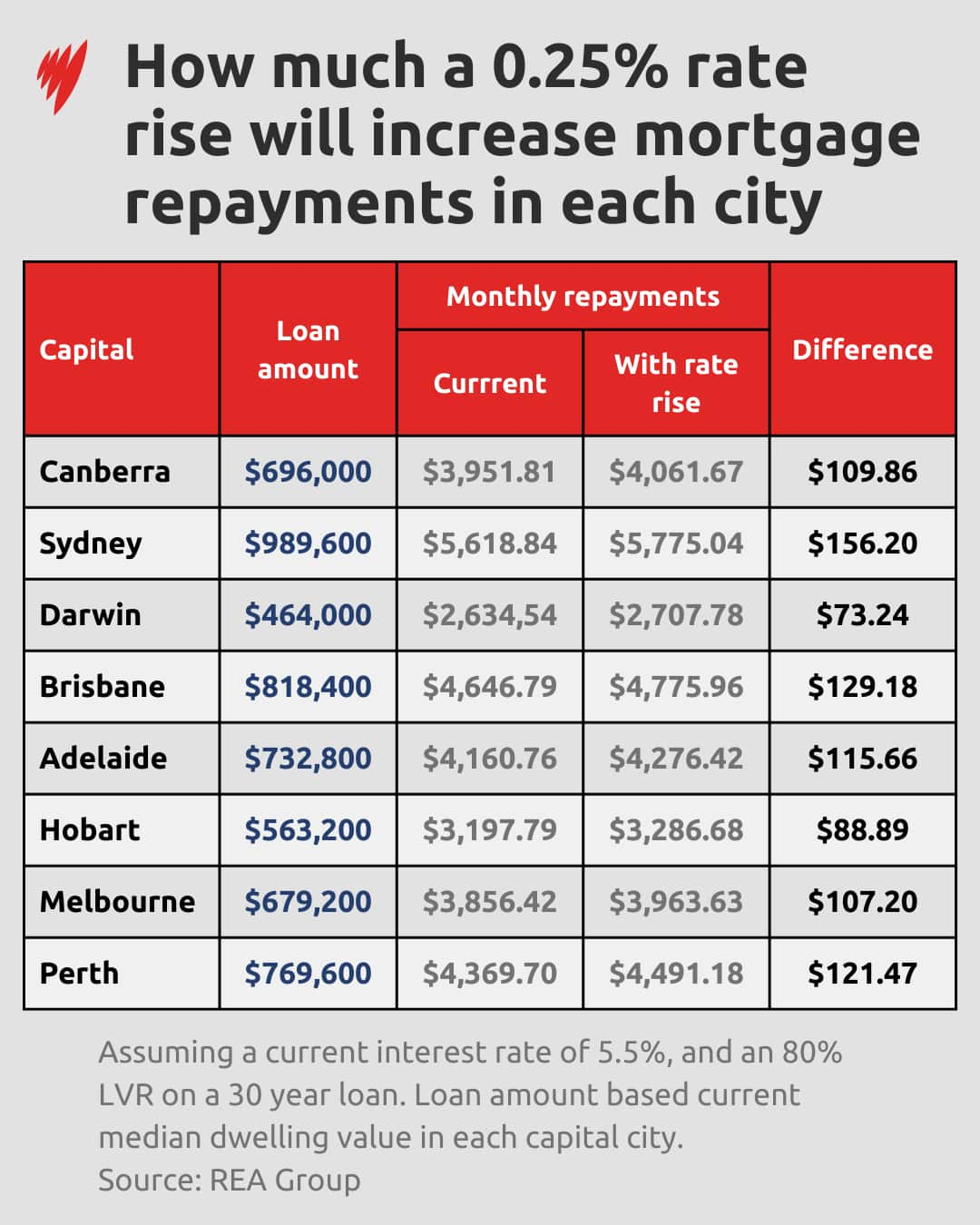

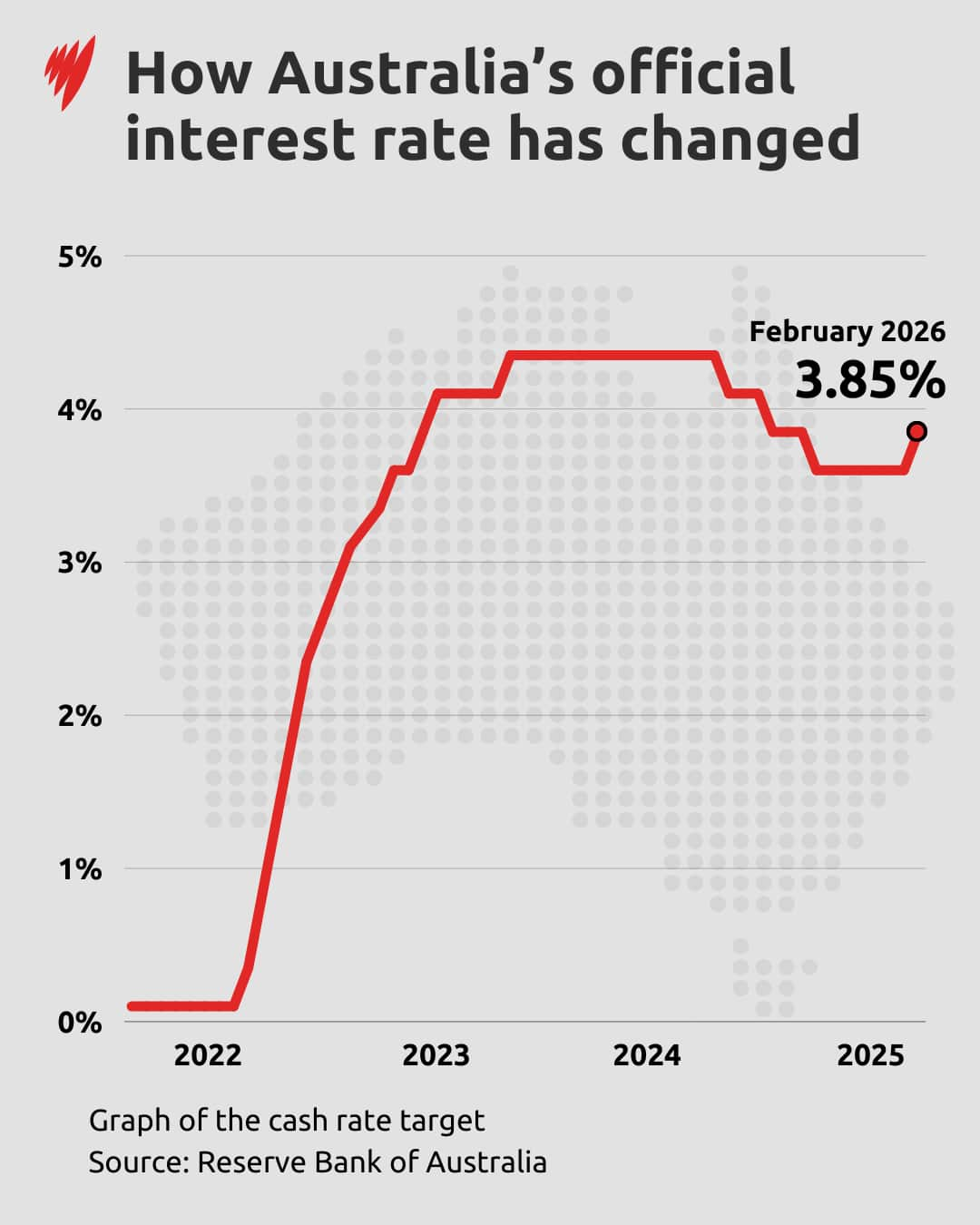

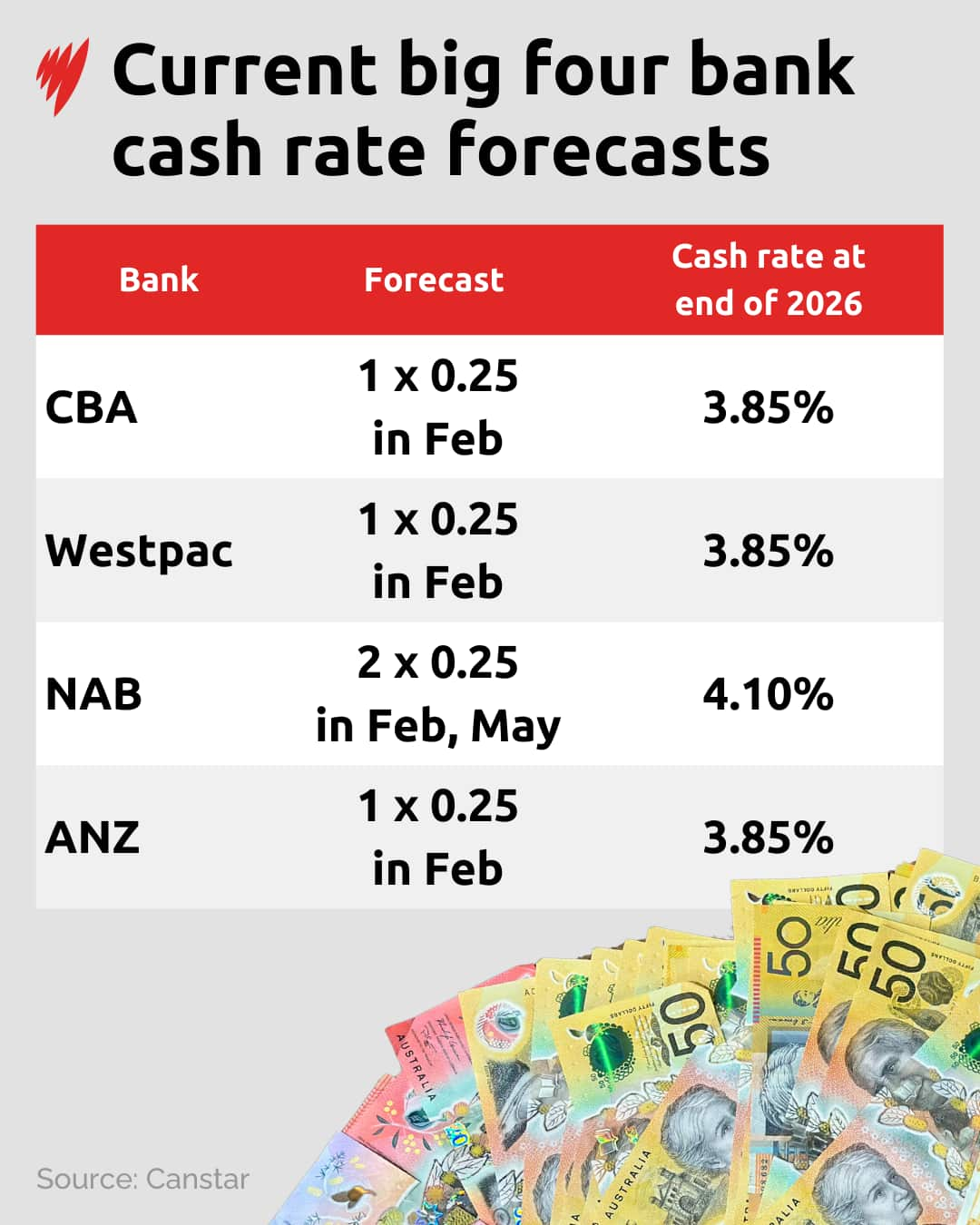

- The Reserve Bank of Australia (RBA) has lifted the cash rate to 3.85 per cent, its first hike in more than two years, after its Monetary Policy Board unanimously concluded that inflation was too strong

- The board said inflation had risen sharply since mid-2025 and it was now expected to stay above the RBA's 2–3 per cent target band for longer than previously forecast

- Stronger-than-expected household spending, investment and housing activity were cited as key drivers of inflation

- RBA governor Michele Bullock acknowledged that rising interest rates meant pain for borrowers but warned that leaving inflation unchecked would ultimately be worse for households and the broader economy

- Bullock defended the August rate cut, arguing it was appropriate based on the information the RBA had at the time

- She said the board was still walking a "narrow path" — aiming to curb inflation without sacrificing hard-won labour market gains

- She described Australia as being in a "really good position" economically, but increasingly constrained by limited supply capacity

- The RBA's economic analysis stressed weak productivity growth, which Bullock said was outside the remit of the central bank to fix

— Gabrielle Katanasho